Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate the monthly excess returns, TM-If, on the market portfolio. 2. MSFT is not currently paying dividend. The closing price in December 1990

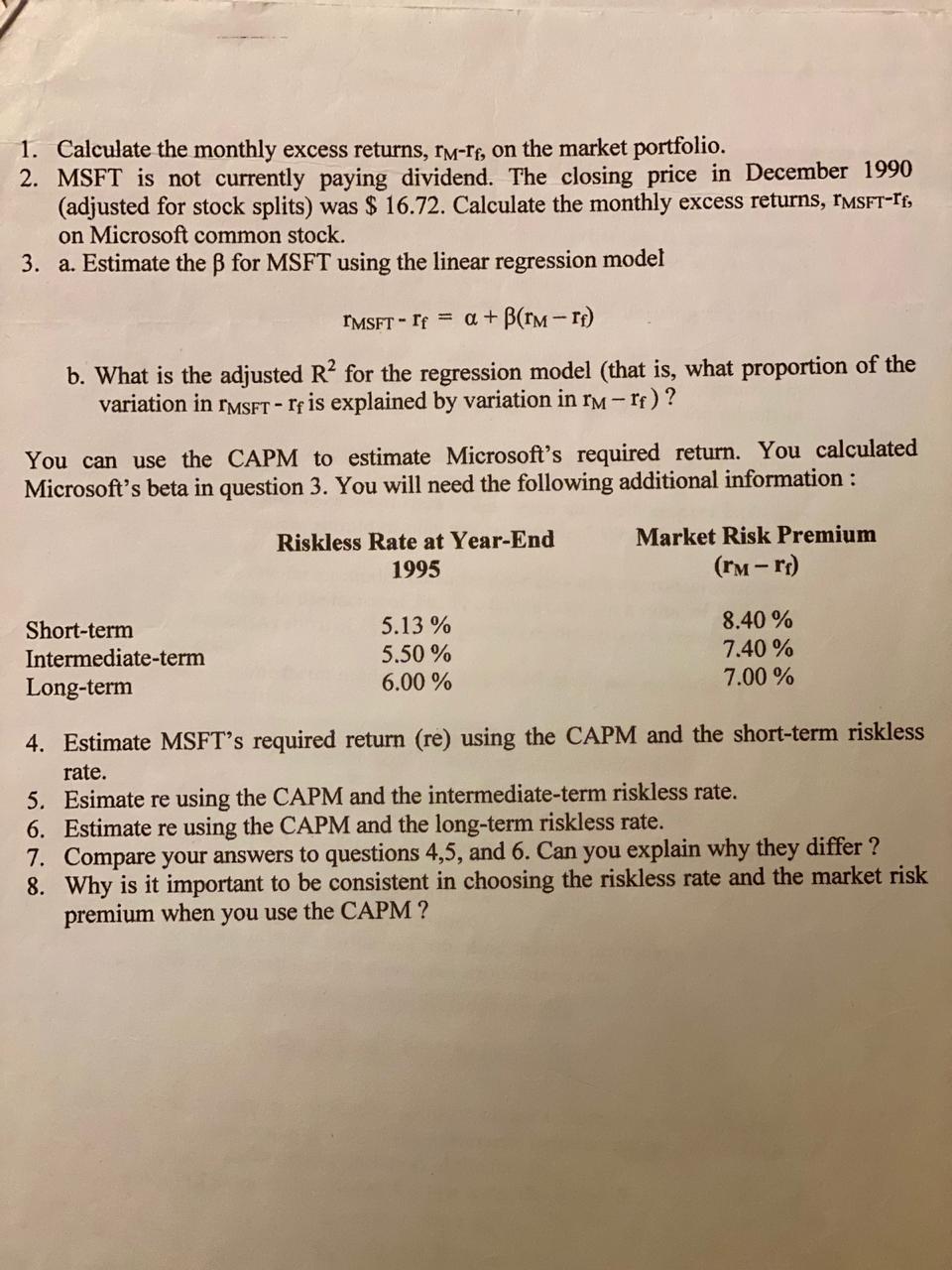

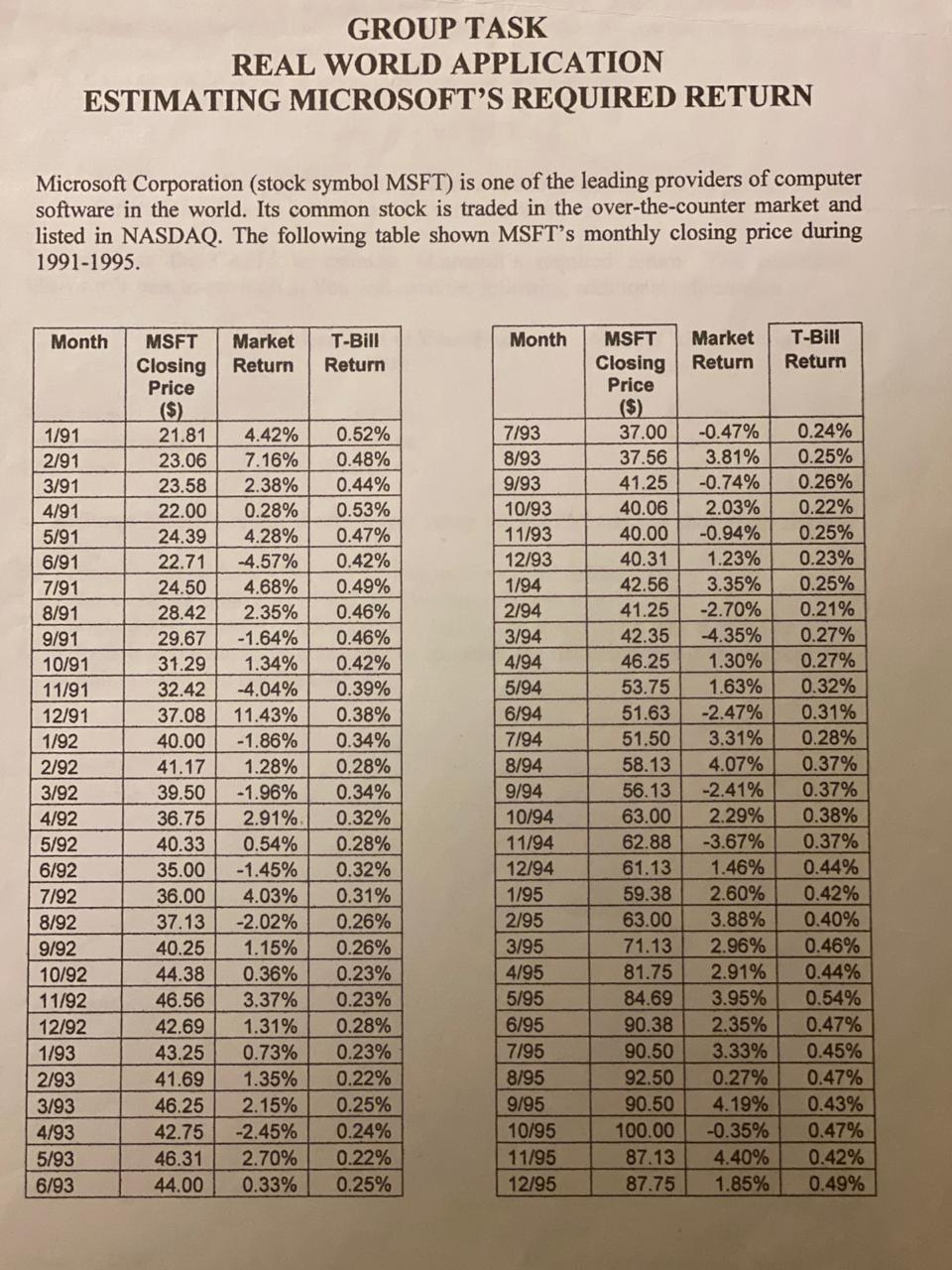

1. Calculate the monthly excess returns, TM-If, on the market portfolio. 2. MSFT is not currently paying dividend. The closing price in December 1990 (adjusted for stock splits) was $ 16.72. Calculate the monthly excess returns, TMSFT-If, on Microsoft common stock. 3. a. Estimate the for MSFT using the linear regression model TMSFT If +(TM-If) b. What is the adjusted R for the regression model (that is, what proportion of the variation in MSFT - If is explained by variation in r- If)? You can use the CAPM to estimate Microsoft's required return. You calculated Microsoft's beta in question 3. You will need the following additional information: Short-term Intermediate-term Long-term Riskless Rate at Year-End 1995 5.13% 5.50% 6.00% Market Risk Premium (rm -rf) 8.40% 7.40% 7.00% 4. Estimate MSFT's required return (re) using the CAPM and the short-term riskless rate. 5. Esimate re using the CAPM and the intermediate-term riskless rate. 6. Estimate re using the CAPM and the long-term riskless rate. 7. Compare your answers to questions 4,5, and 6. Can you explain why they differ? 