Question

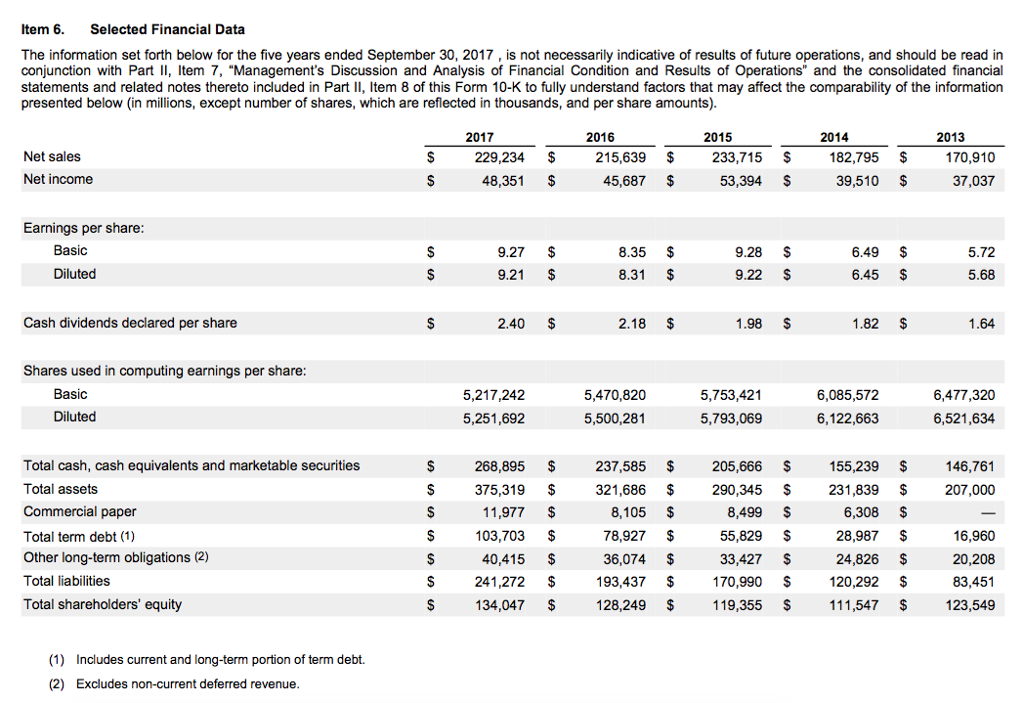

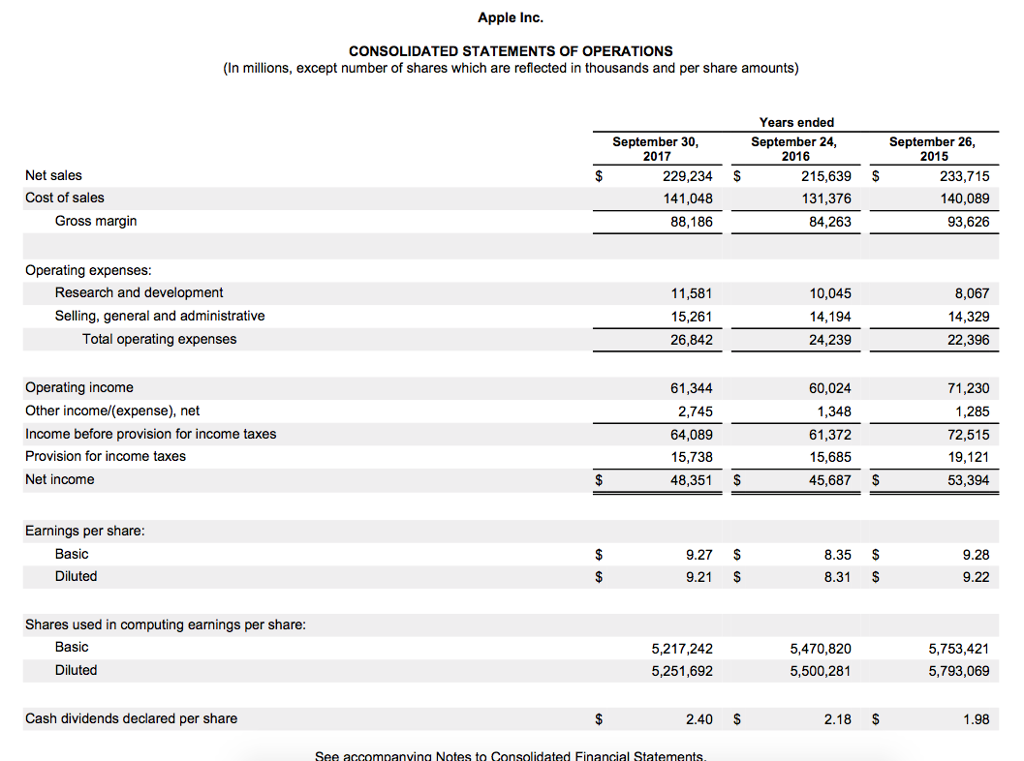

1. Calculate Apples rate of return on operating assets for fiscal year 2017. (See page 407 in your textbook for the formula for this ratio.)

