Answered step by step

Verified Expert Solution

Question

1 Approved Answer

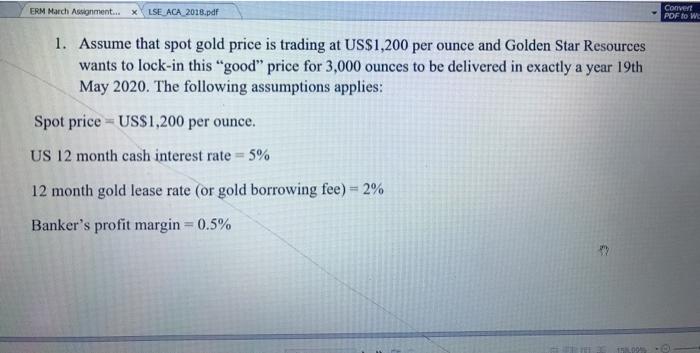

1. calculate the total price Golden Star Resources will recieve on 19th May, 2021 under normal circumstances 2. identify the hedging instrument Golden Star Resources

1. calculate the total price Golden Star Resources will recieve on 19th May, 2021 under normal circumstances

2. identify the hedging instrument Golden Star Resources used to accomplish its objectives

3. what other hedging tool can Golden Star Resources use to accomplish the same objective,and what financial position will the company take?

4. offer two reasons why you selected that hedging tool identified in the above question

The price of Gold at the end of the year is still US$1,200

ERM March Assignment... X LSE ACA 2018.pdf Convert PDF to WE 1. Assume that spot gold price is trading at US$1,200 per ounce and Golden Star Resources wants to lock-in this "good" price for 3,000 ounces to be delivered in exactly a year 19th May 2020. The following assumptions applies: Spot price = US$1,200 per ounce. US 12 month cash interest rate = 5% 12 month gold lease rate (or gold borrowing fee) = 2% Banker's profit margin = 0.5% ERM March Assignment... X LSE ACA 2018.pdf Convert PDF to WE 1. Assume that spot gold price is trading at US$1,200 per ounce and Golden Star Resources wants to lock-in this "good" price for 3,000 ounces to be delivered in exactly a year 19th May 2020. The following assumptions applies: Spot price = US$1,200 per ounce. US 12 month cash interest rate = 5% 12 month gold lease rate (or gold borrowing fee) = 2% Banker's profit margin = 0.5% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started