8. Why is it important to be consistent in choosing the riskless rate and the market risk premium when you use the CAPM? GROUP TASK REAL WORLD APPLICATION ESTIMATING MICROSOFT'S REQUIRED RETURN Microsoft Corporation (stock symbol MSFT) is one of the leading providers of computer software in the world. Its common stock is traded in the over-the-counter market and listed in NASDAQ. The following table shown MSFT's monthly closing price during 1991-1995. Month MSFT Market T-Bill Closing Return Return Month MSFT Market T-Bill Closing Return Return Price Price ($) ($) 1/91 21.81 4.42% 0.52% 7/93 37.00 -0.47% 0.24% 2/91 23.06 7.16% 0.48% 8/93 37.56 3.81% 0.25% 3/91 23.58 2.38% 0.44% 9/93 41.25 -0.74% 0.26% 4/91 22.00 0.28% 0.53% 10/93 40.06 2.03% 0.22% 5/91 24.39 4.28% 0.47% 11/93 40.00 -0.94% 0.25% 6/91 22.71 -4.57% 0.42% 12/93 40.31 1.23% 0.23% 7/91 24.50 4.68% 0.49% 1/94 42.56 3.35% 0.25% 8/91 28.42 2.35% 0.46% 2/94 41.25 -2.70% 0.21% 9/91 29.67 -1.64% 0.46% 3/94 42.35 -4.35% 0.27% 10/91 31.29 1.34% 0.42% 4/94 46.25 1.30% 