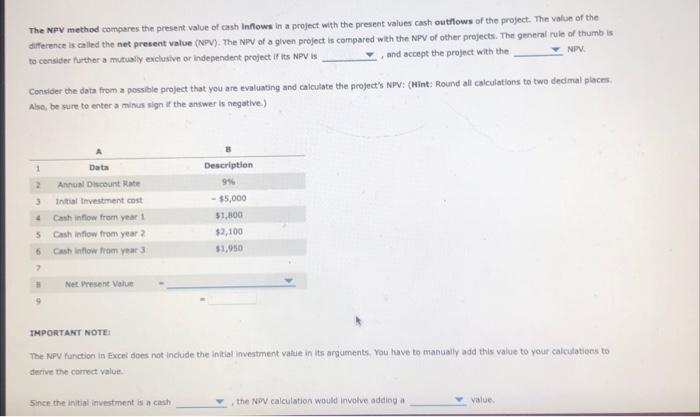

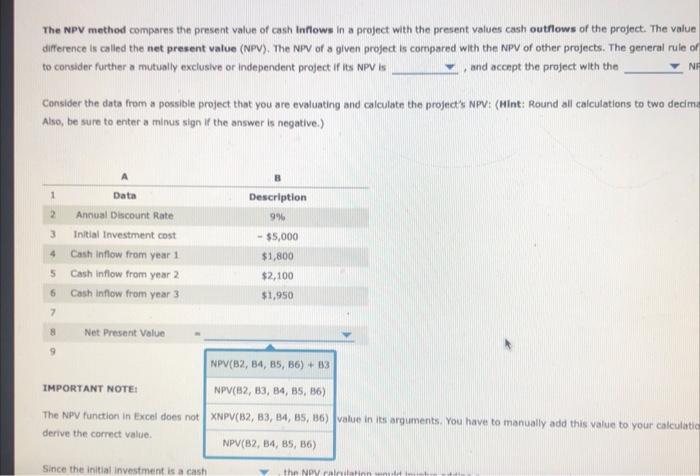

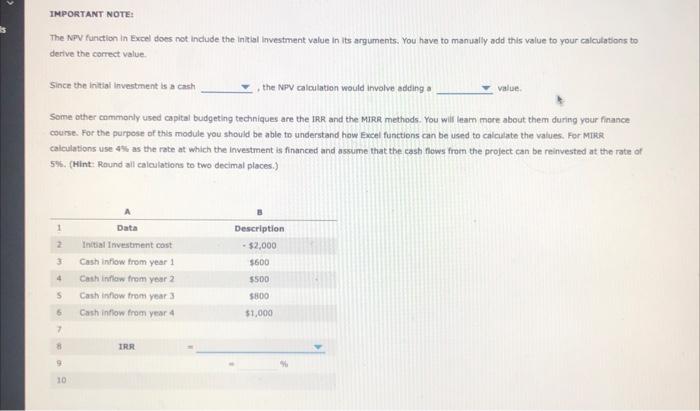

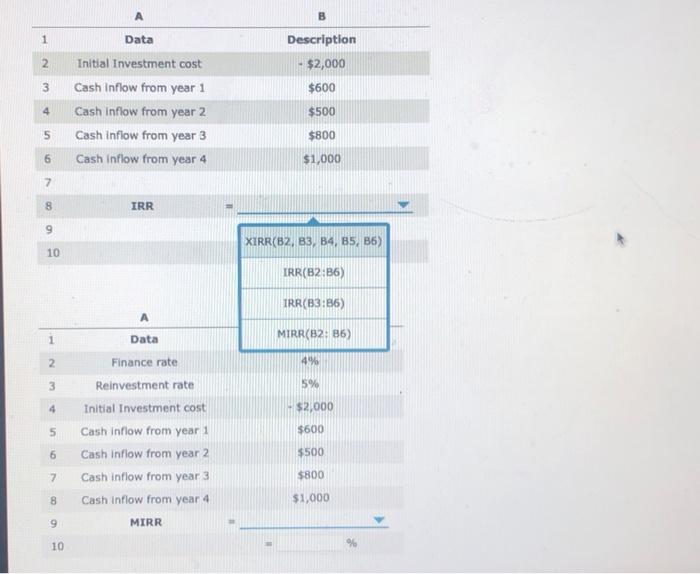

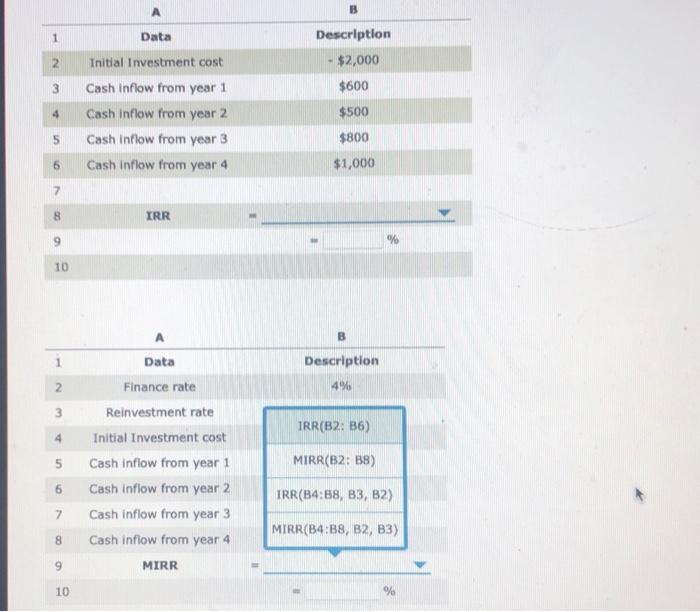

1. Capital budgeting related functions What functions are used to calculate values for data used In capital budgeting? Capkal budgeting decisions require you to evaluate the acceptabinty of investment projects through the use of techniques as the Net Present Value (NPV) method, Internal Rate of Return (IRR) method, Modified Internal Rate of Return (MriRR) method etc. While these methods sound complex, Excel makes it really easy to calculate the numbers that are used in analysis of evaluating investment projects. The NPV method compares the present value of cash Inflows in a project with the present values cash outflows of the project. The value of the difference is called the net present value (NPV). The NPV of a given project is compared with the NPV of other projects. The general rule of thumb is to concider further a mutually exclusive or independent project if its NPV is: and accept the project with the NPV. Consider the data from a possible project that you are evaluating and calculate the project's NPV: (Mint: Round all calculations to two decimal places. Also, be sure to enter a minus sign if the answer is negative.) The Nev method compares the present value of cash Inflows in a project with the present values cash outhows of the project. The value of the diference is called the net present value (NPV). The NPV of a given project is compared with the NPV of other projects. The general rule of thumb is to censider further a mutuaily exclusive or independent project if its NPV is , and accept the project with the NPN Consider the data from a possible project that you are evaluating and calculate the project's NPR: \{Hint: Round all calculations