Answered step by step

Verified Expert Solution

Question

1 Approved Answer

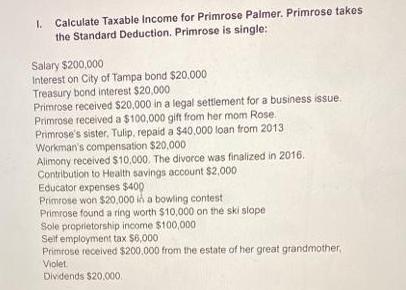

1. Calculate Taxable Income for Primrose Palmer. Primrose takes the Standard Deduction. Primrose is single: Salary $200,000 Interest on City of Tampa bond $20,000

1. Calculate Taxable Income for Primrose Palmer. Primrose takes the Standard Deduction. Primrose is single: Salary $200,000 Interest on City of Tampa bond $20,000 Treasury bond interest $20,000. Primrose received $20,000 in a legal settlement for a business issue. Primrose received a $100,000 gift from her mom Rose. Primrose's sister, Tulip, repaid a $40.000 loan from 2013 Workman's compensation $20,000 Alimony received $10,000. The divorce was finalized in 2016. Contribution to Health savings account $2,000 Educator expenses $400 Primrose won $20,000 in a bowling contest Primrose found a ring worth $10,000 on the ski slope Sole proprietorship income $100,000 Self employment tax $6,000 Primrose received $200.000 from the estate of her great grandmother, Violet Dividends $20.000

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer The data given for cakulate taxable income for primrose palmer calculating th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started