0.27% 11/91 32.42 -4.04% 0.39% 5/94 53.75 1.63% 0.32% 12/91 37.08 11.43% 0.38% 6/94 51.63 -2.47% 0.31% 1/92 40.00 -1.86% 0.34% 7/94 51.50 3.31% 0.28% 2/92 41.17 1.28% 0.28% 8/94 58.13 4.07% 0.37% 3/92 39.50 -1.96% 0.34% 9/94 56.13 -2.41% 0.37% 4/92 36.75 2.91% 0.32% 10/94 63.00 2.29% 0.38% 5/92 40.33 0.54% 0.28% 11/94 62.88 -3.67% 0.37% 6/92 35.00 -1.45% 0.32% 12/94 61.13 1.46% 0.44% 7/92 36.00 4.03% 0.31% 1/95 59.38 2.60% 0.42% 8/92 37.13 -2.02% 0.26% 2/95 63.00 3.88% 0.40% 9/92 40.25 1.15% 0.26% 3/95 71.13 2.96% 0.46% 10/92 44.38 0.36% 0.23% 4/95 81.75 2.91% 0.44% 11/92 46.56 3.37% 0.23% 5/95 84.69 3.95% 0.54% 12/92 42.69 1.31% 0.28% 6/95 90.38 2.35% 0.47% 1/93 43.25 0.73% 0.23% 7/95 90.50 3.33% 0.45% 2/93 41.69 1.35% 0.22% 8/95 92.50 0.27% 0.47% 3/93 46.25 2.15% 0.25% 9/95 90.50 4.19% 0.43% 4/93 42.75 -2.45% 0.24% 10/95 100.00 -0.35% 0.47% 5/93 46.31 2.70% 0.22% 11/95 87.13 4.40% 0.42% 6/93 44.00 0.33% 0.25% 12/95 87.75 1.85% 0.49%

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the monthly excess returns and estimate Microsofts required return using the CAPM we need to follow the steps below 1 Calculate the month...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started