Answered step by step

Verified Expert Solution

Question

1 Approved Answer

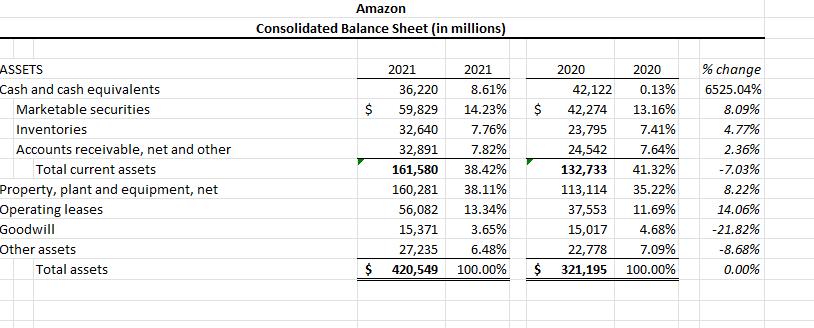

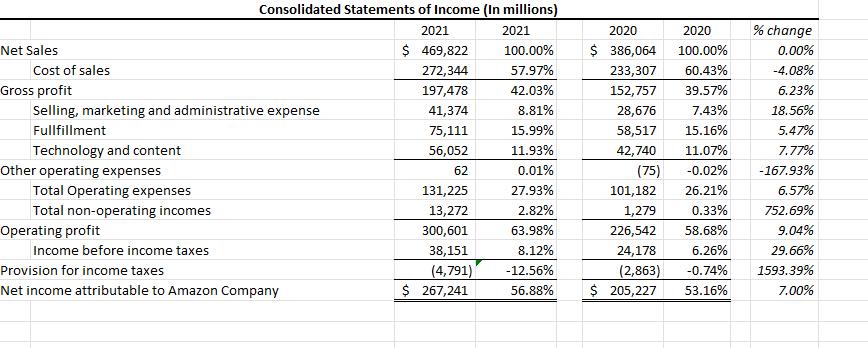

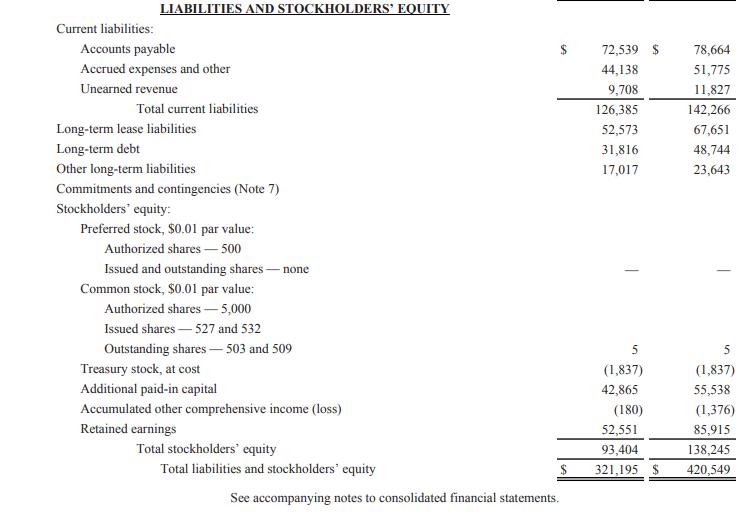

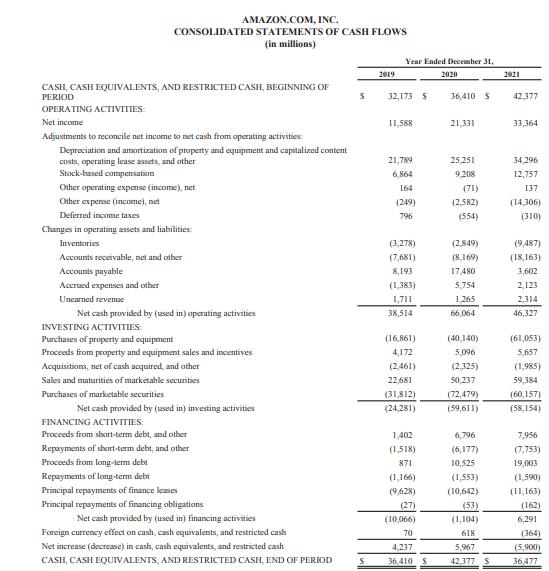

1) C alculate Amazon Company ratio for the two most recent years (2021 & 2020) presented on the financial statements and indicate the percentage the

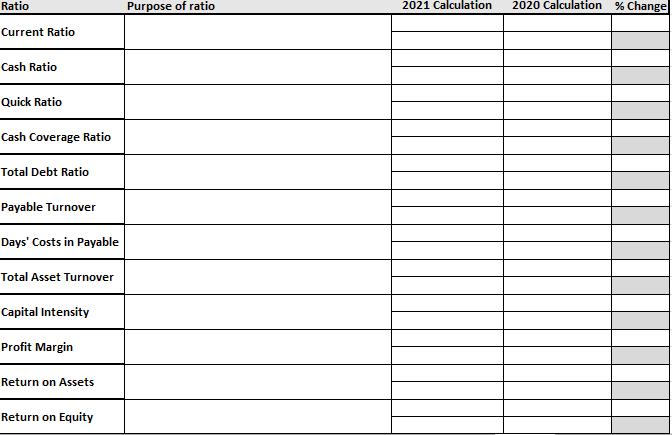

1) Calculate Amazon Company ratio for the two most recent years (2021 & 2020) presented on the financial statements and indicate the percentage the ratio increased or decreased from year-to-year. Include a column that prints the actual calculation. You do not need to fill out "Purpose of ratio" tab. *Please show your calculations used to gather percentages though*

Financial Statements below

Ratio Current Ratio Cash Ratio Quick Ratio Cash Coverage Ratio Total Debt Ratio Payable Turnover Days' Costs in Payable Total Asset Turnover Capital Intensity Profit Margin Return on Assets Return on Equity Purpose of ratio 2021 Calculation 2020 Calculation % Change

Step by Step Solution

★★★★★

3.30 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations with details shown Current Ratio 2021 Total Current As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started