1. Calculate monthly accrued interest expense for the installment note to Ford Credit (based on 365 days per year and interest starting to accrue

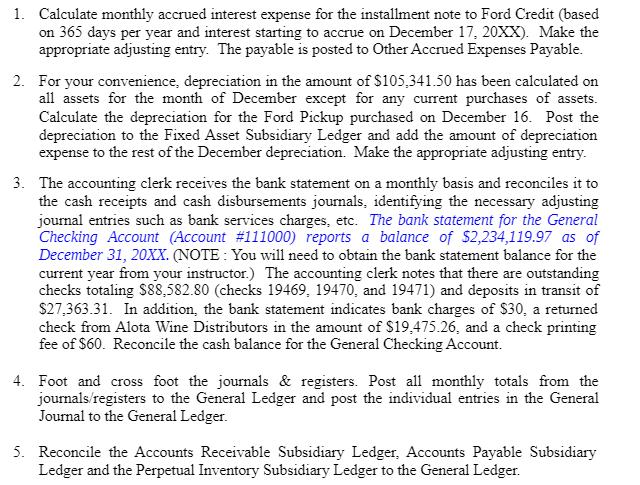

1. Calculate monthly accrued interest expense for the installment note to Ford Credit (based on 365 days per year and interest starting to accrue on December 17, 20XX). Make the appropriate adjusting entry. The payable is posted to Other Accrued Expenses Payable. 2. For your convenience, depreciation in the amount of $105,341.50 has been calculated on all assets for the month of December except for any current purchases of assets. Calculate the depreciation for the Ford Pickup purchased on December 16. Post the depreciation to the Fixed Asset Subsidiary Ledger and add the amount of depreciation expense to the rest of the December depreciation. Make the appropriate adjusting entry. 3. The accounting clerk receives the bank statement on a monthly basis and reconciles it to the cash receipts and cash disbursements journals, identifying the necessary adjusting journal entries such as bank services charges, etc. The bank statement for the General Checking Account (Account #111000) reports a balance of $2,234,119.97 as of December 31, 20XX. (NOTE: You will need to obtain the bank statement balance for the current year from your instructor.) The accounting clerk notes that there are outstanding checks totaling $88,582.80 (checks 19469, 19470, and 19471) and deposits in transit of $27,363.31. In addition, the bank statement indicates bank charges of $30, a returned check from Alota Wine Distributors in the amount of $19,475.26, and a check printing fee of $60. Reconcile the cash balance for the General Checking Account. 4. Foot and cross foot the journals & registers. Post all monthly totals from the journals/registers to the General Ledger and post the individual entries in the General Journal to the General Ledger. 5. Reconcile the Accounts Receivable Subsidiary Ledger, Accounts Payable Subsidiary Ledger and the Perpetual Inventory Subsidiary Ledger to the General Ledger.

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate monthly accrued interest expense for the installment note to Ford Credit based on 365 days per year and interest starting to accrue on December 17 20XX Make the appropriate adjusting entry ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started