Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate the NPV of Fox River Telephones proposed bond refunding. 2. What is the importance of each of the four issues raised by members

1. Calculate the NPV of Fox River Telephone’s proposed bond refunding.

2. What is the importance of each of the four issues raised by members of Fox River’s board regarding the refunding decision?

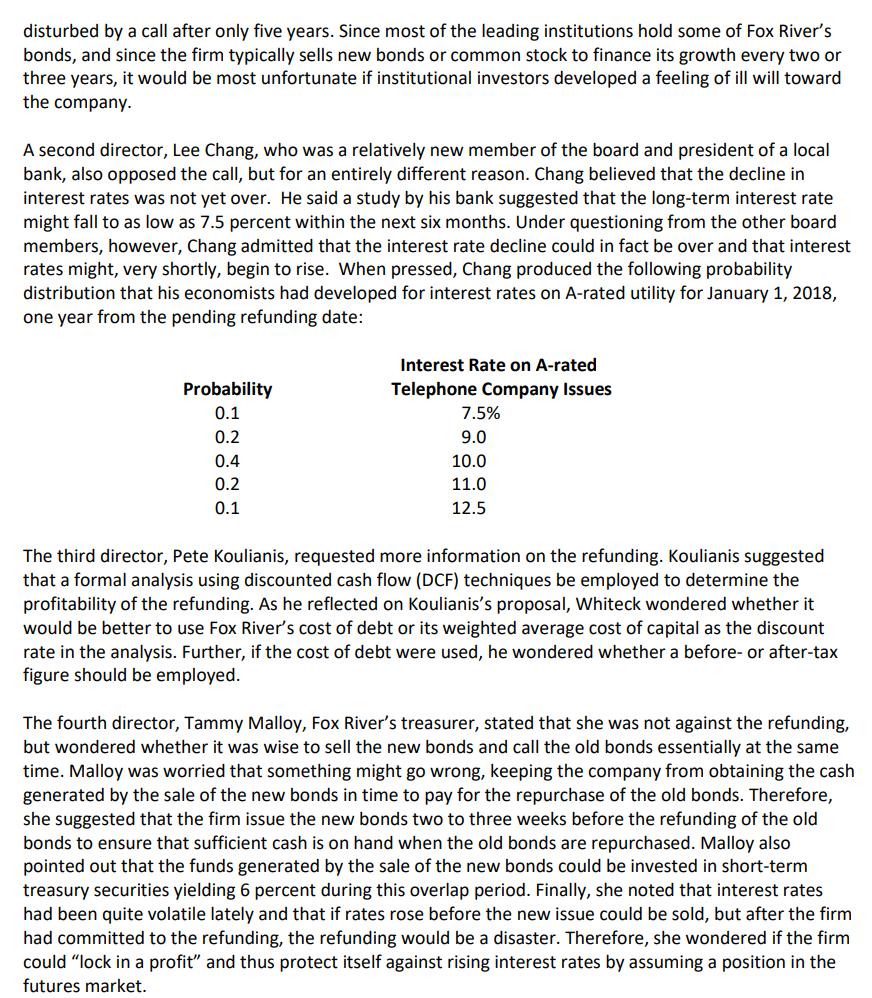

John Whiteck, financial vice president of Fox River Telephone Company, has just begun reviewing the minutes of the company's November 2016 board of directors meeting. The major topic discussed at the meeting was whether Fox River should refund any of its currently outstanding bond issues. Of particular interest is a $50 million, 30-year, 11.5% annual coupon, first-mortgage bond (consisting of 50,000 $1,000 par value bonds) issued approximately five years ago. Four of the board members had taken markedly different positions on the question. At the conclusion of the meeting, Ronald Tire, chairman of the board, asked Whiteck to prepare a report analyzing the alternative points of view. The bonds in question had been issued in January, 2012, when interest rates were still relatively high. It was necessary to issue the bonds at that time, despite the high interest rates, because the company needed to complete the modernization and expansion of its switching facilities outside San Francisco to meet rapidly growing demand for telephone services in its service area. At that time, Whiteck and the board strongly believed interest rates would decline in the future, but they were unsure of when rates would fall or by how much. Now, almost five years later, with lower rates, Fox River can sell A-rated bonds at a coupon rate significantly less than 11.5 percent. Since Whiteck had anticipated a decline in interest rates when he sold the $50 million issue, he had insisted that the bonds be made callable after five years. (If the bonds had not been callable, Fox River would have had to pay an interest rate of only 11.0 percent, a full 50 basis points less than the actual 11.5 percent.) The bonds can be called after January 1, 2017, but an initial call premium of 11.5 percent, or $115 per bond, would have to be paid. This premium declines by 11.5% / 25 = 0.46 percentage points, or $4.60, each year. Thus, if the bonds were called in 2022, the call premium would be (0.115/25)(20) = 9.2% or $92, where 20 represents the number of years remaining to the maturity. The flotation costs on this issue amounted to 1.5 percent of the face amount, or $750,000. The firm's federal-plus-state tax rate is 40 percent. Whiteck estimates that Fox River can sell a new issue of 25-year bonds at an annual coupon interest rate of 9.5 percent. The call of the old and the sale of the new bonds could take place five to seven weeks after the decision to refund has been made; this time is required to give legal notice to bondholders and to arrange the $50 million or more needed to pay them off. The flotation cost on the refunding issue would be one percent of the new issue's face amount, and funds from the new issue would be available from the underwriters the day they were needed to pay off the old bonds. Whiteck had proposed at the last directors' meeting that the company call the 11.5 percent bonds and refund them with a new 9.5 percent issue. (The bonds could not have been called earlier because of the call protection provision in the indenture.) Although the refunding cost would be substantial, he believed the interest savings of 2 percent per year for 25 years on a $50 million issue would be well worth the cost. Whiteck did not anticipate adverse reactions from the other board members; however, four of them voiced strong doubts about the refunding proposal. The first doubt was raised by Trish Esposito, a long-term member of Fox River's board and president of Esposito, Arfaras, and Black, an investment banking house catering primarily to institutional clients such as insurance companies and pension funds. Esposito argued that calling the bonds for refunding would not be well received by the major financial institutions that hold the firm's outstanding bonds. According to Esposito, the institutional investors that hold the bonds purchased them with the expectation of receiving the 11.5 percent interest rate for at least 10 years, and these investors would be very

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV of Fox River Telephones proposed bond refunding we need to consider the cash flows associated with the old bonds and the new bonds Here are the steps to calculate the NPV 1 Calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started