Answered step by step

Verified Expert Solution

Question

1 Approved Answer

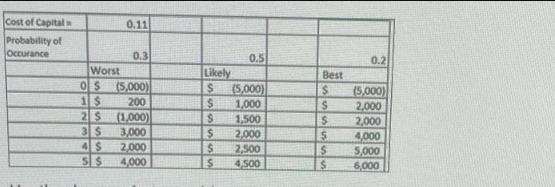

1. Calculate weighted NPV 2. Calculate weighted IRR 3. Calculate profitability Index for the Likely scenario 4. Briefly discuss why you would or would

1. Calculate weighted NPV 2. Calculate weighted IRR 3. Calculate profitability Index for the Likely scenario 4. Briefly discuss why you would or would not move forward with this project based upon your calculations? Discuss each measurement and how it influenced your decision in your commentary. Cost of Capital Probability of Occurance 0.11 0.3 Worst 0$ (5,000) 1 $ 2 S 200 (1,000) 3,000 3 $ 4 $ 2,000 S$ 4,000 Likely $ $ 55 In [s] $ 1,500 $ 2,000 2,500 4,500 $ 0.5 $ (5,000) 1,000 Best SS5 $ $ $ $ SS $ $ 0.2 (5,000) 2,000 2,000 4,000 5,000 6,000

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Weighted NPV The weighted NPV calculation takes into account the probability of each cash flow occurring and its corresponding value The formula for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started