1: Catch up with the Mitchells.

See what updates the Mitchells have in their life and the potential effects on their current financial situation in this file:

2: Prepare updated documents based on the new information provided in this case.

Your updated documents should include a PROJECTED income statement for 2024 and a PROJECTED year-end balance sheet for 12-31-2024. Reference Chapter 10 in your textbook for the relevant Case Study example (pg. 468-489).

3: Write a brief, 1-2 page report to prepare for your next meeting with the Mitchells.

You must answer the following questions. Remember, do not simply answer the questions create a document that demonstrates your understanding of financial concepts learned so far in the course!

- What new areas of financial concern(s) are the Mitchells now facing?

- What type of advice/recommendations will you provide to the Mitchells as it relates to Pauls employment?

- The Mitchells have decided they want to have money set aside for both Nakita and Josh to attend college. If college costs are $42,000 per year for each child, how much money will the Mitchells need to set aside today to pay these costs, if they could invest at an interest rate of 6% per year (ignore inflation)?

- How can the Mitchells provide for Pauls parents needs ($25,000 in three years)?

- What recommendations do you have for the Mitchells to increase their available cash flow to provide for Ritas mother?

- What new information would you now want to know from the Mitchells? Prepare a new set of 5-6 questions that you would deem as being critical during your next client meeting. The answers to these questions should allow you to finalize a financial plan for the Mitchells.

- Based on the family and financial information provided, advise the Mitchells on three new financial goals: short-, medium- and long-term. These should be three new three goals not an update to the goals you submitted for Week 3 Case Study Assignment.

