Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate the simple interest and amount of the loan on each of the following personal loans: (a) $3 000 for 2 years at

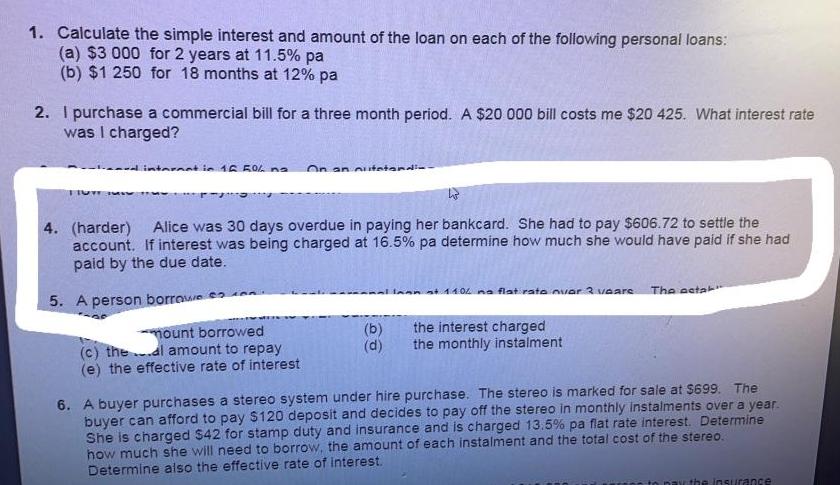

1. Calculate the simple interest and amount of the loan on each of the following personal loans: (a) $3 000 for 2 years at 11.5% pa (b) $1 250 for 18 months at 12% pa 2. I purchase a commercial bill for a three month period. A $20 000 bill costs me $20 425. What interest rate was I charged? HUW atarmat in 16 50% no On an outstandi-- T 4. (harder) Alice was 30 days overdue in paying her bankcard. She had to pay $606.72 to settle the account. If interest was being charged at 16.5% pa determine how much she would have paid if she had paid by the due date. 5. A person borroweso mount borrowed (c) theal amount to repay (e) the effective rate of interest h (b) (d) Jannat 11% no flat rate over 3 years The astak the interest charged the monthly instalment 6. A buyer purchases a stereo system under hire purchase. The stereo is marked for sale at $699. The buyer can afford to pay $120 deposit and decides to pay off the stereo in monthly instalments over a year. She is charged $42 for stamp duty and insurance and is charged 13.5% pa flat rate interest. Determine how much she will need to borrow, the amount of each instalment and the total cost of the stereo. Determine also the effective rate of interest. w the insurance

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Loan amount 3000 Interest rate 115 per annum Time 2 years Simple interest can be calculated using the formula Interest Principal Rate Time 100 Inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started