Answered step by step

Verified Expert Solution

Question

1 Approved Answer

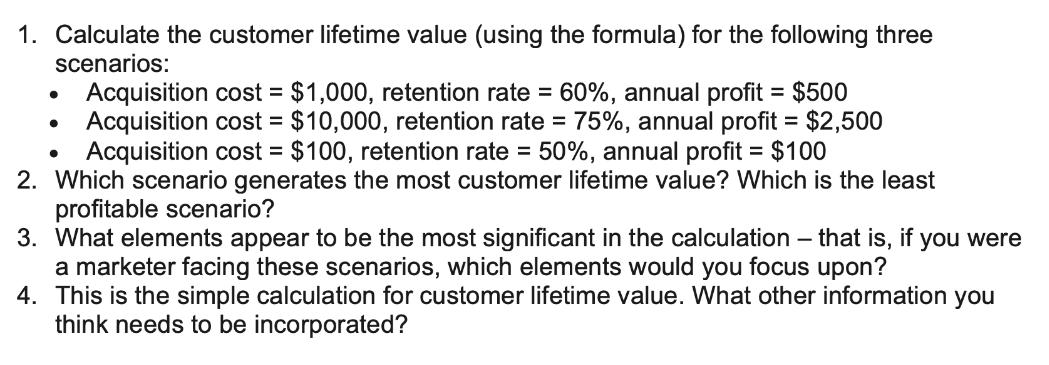

1. Calculate the customer lifetime value (using the formula) for the following three scenarios: Acquisition cost = $1,000, retention rate = 60%, annual profit

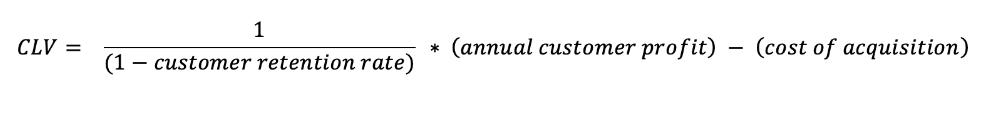

1. Calculate the customer lifetime value (using the formula) for the following three scenarios: Acquisition cost = $1,000, retention rate = 60%, annual profit = $500 Acquisition cost = $10,000, retention rate = 75%, annual profit = $2,500 Acquisition cost = $100, retention rate = 50%, annual profit = $100 2. Which scenario generates the most customer lifetime value? Which is the least profitable scenario? 3. What elements appear to be the most significant in the calculation - that is, if you were a marketer facing these scenarios, which elements would you focus upon? 4. This is the simple calculation for customer lifetime value. What other information you think needs to be incorporated? CLV = 1 (1 customer retention rate) * (annual customer profit) - (cost of acquisition)

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Customer Lifetime Value CLV Calculation Scenario 1 Acquisition cost 1000 Retention rate 60 Annual profit 500 CLV 1000 1 06 500 1000 1667 Sc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started