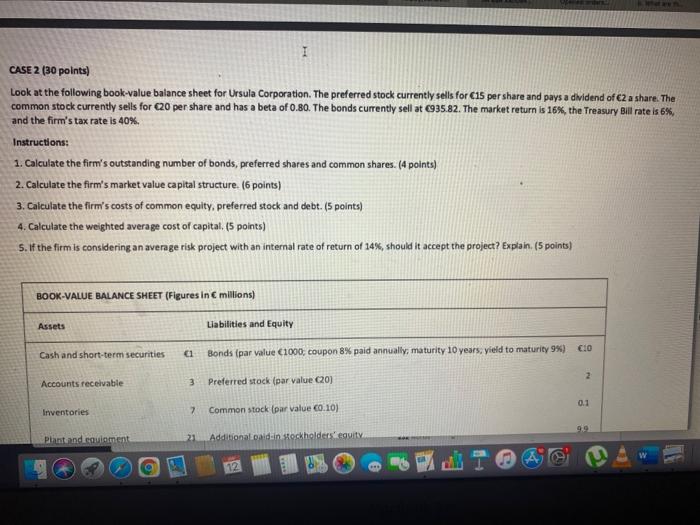

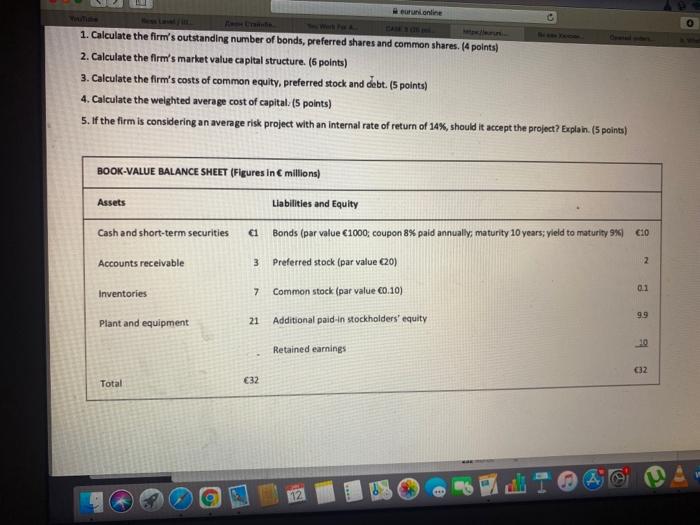

1 CASE 2 (30 points) Look at the following book-value balance sheet for Ursula Corporation. The preferred stock currently sells for C15 per share and pays a dividend of C2 a share. The common stock currently sells for C20 per share and has a beta of 0.80. The bonds currently sell at 935.82. The market return is 16%, the Treasury Bill rate is 6% and the firm's tax rate is 40% Instructions: 1. Calculate the firm's outstanding number of bonds, preferred shares and common shares (4 points) 2. Calculate the firm's market value capital structure. (6 points) 3. Calculate the firm's costs of common equity, preferred stock and debt. (5 points) 4. Calculate the weighted average cost of capital, (5 points) 5. If the firm is considering an avenge risk project with an internal rate of return of 14%, should it accept the project? Explain, (5 points) BOOK -VALUE BALANCE SHEET (Figures in a milions) Assets Llabilities and Equity CO Cast and short-term securities a Bonds (par value 1000, coupon 8% paid annually, maturity 10 years, yield to maturity 9%) 2 Accounts receivabile 3 Preferred stack (par value (20) 0.1 Inventories 2 Common stock (par value 0.10) 9.9 plant and regulament 23 Additional cald in stockholderseguit 12 run.online 1. Calculate the firm's outstanding number of bonds, preferred shares and common shares. (4 points) 2. Calculate the firm's market value capital structure. (5 points) 3. Calculate the firm's costs of common equity, preferred stock and debt. (5 points) 4. Calculate the welghted average cost of capital: (5 points) 5. If the firm is considering an average risk project with an internal rate of return of 14%, should it accept the project? Explain. (5 points) BOOK-VALUE BALANCE SHEET (Figures in millions) Assets Liabilities and Equity ei Cash and short-term securities Accounts receivable 3 Bonds (par value 1000, coupon 8% paid annually, maturity 10 years; yield to maturity 9%) 0:0 Preferred stock (par value (20) Common stock (par value 60.10) 2 0.1 7 Inventories Plant and equipment 99 21 Additional paid in stockholders' equity Retained earnings 02 Total 32 12