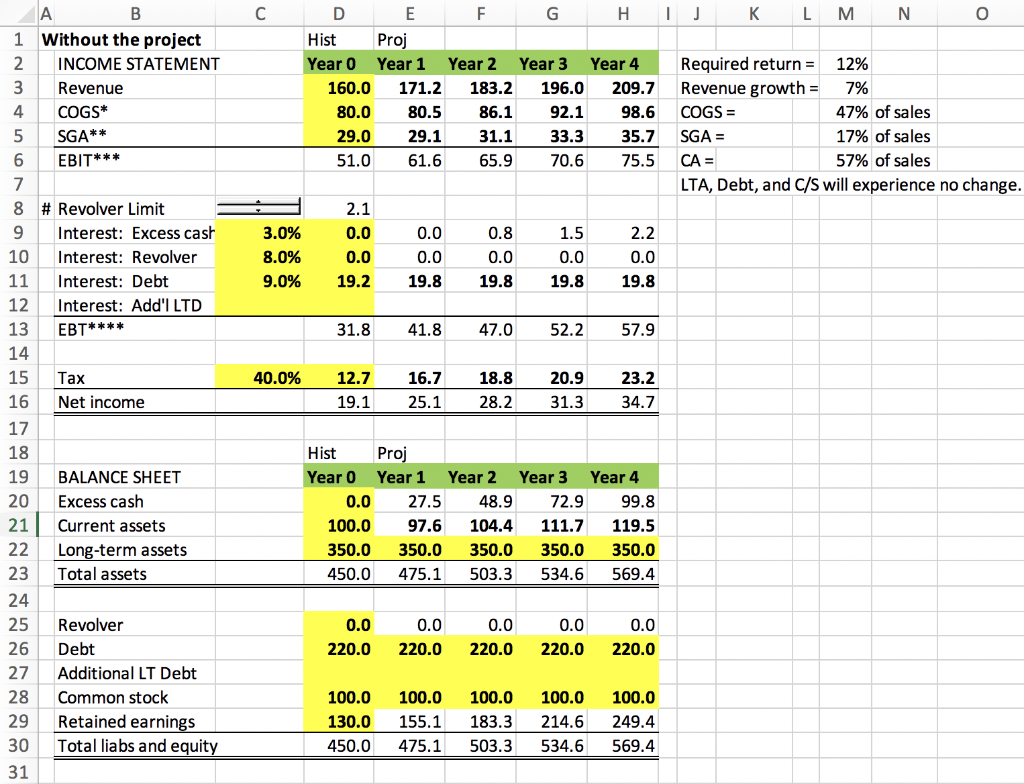

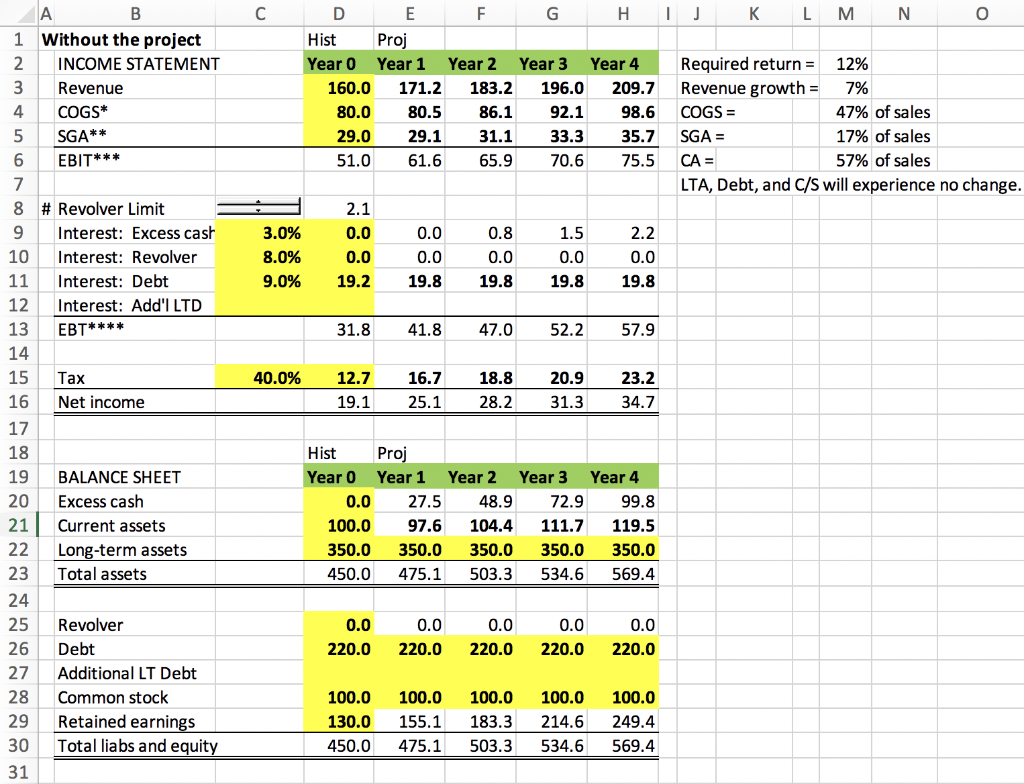

1. Calculate total value of the finance plug. (Please show excel formula)

I J K L M N O A 1 Without the project INCOME STATEMENT Revenue COGS* SGA** EBIT*** D E F G H Hist Proj Year 0 Year 1 Year 2 Year 3 Year 4 160.0 171.2 183.2 196.0 209.7 80.0 80.5 86.1 92.1 29.0 29.1 31.1 33.3 35.7 51.0 61.6 65.9 70.6 75.5 Required return = 12% Revenue growth = 7% COGS = 47% of sales SGA = 17% of sales CA = 57% of sales LTA, Debt, and C/S will experience no change. 8 2.1 9 - 10 # Revolver Limit Interest: Excess cash Interest: Revolver Interest: Debt Interest: Add'l LTD EBT**** 3.0% 8.0% 9.0% 0.0 0.0 0.0 19.8 0.8 0.0 19.8 1.5 0.0 19.8 2.2 0.0 19.8 31.8 41.8 47.0 52.2 57.9 40.0% Tax Net income 12.7 19.1 16.7 25.1 18.8 28.2 20.9 31.3 23.2 34.7 19 0.0 Hist Proj Year 0 Year 1 Year 2 Year 3 Year 4 27.5 48.9 72. 9 99.8 100.0 97.6 104.4 111.7 119.5 350.0 350.0 350.0 350.0 350.0 450.0 475.1 503.3 534.6 569.4 BALANCE SHEET Excess cash Current assets Long-term assets Total assets 21 | 22 23 0.0 220.0 0.0 220.0 0.0 220.0 0.0 220.0 0.0 220.0 Revolver Debt Additional LT Debt Common stock Retained earnings Total liabs and equity 100.0 130.0 