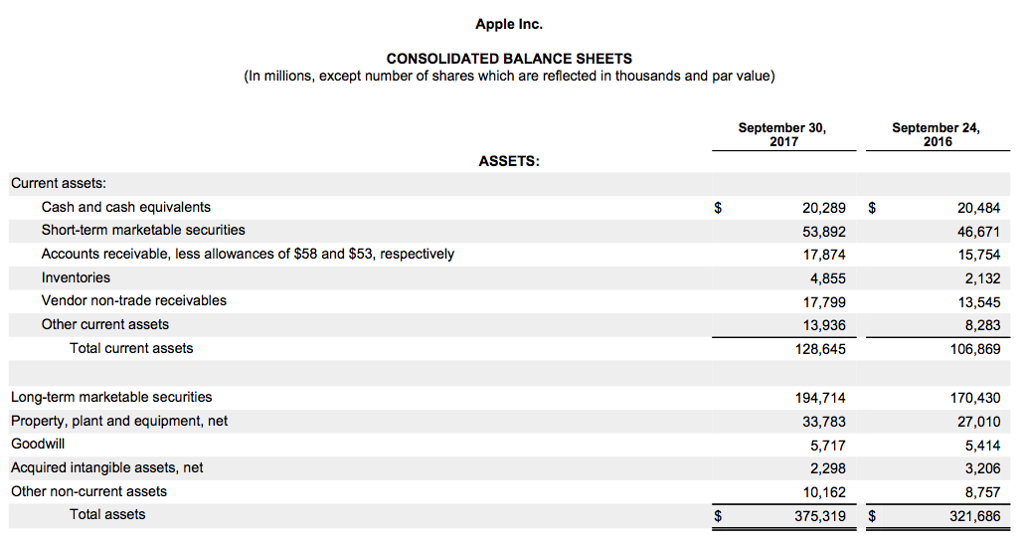

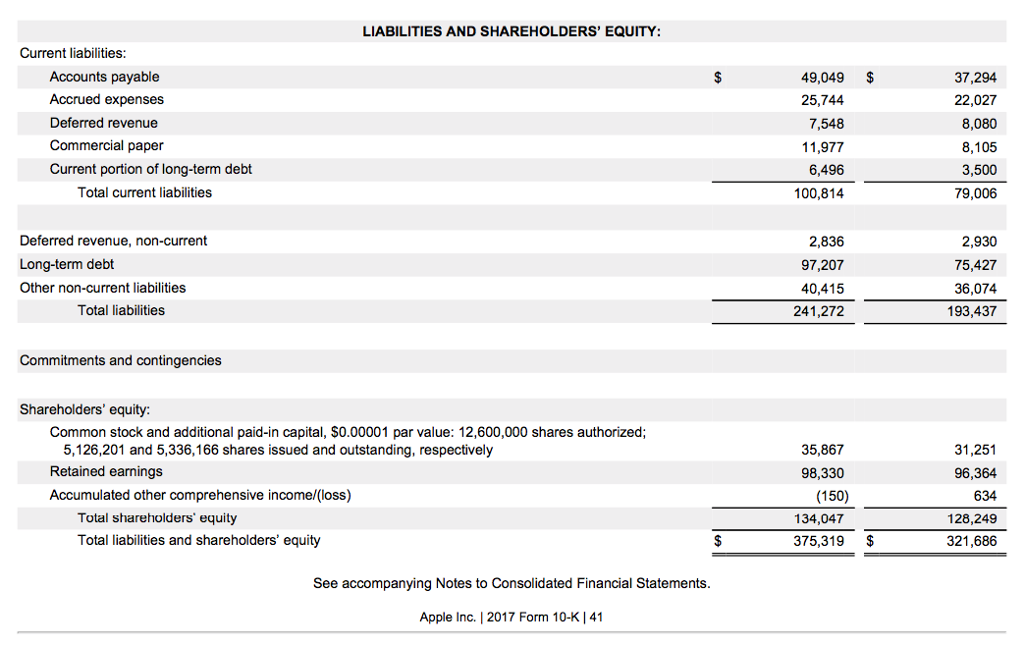

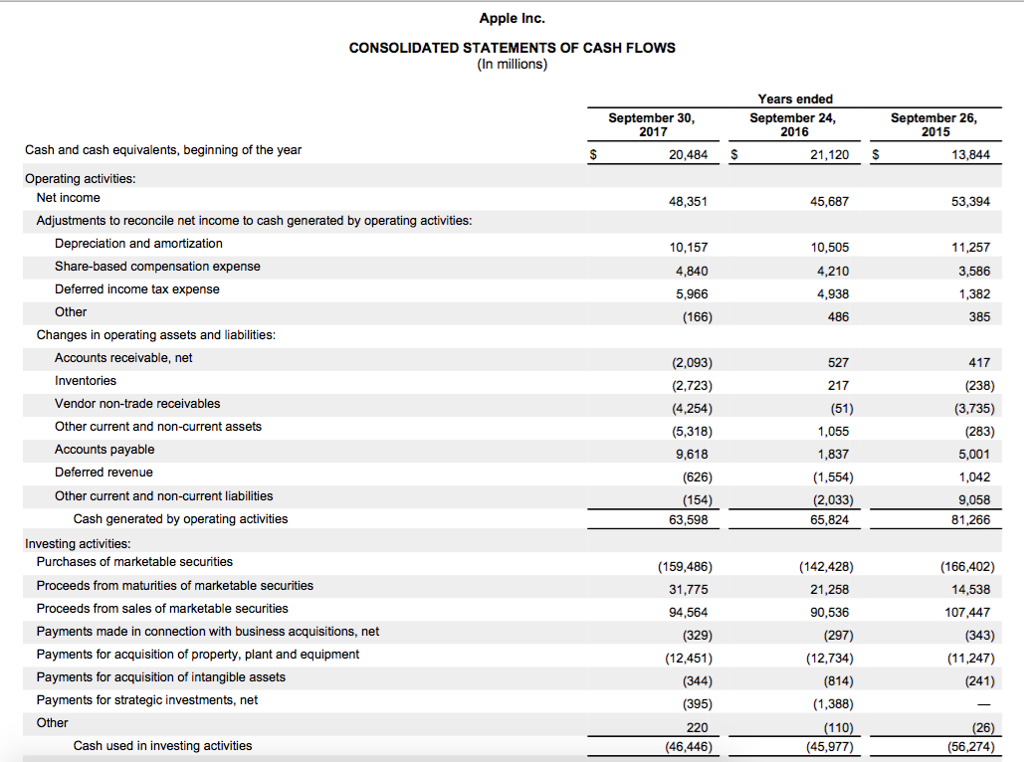

1. Calculate Apples rate of return on operating assets for fiscal year 2017. (See page 407 in your textbook for the formula for this ratio.) For the purposes of this assignment, use the amounts labeled Total assets on the consolidated balance sheets as the amounts for operating assets. Also, use the amount labeled Operating income on the consolidated