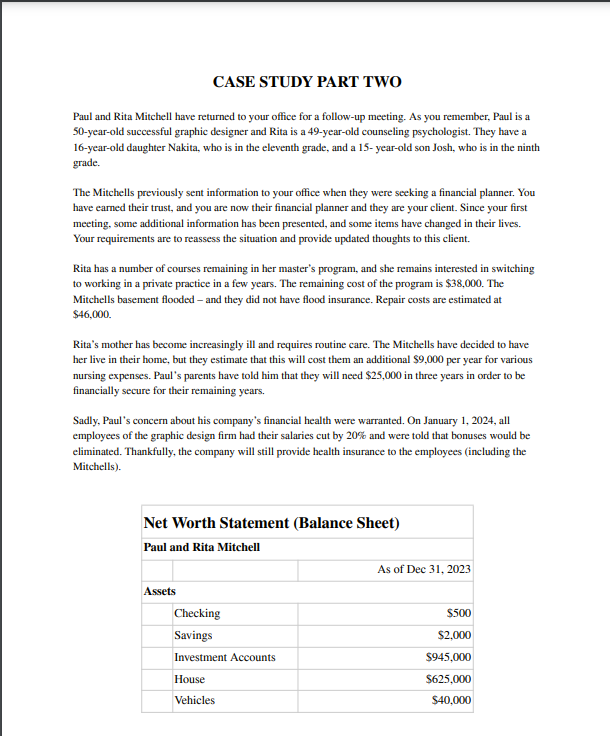

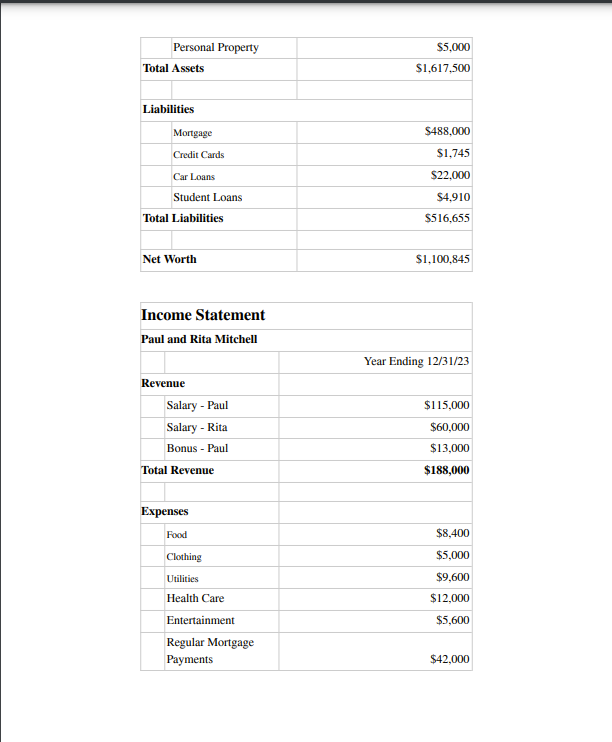

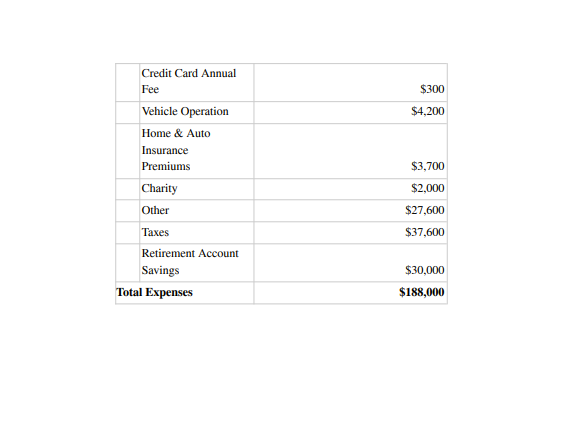

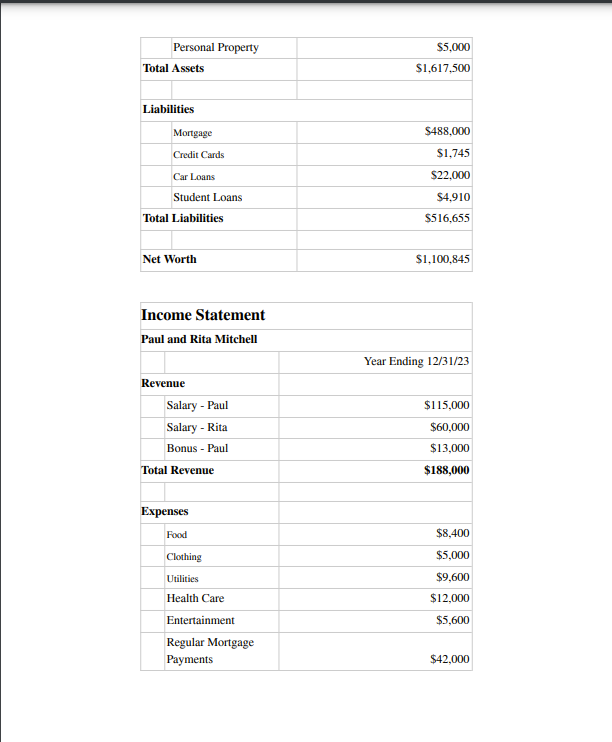

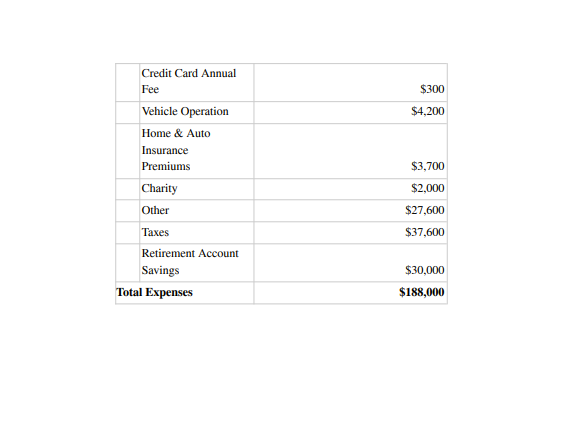

Paul and Rita Mitchell have returned to your office for a follow-up meeting. As you remember, Paul is a 50-year-old successful graphic designer and Rita is a 49-year-old counseling psychologist. They have a 16-year-old daughter Nakita, who is in the eleventh grade, and a 15-year-old son Josh, who is in the ninth grade. The Mitchells previously sent information to your office when they were seeking a financial planner. You have earned their trust, and you are now their financial planner and they are your client. Since your first meeting, some additional information has been presented, and some items have changed in their lives. Your requirements are to reassess the situation and provide updated thoughts to this client. Rita has a number of courses remaining in her master's program, and she remains interested in switching to working in a private practice in a few years. The remaining cost of the program is $38,000. The Mitchells basement flooded - and they did not have flood insurance. Repair costs are estimated at $46,000. Rita's mother has become increasingly ill and requires routine care. The Mitchells have decided to have her live in their home, but they estimate that this will cost them an additional $9,000 per year for various nursing expenses. Paul's parents have told him that they will need $25,000 in three years in order to be financially secure for their remaining years. Sadly, Paul's concern about his company's financial health were warranted. On January 1, 2024, all employees of the graphic design firm had their salaries cut by 20% and were told that bonuses would be eliminated. Thankfully, the company will still provide health insurance to the employees (including the Mitchells). \begin{tabular}{|c|c|} \hline Personal Property & $5,000 \\ \hline Total Assets & $1,617,500 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Mortgage & $488,000 \\ \hline Credit Cards & $1,745 \\ \hline Car Loans & $22,000 \\ \hline Student Loans & $4,910 \\ \hline Total Liabilities & $516,655 \\ \hline Net Worth & $1,100,845 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{ Income Statement } \\ \hline \multicolumn{2}{|l|}{ Paul and Rita Mitchell } \\ \hline & Year Ending 12/31/23 \\ \hline \multicolumn{2}{|l|}{ Revenue } \\ \hline Salary - Paul & $115,000 \\ \hline Salary - Rita & $60,000 \\ \hline Bonus - Paul & $13,000 \\ \hline Total Revenue & $188,000 \\ \hline \multicolumn{2}{|l|}{ Expenses } \\ \hline Food & $8,400 \\ \hline Clothing & $5,000 \\ \hline Utilities & $9,600 \\ \hline Health Care & $12,000 \\ \hline Entertainment & $5,600 \\ \hline RegularMortgagePayments & $42,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \begin{tabular}{|l|} Credit Card Annual \\ Fee \end{tabular} & $300 \\ \hline Vehicle Operation & $4,200 \\ \hline Home&AutoInsurancePremiums & $3,700 \\ \hline Charity & $2,000 \\ \hline Other & $27,600 \\ \hline Taxes & $37,600 \\ \hline