Question

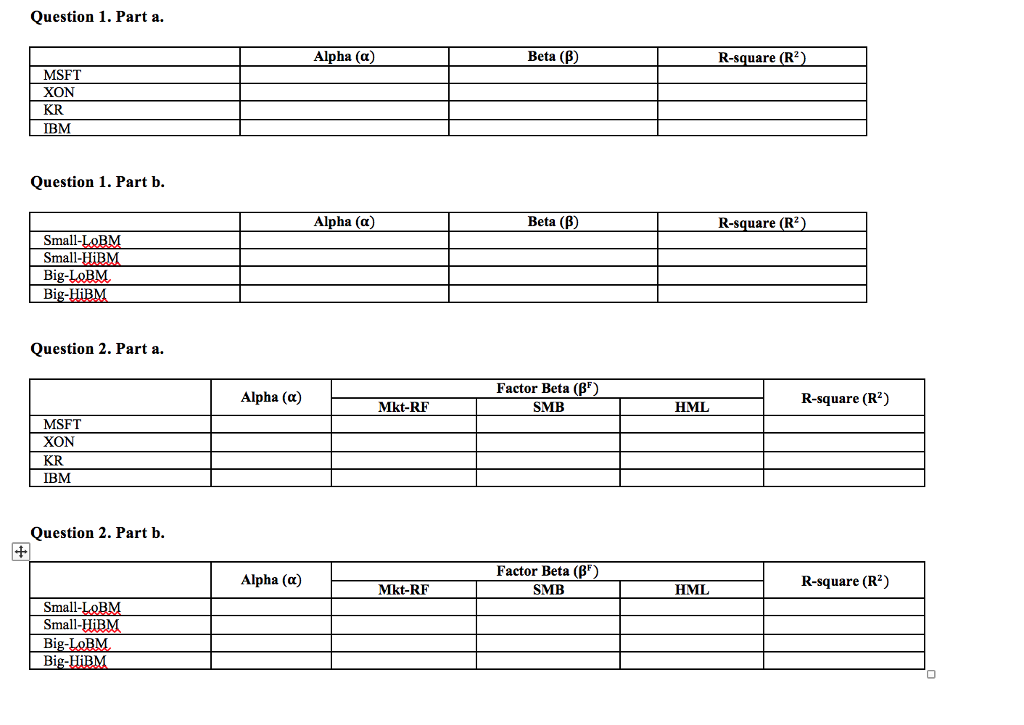

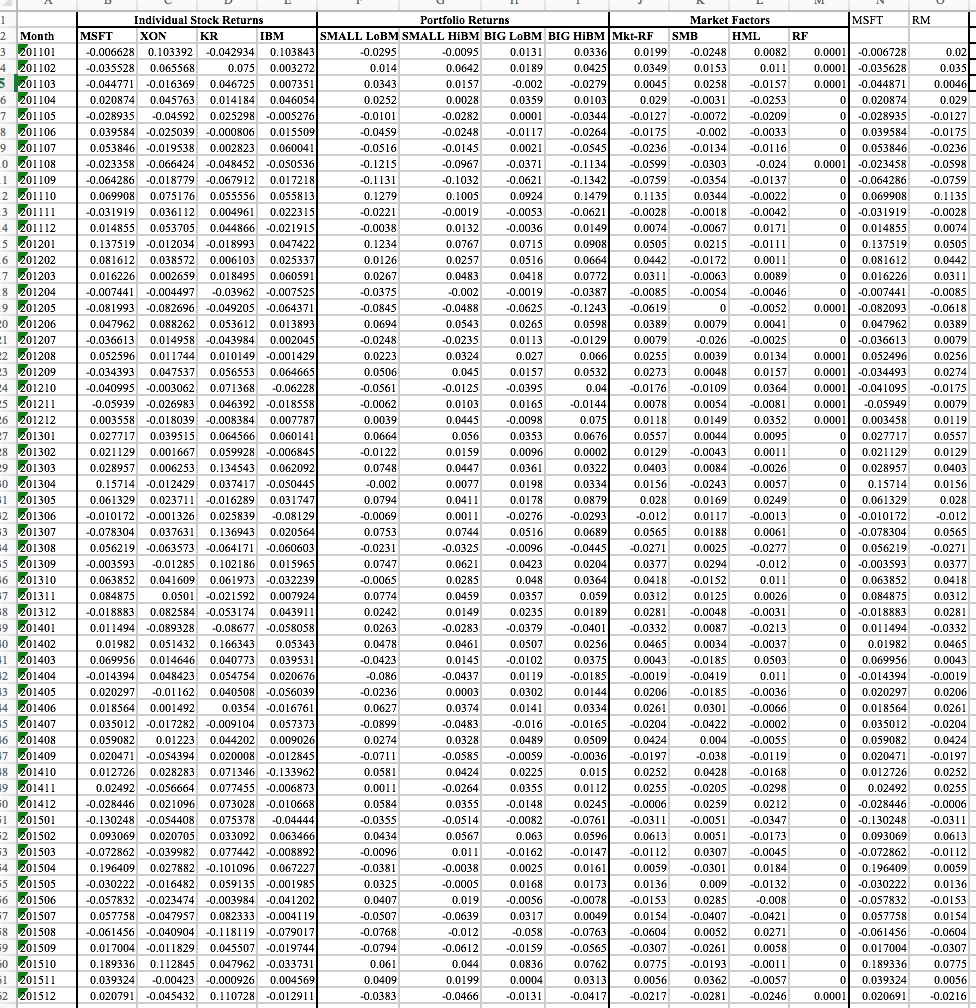

1. Capital Asset Pricing Model (CAPM) regressions a. For each individual stock, run the regression of stock excess returns (ri ? ????) on the market

1. Capital Asset Pricing Model (CAPM) regressions

a. For each individual stock, run the regression of stock excess returns (ri ? ????) on the market excess returns (rm ? ????). Report alpha, beta, and r-square.

b. For each portfolio, run the regression of portfolio excess returns (rp ? ????) on the market excess returns. Report alpha, beta, and r-square.

2. Fama-French Three Factor Model regressions

a. For each individual stock, run the regression of stock excess returns on the FamaFrench three factors, i.e., Mkt-RF, SMB, and HML. Report alpha, beta, and rsquare.

b. For each portfolio, run the regression of portfolio excess returns on the FamaFrench three factors, i.e., Mkt-RF, SMB, and HML. Report alpha, beta, and rsquare.

3. Compare CAPM and Fama-French Three Factor Model using your results from Q1 and Q2. Also, discuss the difference between the results from individual stock regressions and those from portfolio regressions.

4. Using five years (from now) of monthly stock returns data from https://finance.yahoo.com/, find at least two firms (stocks) that yield negative alpha using CAPM regressions. Report alpha, beta, and r-square for these stocks. Also, for the negative alpha stocks you found, run the Fama-French three factor model regressions. For each firm, compare the alpha from CAPM and that from Fama-French three factor model.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started