Question

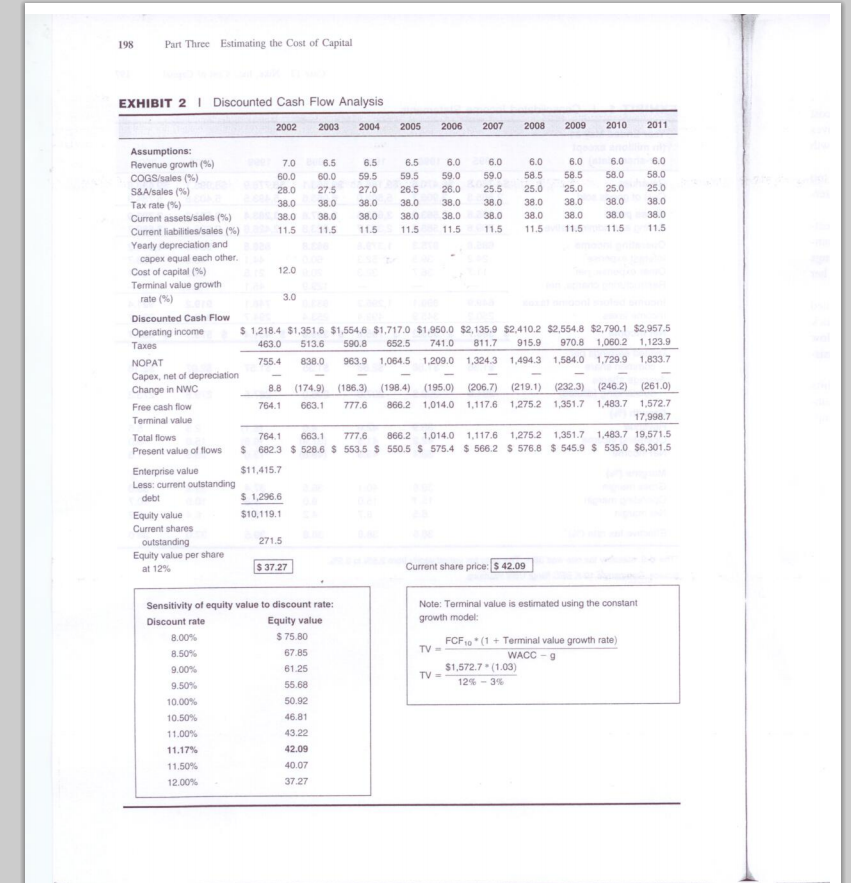

1. Calculate a revised Nike value of operations using the existing annual 2002 through 2011 cash flow projections in Exhibit 2, but assume a 4%

1. Calculate a revised Nike value of operations using the existing annual 2002 through 2011 cash flow projections in Exhibit 2, but assume a 4% terminal growth rate and a 10% WACC. This will cause you to calculate a new terminal value. Use the new terminal value in calculating a revised Nike value of operations. See the helpful notes below to help you get started.

2. Calculate an equity value per share using your revised Nike value of operations as well as the stated 1,296.6 debt and the stated 271.5 shares outstanding.

Helpful notes on how to get started on this assignment:

Remember that the value of operations is the present value of all future cash flows discounted back to time zero by the WACC. You can think of those future cash flows as being in two parts. The first part is the free cash flows from 2002 through 2011 that are already listed on Exhibit 2 (with the year 2001 being time zero in this case). The second part is the free cash flows for 2012 to forever. This second group of free cash flows is represented by the terminal value. Therefore, to get the Nike value of operations, you need to discount back to time zero both the 2002 to 2011 free cash flows and also the terminal value.

You begin by calculating the terminal value. Then you add that newly calculated terminal value to the existing 2011 free cash flow of 1,572.7 to get a new total amount for 2011. You can see that Kimi previously did this with her total flows line. The total flows line is the same as the free cash flow line except that in year 2011 the free cash flow amount is added to the terminal value.

You can now enter those total flow numbers into your financial calculator starting with 2002 and ending with your new total 2011 number. Then you enter the WACC into your financial calculator as an interest amount and then hit NPV to have your calculator calculate the net present value. Note that different financial calculators can work slightly differently, so you need to know how to operate your particular financial calculator to discount a stream of future values into a net present value.

In Exhibit 2, the listed enterprise value refers to the value of operations. You can now proceed to do part 2 of this homework assignment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started