1. Calculate Net operating profit margin

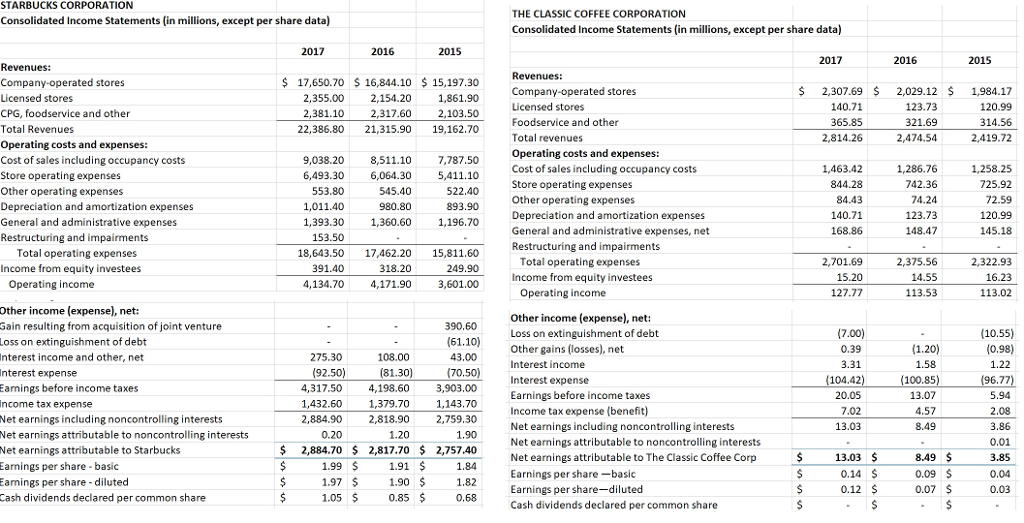

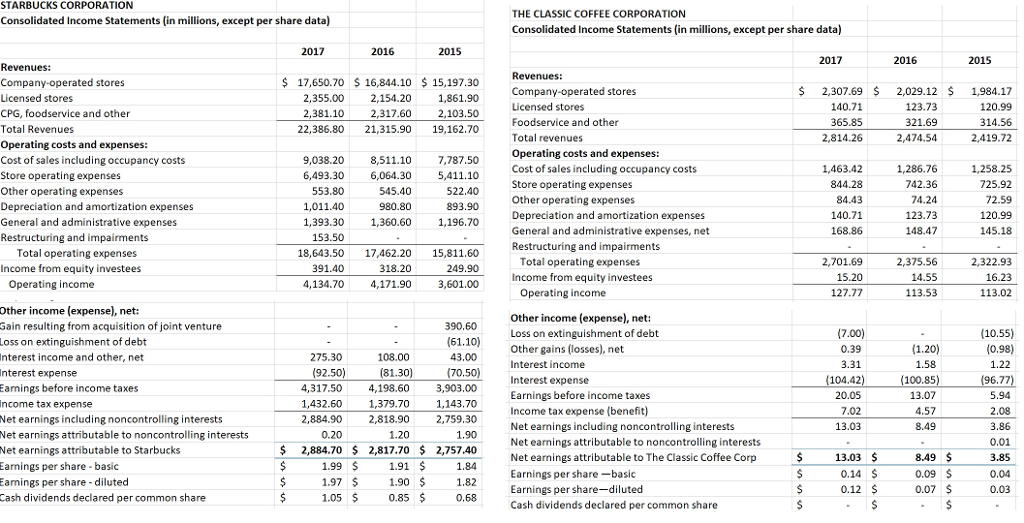

STARBUCKS CORPORATION THE CLASSIC COFFEE CORPORATION Consolidated Income Statements (in millions, except per share data) Consolidated Income Statements (in millions, except per share data) 2016 Revenues: Company-operated stores Licensed stores CPG, foodservice and other Total Revenues Operating costs and expenses: Cost of sales including occupancy costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Revenues: 17,650.70 16,844.10 15,197.30 1,861.90 2,381.10 2,317.60 2,103.50 22,386.80 21,315.90 19,162.70 S 2,307.69 2,029.12 1,984.17 120.99 314.56 Company-operated stores Licensed stores Foodservice and other Total revenues Operating costs and expenses: Cost of sales including occupancy costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses, net Restructuring and impairments 2,355.00 2,154.20 123.73 365.85 2,814.26 2,474.54 9,038.20 8,511.10 7,787.50 6,493.30 6,064.30 5,411.10 522.40 893.90 1,196.70 1,463.42 844.28 1,286.76 742.36 1,258.25 553.80 1,011.40 545.40 980.80 1,393.30,360.60 123.73 148.47 168.86 Total operating expenses Income from equity investees 18,643.50 17,462.20 15,811.60 249.90 4,134.70 4,171.90 3,601.00 Total operating expenses Income from equity investees 2,701.69 15.20 127.77 2,375.56 14.55 113.53 2,322.93 16.23 113.02 391.40 318.20 0 perating income Operating income Other income (expense), net: Gain resulting from acquisition of joint venture Loss on extinguishment of debt Interest income and other, net nterest expense Earnings before income taxes Other income (expense), net: Loss on extinguishment of debt 390,60 (61.10 other gains (losses), net 275.30 108.00 3.31 1.58 1.22 Interest income Interest expense Earnings before income taxes Income tax expense (benefit) Net earnings including noncontrolling interests Net eanings attributable to noncontrolling interests Net earnings attributable to The Classic Coffee Corp Earnings per share-basic Earnings per share-diluted Cash dividends declared per common share (70.50) 4,317.50 4,198.60 3,903.00 1,432.60 1,379.70 1,143.70 2,884.90 2,818.90 2,759.30 (100.85) Net earnings including noncontrolling interests Net earnings attributable to noncontrolling interests Net earnings attributable to Starbucks Earnings per share-basic Earnings per share - diluted Cash dividends declared per common share 13.03 8.49 0.01 2,884.70 2,817.70 2,757.40 $13.03 8.49 0.07 $ 0.85