Answered step by step

Verified Expert Solution

Question

1 Approved Answer

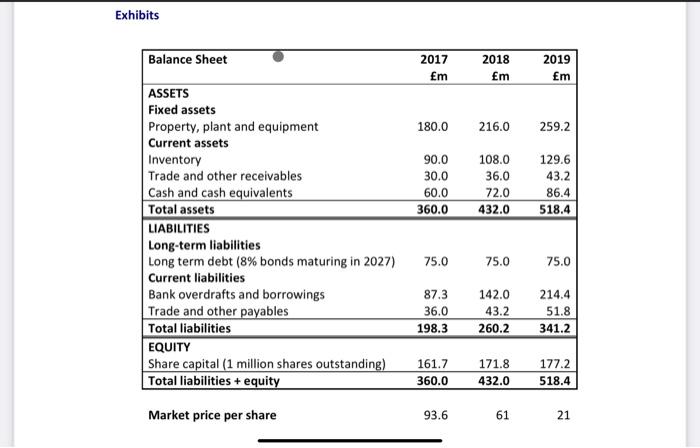

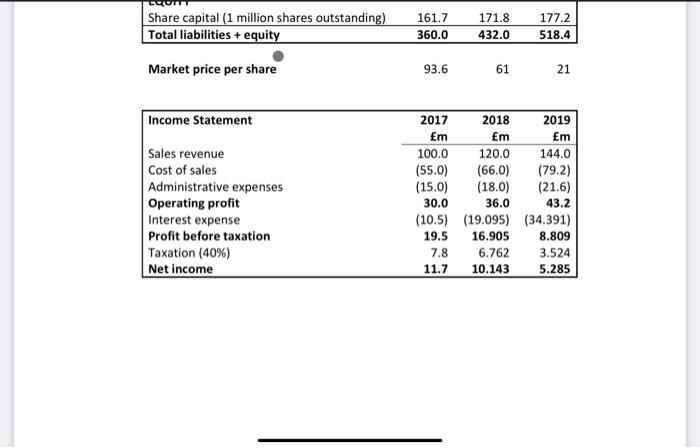

1. Calculate EVERGREEN CORP.s annual growth rate for sales, assets and operating profit in 2018 and 2019. What are the underlying drivers of these growth

1. Calculate EVERGREEN CORP.s annual growth rate for sales, assets and operating profit in 2018 and 2019. What are the underlying drivers of these growth rates?

2. Calculate EVERGREEN CORP.s financial ratios for 2018 and 2019, including a full Du Pont analysis.

3. Calculate EVERGREEN CORP.s Z-score for 2018 and 2019.

4. Based on your calculations, what are EVERGREEN CORP.s key strengths and weaknesses?

5. What recommendations would you make to the management of EVERGREEN CORP. to improve its performance? (be specific and make use of all the data available)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started