Answered step by step

Verified Expert Solution

Question

1 Approved Answer

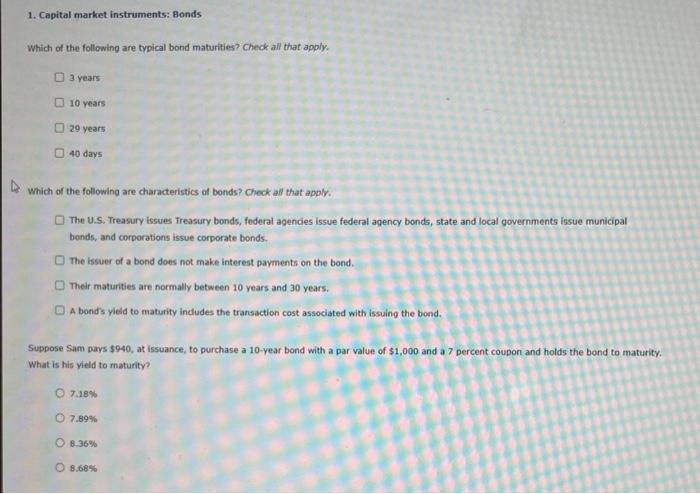

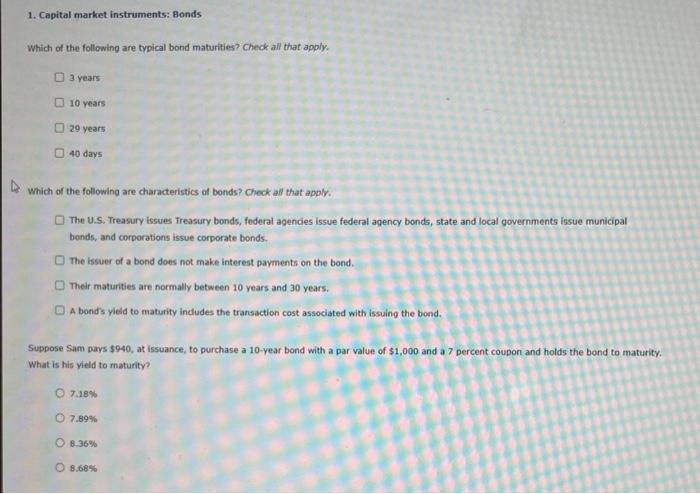

1. Capital market instruments: Bonds Which of the following are typical bond maturities? Check all that apply. 3 years 10 vears 29 years 40 days

1. Capital market instruments: Bonds Which of the following are typical bond maturities? Check all that apply. 3 years 10 vears 29 years 40 days Which of the following are characteristics of bonds? Chock all that apply. The U.S. Treasury issues Treasury bonds, federal agencies issue federal agency bonds, state and local governments issue municipal bonds, and corporations issue corporate bonds. The issuer of a bond does not make interest payments on the bond. Their maturities are normally between 10 years and 30 years. A bonds yetd to maturfy includes the transaction cost associated with issuing the bond. Suppose Sam pays $940, at issuance, to purchase a 10-year bond with a par value of $1,000 and a 7 percent coupon and holds the bond to maturity. What is his yield to maturity? 7.18% 7.89% 8. 36% 8.685

1. Capital market instruments: Bonds Which of the following are typical bond maturities? Check all that apply. 3 years 10 vears 29 years 40 days Which of the following are characteristics of bonds? Chock all that apply. The U.S. Treasury issues Treasury bonds, federal agencies issue federal agency bonds, state and local governments issue municipal bonds, and corporations issue corporate bonds. The issuer of a bond does not make interest payments on the bond. Their maturities are normally between 10 years and 30 years. A bonds yetd to maturfy includes the transaction cost associated with issuing the bond. Suppose Sam pays $940, at issuance, to purchase a 10-year bond with a par value of $1,000 and a 7 percent coupon and holds the bond to maturity. What is his yield to maturity? 7.18% 7.89% 8. 36% 8.685

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started