to two dedmal places: Als, be sure to enter a minis sign of the answer is negative.) IMPORTANT NOTE. The NpP function in Excei does not include the initiai investment vatue in its arguments. You have to manualiy add this value to your calculations fo desive the correct value: Since the initial imvertment is a cash , the Noy calculation would involve adding a The NPV method compares the present value of cash inflows in a project with the present values cash outhows of the project. The value difference is called the net present value (NPV). The NPV of a given project is cornpared with the NPV of other projects. The general rule of to consider further a mutually exclusive or independent project if its NPV is , and accept the project with the Consider the data from a possible project, that you are evaluating and calculate the project's NPV: (Hint: Round all calculations to two decim Also, be sure to enter a minus sign if the answer is negative.) IMPORTANT NOTE: The Npy function in Excel does not value in its arguments. You have to manually add this value to your calculatic derive the correct value. 1MPORTANT NOTE: The NPV function in Excel does not. include the initial investment value in its arguments. You have to manually add this value to your calculatons to derive the correct value Since the intlal investinent is a cash , the NPV calculation would involve adding a Valise Some other cammonly used capital budgeting techniques are the IRR and the MJRR methods. You will leam mere about them during your finance course. For the purpose of this module you should be able to understand how Excel functions can be used to calculate the values. For Mritk. calculations use 4ts as the rate at which the investrment is financed and assume that the cash flows from the project can be reinvested at the rate of 505. (Mint: Paunid ail calculations to two decimal places.)