450.0 100.0 155.1 475.1 100.0 183.3 503.3 100.0 214.6 534.6 100.0 249.4 569.4 31 I J K L M N O A 1 Without the project INCOME STATEMENT Revenue COGS* SGA** EBIT*** D E F G H Hist Proj Year 0 Year 1 Year 2 Year 3 Year 4 160.0 171.2 183.2 196.0 209.7 80.0 80.5 86.1 92.1 29.0 29.1 31.1 33.3 35.7 51.0 61.6 65.9 70.6 75.5 Required return = 12% Revenue growth = 7% COGS = 47% of sales SGA = 17% of sales CA = 57% of sales LTA, Debt, and C/S will experience no change. 8 2.1 9 - 10 # Revolver Limit Interest: Excess cash Interest: Revolver Interest: Debt Interest: Add'l LTD EBT**** 3.0% 8.0% 9.0% 0.0 0.0 0.0 19.8 0.8 0.0 19.8 1.5 0.0 19.8 2.2 0.0 19.8 31.8 41.8 47.0 52.2 57.9 40.0% Tax Net income 12.7 19.1 16.7 25.1 18.8 28.2 20.9 31.3 23.2 34.7 19 0.0 Hist Proj Year 0 Year 1 Year 2 Year 3 Year 4 27.5 48.9 72. 9 99.8 100.0 97.6 104.4 111.7 119.5 350.0 350.0 350.0 350.0 350.0 450.0 475.1 503.3 534.6 569.4 BALANCE SHEET Excess cash Current assets Long-term assets Total assets 21 | 22 23 0.0 220.0 0.0 220.0 0.0 220.0 0.0 220.0 0.0 220.0 Revolver Debt Additional LT Debt Common stock Retained earnings Total liabs and equity 100.0 130.0 450.0 100.0 155.1 475.1 100.0 183.3 503.3 100.0 214.6 534.6 100.0 249.4 569.4 31