income statements as the amounts for net operating income. What does this ratio attempt to measure? How might an investor use this information?

2. Calculate Apples total assets turnover for fiscal year 2017. (See page 442 in your textbook for the formula for this ratio.) What does this ratio attempt to measure? How might an investor use this information?

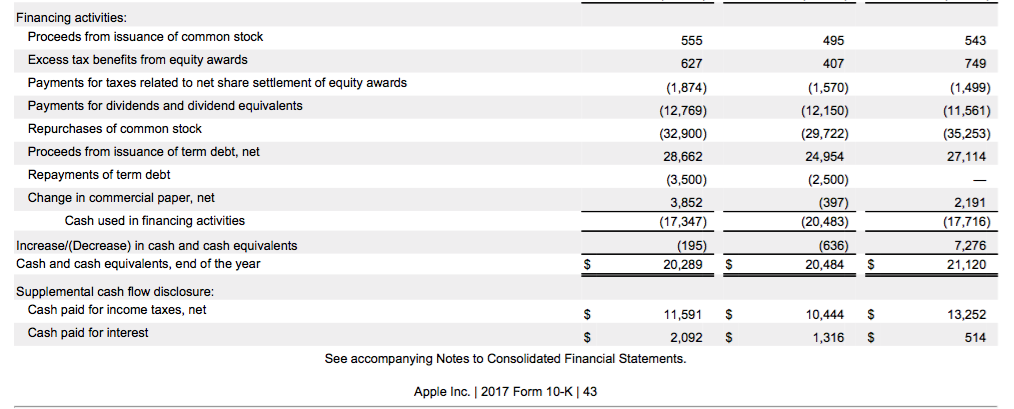

Income Statement:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started