Question

1. BS Co. doesn't want to incur any additional financing. The dividend payout ratio is constant. What is the firm's maximum rate of growth? 2.

1. BS Co. doesn't want to incur any additional financing. The dividend payout ratio is constant. What is the firm's maximum rate of growth?

1. BS Co. doesn't want to incur any additional financing. The dividend payout ratio is constant. What is the firm's maximum rate of growth?

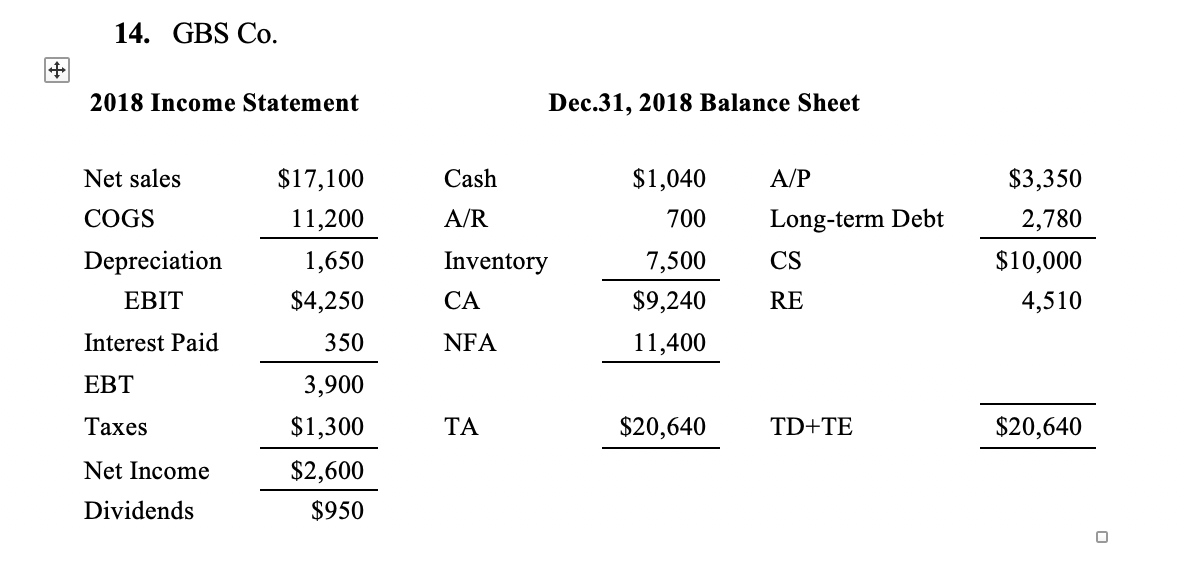

2. Use income statement and balance sheet for GBS Co., from previous example. Assume that the profit margin and the payout ratio of GBS Co are constant. If sales increase by 9%, what is the pro forma retained earnings in 2019?

3. Use income statement and balance sheet for GBS Co., from previous example. Assume that GBS Co. is currently operating at 97% of capacity and that sales are projected to increase to $20,000. What is the pro forma external financing needed in 2019 if capacity utilization increases to 100%? Assume that costs (including interest costs and depreciation), current assets and accounts payables will increase in the same proportion as sales. Also assume that accounts payables are a source of internal financing. The average tax rate will be 37% and 40% of net income will be paid in dividends.

4. Use income statement and balance sheet for GBS Co., from previous example. GBS Co. is currently operating at 82% of capacity. In the 2019 pro forma, capacity utilization will increase by 15%. All costs (including interest expenses and depreciation) and net working capital vary directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much additional debt is required in the 2019 pro forma, if no new equity is raised and sales are projected to increase to $19,665?

14. GBS Co. 2018 Income Statement Dec.31, 2018 Balance Sheet Net sales Cash A/P $1,040 700 COGS A/R $17,100 11,200 1,650 $4,250 Long-term Debt CS $3,350 2,780 $10,000 4,510 Depreciation EBIT Inventory CA 7,500 $9,240 11,400 RE Interest Paid 350 NFA EBT Taxes TA $20,640 TD+TE $20,640 3,900 $1,300 $2,600 $950 Net Income Dividends OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started