Question

1. Calculate the Weighted Average Cost of Capital (WACC). Explain if the company ABC should apply this WACC for its other capital projects. 2. Calculate

1. Calculate the Weighted Average Cost of Capital (WACC). Explain if the company ABC should apply this WACC for its other capital projects.

2. Calculate the price per share of ABC Company using DCF (Free cash flow to Firm) and DDM model. As a rational investor, would you invest in this company based on this valuation?

Also, calculate the bond price of the company ABC bond issue and explain the potential reasons why the bond is trading at premium or discount.

3. Calculate the Economic Value Added (EVA). As an investment analyst of your investment firm, would you recommend ABC for investment based on your EVA calculations of this company?

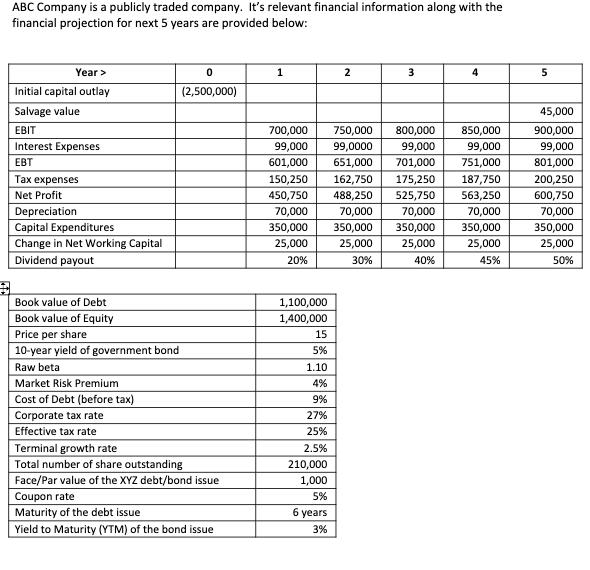

ABC Company is a publicly traded company. It's relevant financial information along with the financial projection for next 5 years are provided below: Year > Initial capital outlay Salvage value EBIT Interest Expenses. EBT Tax expenses Net Profit Depreciation Capital Expenditures Change in Net Working Capital Dividend payout Book value of Debt Book value of Equity Price per share 10-year yield of government bond Raw beta Market Risk Premium Cost of Debt (before tax) Corporate tax rate Effective tax rate 0 (2,500,000) Terminal growth rate Total number of share outstanding Face/Par value of the XYZ debt/bond issue Coupon rate Maturity of the debt issue Yield to Maturity (YTM) of the bond issue 1 700,000 750,000 99,000 99,0000 601,000 651,000 150,250 450,750 488,250 70,000 70,000 350,000 350,000 25,000 25,000 20% 30% 1,100,000 1,400,000 2 15 5% 1.10 4% 9% 27% 25% 2.5% 210,000 1,000 5% 6 years 3% 3 800,000 850,000 99,000 99,000 701,000 751,000 162,750 175,250 187,750 525,750 70,000 4 350,000 25,000 40% 563,250 70,000 350,000 25,000 45% 5 45,000 900,000 99,000 801,000 200,250 600,750 70,000 350,000 25,000 50%

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the Weighted Average Cost of Capital WACC WACC Cost of Equity Equity Weight Cost of Debt Debt Weight Assuming the financial information we can calculate the following Equity Weight Total E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started