Answered step by step

Verified Expert Solution

Question

1 Approved Answer

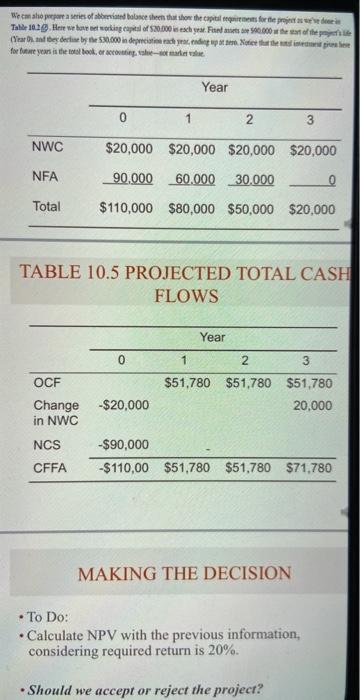

1. Calculate NPV with the information provided, considering required return is 20%. 2. Should we accept or reject the project? We can also prepare a

1. Calculate NPV with the information provided, considering required return is 20%.

2. Should we accept or reject the project?

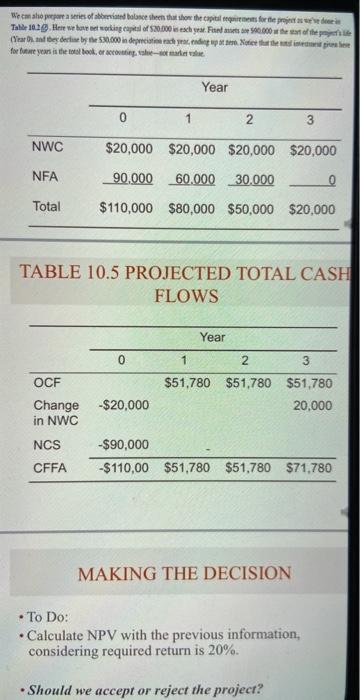

We can also prepare a series of abbreviated balance sheets that show the capital requirements for the project as we've done in table 10.2. Here we have net working and capital of $20,000 in each year. Fixed assets are $90,000 at the start of the project's life (year 0), and they decline by the $30,000 in depreciation each year, ending up at zero. Notice that the total investment given here for future years is the total book, or accounting, value- not market value.

Wecm sto prepare a series of red bone that shows the capital gains for the projet Talle 1039. Here we have tworking capital of $20.000 es each Fed0.000 hehe Year of the deste 30.000 is deprecated and protect that the for future year is the book, regalo Year 0 1 2 NWC $20,000 $20,000 $20,000 $20,000 NFA 90,000 60.000 30.000 Total $110,000 $80,000 $50,000 $20,000 TABLE 10.5 PROJECTED TOTAL CASH FLOWS Year 0 1 2 3 OCF Change in NWC $51.780 $51,780 $51.780 20,000 -$20,000 NCS CFFA -$90,000 -$110,00 $51,780 $51,780 $71.780 MAKING THE DECISION To Do: Calculate NPV with the previous information, considering required return is 20%. . Should we accept or reject the project 1. Calculate NPV, considering requires return is 20%

2. Should we accept or reject the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started