Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Categorize each transaction into one or more of the following categories: equity, assets, liabilities, income, and expenses. Utilize the Double Entry System principles to

1. Categorize each transaction into one or more of the following categories: equity, assets, liabilities, income, and expenses. Utilize the Double Entry System principles to guide your categorization.

2. Provide a clear explanation for each classification, explaining why you have categorized the transaction as you have. Include references to relevant accounting principles or guidelines where applicable.

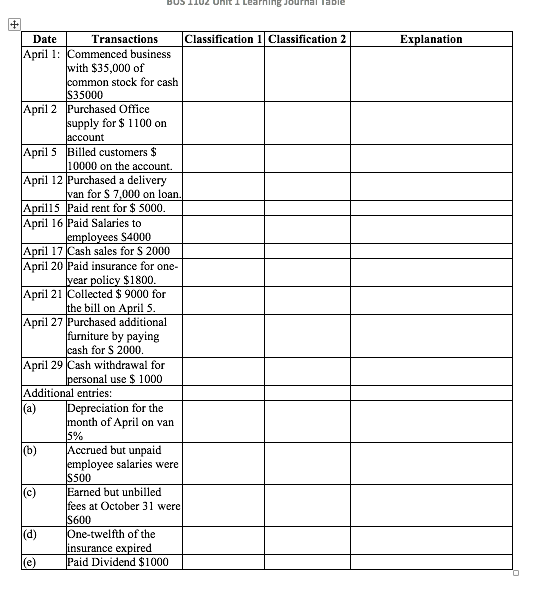

BUS 1102 Unit I Learning Journal Table Date Transactions April 1: Commenced business with $35,000 of common stock for cash $35000 April 2 Purchased Office supply for $1100 on account April 5 Billed customers $ 10000 on the account. April 12 Purchased a delivery van for $ 7,000 on loan. April15 Paid rent for $5000. April 16 Paid Salaries to employees $4000 April 17 Cash sales for $ 2000 April 20 Paid insurance for one- year policy $1800. April 21 Collected $ 9000 for the bill on April 5. April 27 Purchased additional furniture by paying cash for $ 2000. April 29 Cash withdrawal for personal use $ 1000 Additional entries: (a) (b) (c) Depreciation for the month of April on van 5% Accrued but unpaid employee salaries were $500 Earned but unbilled fees at October 31 were $600 (d) (e) One-twelfth of the insurance expired Paid Dividend $1000 Classification 1 Classification 2 Explanation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I will categorize the transactions into equity assets liabilities income and expenses followed by explanations April 1 Commenced business with 35000 of common stock for cash 35000 Classification ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started