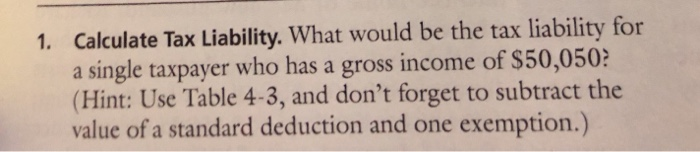

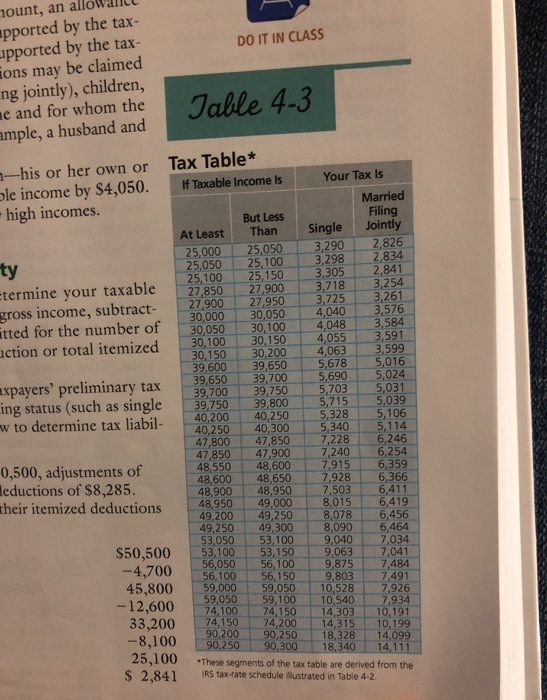

1. Calculate Tax Liability. What would be the tax liability for a single taxpayer who has a gross income of $50,050 (Hint: Use Table 4-3, and don't forget to subtract the value of a standard deduction and one exemption.) DO IT IN CLASS mount, an allowance apported by the tax- Lupported by the tax- ions may be claimed ng jointly), children, me and for whom the ample, a husband and Table 4-3 Tax Table* If Taxable income is 3,298 ty 1-his or her own or ble income by $4,050. Married -high incomes. But Less Filing At Least Than Jointly Single 25,000 25,050 3,290 2,826 25,050 2,834 25,100 25,100 25,150 3,305 2,841 37183,254 etermine your taxable 27,850 27,900 27,900 27,950 3,261 3,725 gross income, subtract- 30,000 30,050 4,040 3,576 30,050 30,100 4,048 atted for the number of 3,584 30,100 30,150 4,055 3,591 action or total itemized 30,150 30,200 4,063 3,599 39,600 39,650 5,678 5,016 39,650 39,700 5,690 5,024 axpayers' preliminary tax 39,700 39,750 5,703 5,031 39,750 39,800 5,715 ing status (such as single 5,039 40,200 40,250 5,328 5,106 w to determine tax liabil- 40,250 40,300 5,340 5,114 47,800 47,850 7,228 6,246 47,850 47,900 7,240 6,254 48,550 0,500, adjustments of 48,600 7.915 6,359 48,600 48,650 7,928 6,366 eductions of $8,285. 48,900 48,950 7,503 6,411 48,950 their itemized deductions 49,000 8,015 6,419 49,200 49,250 8,078 6,456 49,250 49,300 8,090 6,464 53,050 53,100 9,040 7,034 $50,500 53,100 53,150 9,063 7,041 56,050 56,100 9,875 7,484 -4,700 56,100 56,150 9,803 7,491 45,800 59,000 59,050 10,528 7.926 59,050 -12,600 59,100 10,5407 ,934 74,100 74,150 14,303 10,191 33,200 74,150 74,200 14,31510,199 90,200 -8,100 90,25018,328 14,099 90,250 90,300 1 8,340 14,111 25,100 *These segments of the tax table are derived from the $ 2,841 RS tax-rate schedule illustrated in Table 4-2. 1. Calculate Tax Liability. What would be the tax liability for a single taxpayer who has a gross income of $50,050 (Hint: Use Table 4-3, and don't forget to subtract the value of a standard deduction and one exemption.) DO IT IN CLASS mount, an allowance apported by the tax- Lupported by the tax- ions may be claimed ng jointly), children, me and for whom the ample, a husband and Table 4-3 Tax Table* If Taxable income is 3,298 ty 1-his or her own or ble income by $4,050. Married -high incomes. But Less Filing At Least Than Jointly Single 25,000 25,050 3,290 2,826 25,050 2,834 25,100 25,100 25,150 3,305 2,841 37183,254 etermine your taxable 27,850 27,900 27,900 27,950 3,261 3,725 gross income, subtract- 30,000 30,050 4,040 3,576 30,050 30,100 4,048 atted for the number of 3,584 30,100 30,150 4,055 3,591 action or total itemized 30,150 30,200 4,063 3,599 39,600 39,650 5,678 5,016 39,650 39,700 5,690 5,024 axpayers' preliminary tax 39,700 39,750 5,703 5,031 39,750 39,800 5,715 ing status (such as single 5,039 40,200 40,250 5,328 5,106 w to determine tax liabil- 40,250 40,300 5,340 5,114 47,800 47,850 7,228 6,246 47,850 47,900 7,240 6,254 48,550 0,500, adjustments of 48,600 7.915 6,359 48,600 48,650 7,928 6,366 eductions of $8,285. 48,900 48,950 7,503 6,411 48,950 their itemized deductions 49,000 8,015 6,419 49,200 49,250 8,078 6,456 49,250 49,300 8,090 6,464 53,050 53,100 9,040 7,034 $50,500 53,100 53,150 9,063 7,041 56,050 56,100 9,875 7,484 -4,700 56,100 56,150 9,803 7,491 45,800 59,000 59,050 10,528 7.926 59,050 -12,600 59,100 10,5407 ,934 74,100 74,150 14,303 10,191 33,200 74,150 74,200 14,31510,199 90,200 -8,100 90,25018,328 14,099 90,250 90,300 1 8,340 14,111 25,100 *These segments of the tax table are derived from the $ 2,841 RS tax-rate schedule illustrated in Table 4-2