Answered step by step

Verified Expert Solution

Question

1 Approved Answer

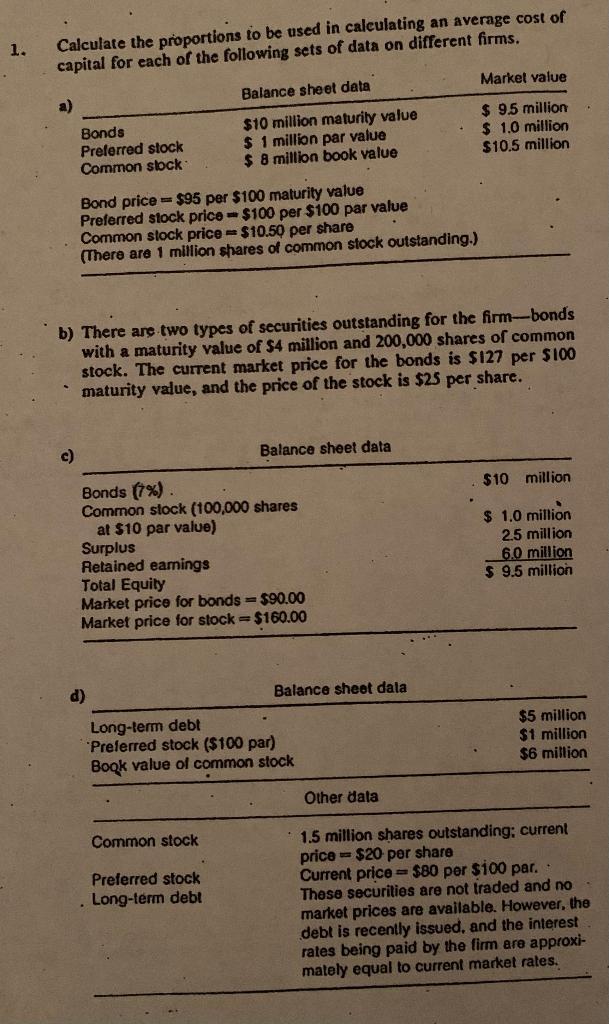

1. Calculate the proportions to be used in calculating an average cost of capital for each of the following sets of data on different

1. Calculate the proportions to be used in calculating an average cost of capital for each of the following sets of data on different firms. Bonds Preferred stock Common stock c) Bond price $95 per $100 maturity value Balance sheet data $10 million maturity value $ 1 million par value $ 8 million book value Preferred stock price Common stock price (There are 1 million shares of common stock outstanding.) $100 per $100 par value $10.50 per share b) There are two types of securities outstanding for the firm-bonds with a maturity value of $4 million and 200,000 shares of common stock. The current market price for the bonds is $127 per $100 ` maturity value, and the price of the stock is $25 per share. d) Bonds (7%) Common stock (100,000 shares at $10 par value) Surplus Retained earnings Balance sheet data Total Equity Market price for bonds $90.00 Market price for stock = $160.00 Common stock Preferred stock Long-term debt Balance sheet dala Long-term debt Preferred stock ($100 par) Book value of common stock Market value $ 9.5 million $ 1.0 million $10.5 million Other data $10 million $ 1.0 million 2.5 million 6.0 million $ 9.5 million $5 million $1 million $6 million 1.5 million shares outstanding; current price = $20 per share Current price $80 per $100 par. These securities are not traded and no market prices are available. However, the debt is recently issued, and the interest rates being paid by the firm are approxi- mately equal to current market rates.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the proportion of each type of capital for the purpose of calculating the average cost of capital for each firm you need to determine the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started