Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate inventory valuation using FIFO method using the following information The following transactions occurred in the month of May for Parts Pearl Inc.

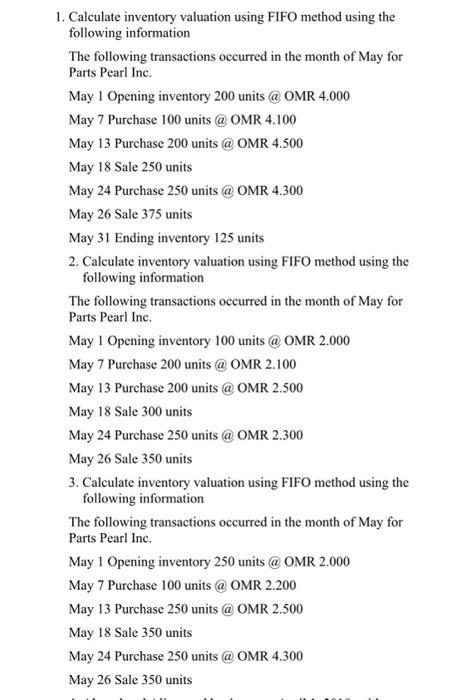

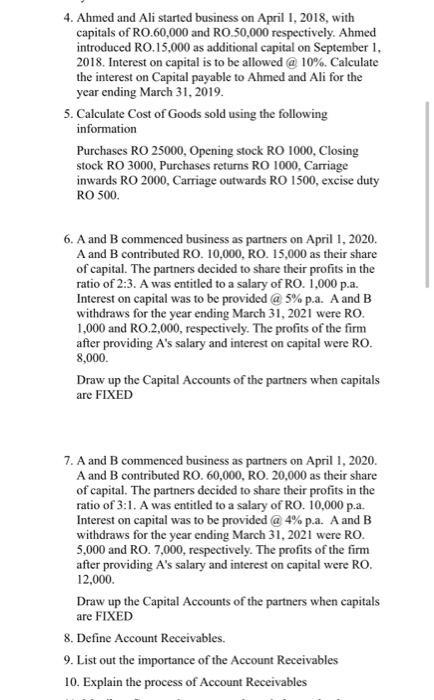

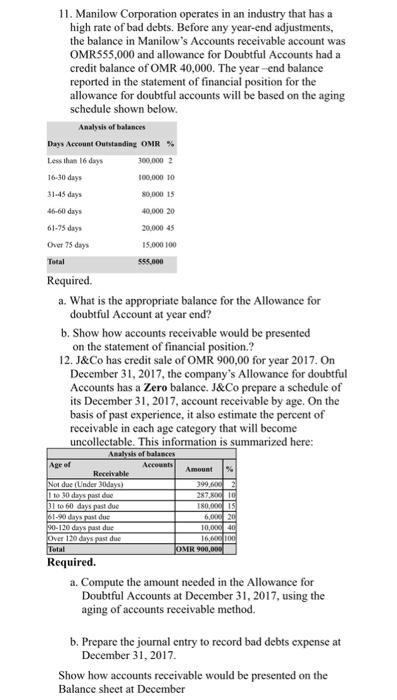

1. Calculate inventory valuation using FIFO method using the following information The following transactions occurred in the month of May for Parts Pearl Inc. May 1 Opening inventory 200 units @ OMR 4.000 May 7 Purchase 100 units @ OMR 4.100 May 13 Purchase 200 units @ OMR 4.500 May 18 Sale 250 units May 24 Purchase 250 units @ OMR 4.300 May 26 Sale 375 units May 31 Ending inventory 125 units 2. Calculate inventory valuation using FIFO method using the following information The following transactions occurred in the month of May for Parts Pearl Inc. May 1 Opening inventory 100 units @ OMR 2.000 May 7 Purchase 200 units @ OMR 2.100 May 13 Purchase 200 units @ OMR 2.500 May 18 Sale 300 units May 24 Purchase 250 units @ OMR 2.300 May 26 Sale 350 units 3. Calculate inventory valuation using FIFO method using the following information The following transactions occurred in the month of May for Parts Pearl Inc. May 1 Opening inventory 250 units @ OMR 2.000 May 7 Purchase 100 units @ OMR 2.200 May 13 Purchase 250 units @ OMR 2.500 May 18 Sale 350 units May 24 Purchase 250 units @ OMR 4.300 May 26 Sale 350 units 4. Ahmed and Ali started business on April 1, 2018, with capitals of RO.60,000 and RO.50,000 respectively. Ahmed introduced RO.15,000 as additional capital on September 1, 2018. Interest on capital is to be allowed @ 10%. Calculate the interest on Capital payable to Ahmed and Ali for the year ending March 31, 2019. 5. Calculate Cost of Goods sold using the following information Purchases RO 25000, Opening stock RO 1000, Closing stock RO 3000, Purchases returns RO 1000, Carriage inwards RO 2000, Carriage outwards RO 1500, excise duty RO 500. 6. A and B commenced business as partners on April 1, 2020. A and B contributed RO. 10,000, RO. 15,000 as their share of capital. The partners decided to share their profits in the ratio of 2:3. A was entitled to a salary of RO. 1,000 p.a. Interest on capital was to be provided @ 5% p.a. A and B withdraws for the year ending March 31, 2021 were RO. 1,000 and RO.2,000, respectively. The profits of the firm after providing A's salary and interest on capital were RO. 8,000. Draw up the Capital Accounts of the partners when capitals are FIXED 7. A and B commenced business as partners