Retirement Account & $30,000 \\ \hline Savings & $188,000 \\ \hline Total Expenses & \\ \hline \end{tabular} Paul and Rita Mitchell have returned to your office for a follow-up meeting. As you remember, Paul is a 50-year-old successful graphic designer and Rita is a 49-year-old counseling psychologist. They have a 16-year-old daughter Nakita, who is in the eleventh grade, and a 15-year-old son Josh, who is in the ninth grade. The Mitchells previously sent information to your office when they were seeking a financial planner. You have earned their trust, and you are now their financial planner and they are your client. Since your first meeting, some additional information has been presented, and some items have changed in their lives. Your requirements are to reassess the situation and provide updated thoughts to this client. Rita has a number of courses remaining in her master's program, and she remains interested in switching to working in a private practice in a few years. The remaining cost of the program is $38,000. The Mitchells basement flooded - and they did not have flood insurance. Repair costs are estimated at $46,000. Rita's mother has become increasingly ill and requires routine care. The Mitchells have decided to have her live in their home, but they estimate that this will cost them an additional $9,000 per year for various nursing expenses. Paul's parents have told him that they will need $25,000 in three years in order to be financially secure for their remaining years. Sadly, Paul's concern about his company's financial health were warranted. On January 1, 2024, all employees of the graphic design firm had their salaries cut by 20% and were told that bonuses would be eliminated. Thankfully, the company will still provide health insurance to the employees (including the Mitchells). \begin{tabular}{|c|c|} \hline Personal Property & $5,000 \\ \hline Total Assets & $1,617,500 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Mortgage & $488,000 \\ \hline Credit Cards & $1,745 \\ \hline Car Loans & $22,000 \\ \hline Student Loans & $4,910 \\ \hline Total Liabilities & $516,655 \\ \hline Net Worth & $1,100,845 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{ Income Statement } \\ \hline \multicolumn{2}{|l|}{ Paul and Rita Mitchell } \\ \hline & Year Ending 12/31/23 \\ \hline \multicolumn{2}{|l|}{ Revenue } \\ \hline Salary - Paul & $115,000 \\ \hline Salary - Rita & $60,000 \\ \hline Bonus - Paul & $13,000 \\ \hline Total Revenue & $188,000 \\ \hline \multicolumn{2}{|l|}{ Expenses } \\ \hline Food & $8,400 \\ \hline Clothing & $5,000 \\ \hline Utilities & $9,600 \\ \hline Health Care & $12,000 \\ \hline Entertainment & $5,600 \\ \hline RegularMortgagePayments & $42,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \begin{tabular}{|l|} Credit Card Annual \\ Fee \end{tabular} & $300 \\ \hline Vehicle Operation & $4,200 \\ \hline Home&AutoInsurancePremiums & $3,700 \\ \hline Charity & $2,000 \\ \hline Other & $27,600 \\ \hline Taxes & $37,600 \\ \hline Retirement Account & $30,000 \\ \hline Savings & $188,000 \\ \hline Total Expenses & \\ \hline \end{tabular}