on April 1, 2020. A and B contributed RO. 60,000, RO. 20,000 as their share of capital. The partners decided to share their profits in the ratio of 3:1. A was entitled to a salary of RO. 10,000 p.a. Interest on capital was to be provided @ 4% p.a. A and B withdraws for the year ending March 31, 2021 were RO. 5,000 and RO. 7,000, respectively. The profits of the firm after providing A's salary and interest on capital were RO. 12,000. Draw up the Capital Accounts of the partners when capitals are FIXED 8. Define Account Receivables. 9. List out the importance of the Account Receivables 10. Explain the process of Account Receivables 11. Manilow Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Manilow's Accounts receivable account was OMR555,000 and allowance for Doubtful Accounts had a credit balance of OMR 40,000. The year-end balance reported in the statement of financial position for the allowance for doubtful accounts will be based on the aging schedule shown below. Analysis of balances Days Account Outstanding OMR % Less than 16 days 300,000 2 16-30 days 100,000 10 31-45 days 80,000 15 46-60 days 40,000 20 61-75 days 20,000 45 Over 75 days 15,000 100 Total 555.000 Required. a. What is the appropriate balance for the Allowance for doubtful Account at year end? b. Show how accounts receivable would be presented on the statement of financial position.? 12. J&Co has credit sale of OMR 900,00 for year 2017. On December 31, 2017, the company's Allowance for doubtful Accounts has a Zero balance. J&Co prepare a schedule of its December 31, 2017, account receivable by age. On the basis of past experience, it also estimate the percent of receivable in each age category that will become uncollectable. This information is summarized here: Analysis of balances Age of Receivable Not due (Under 30days) 1 to 30 days past due 31 to 60 days past due 61-90 days past due 90-120 days past due Over 120 days past due Total Required. Accounts Amount % 399,600 287,800 10 180,000 15 6,000 20 10,000 40 16,600 100 OMR 900,000 a. Compute the amount needed in the Allowance for Doubtful Accounts at December 31, 2017, using the aging of accounts receivable method. b. Prepare the journal entry to record bad debts expense at December 31, 2017. Show how accounts receivable would be presented on the Balance sheet at December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the inventory valuation using the FIFO FirstIn FirstOut method for each scenario Scenario 1 Transactions May 1 Opening inventory 200 un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started