Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. CEVAG Limited manufactures a single product called PowerZone. The inventory levels for production and sales are given in the following: Quarter 1 Quarter

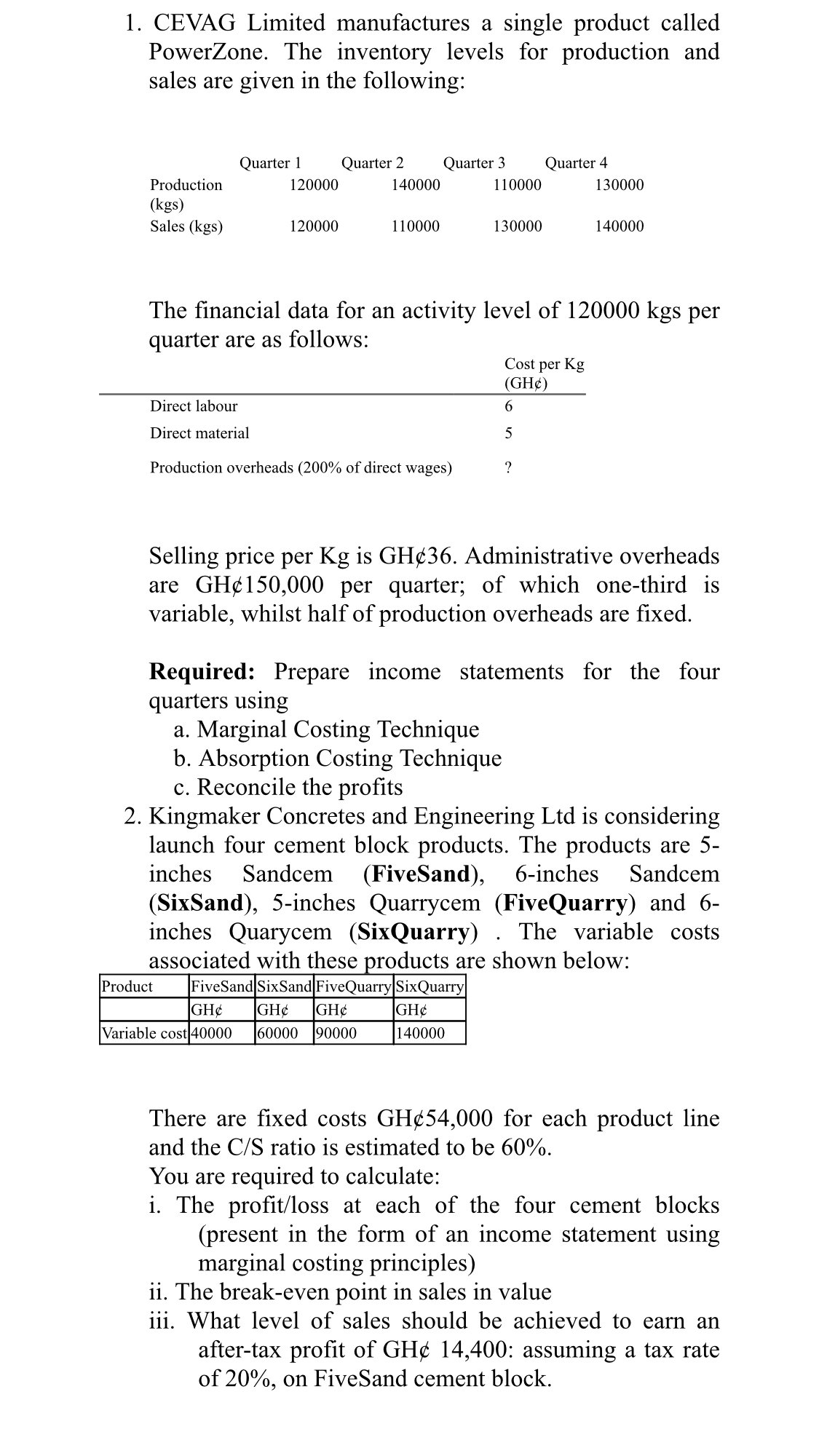

1. CEVAG Limited manufactures a single product called PowerZone. The inventory levels for production and sales are given in the following: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Production (kgs) Sales (kgs) 120000 140000 110000 130000 120000 110000 130000 140000 The financial data for an activity level of 120000 kgs per quarter are as follows: Cost per Kg (GH) Direct labour Direct material Production overheads (200% of direct wages) 6 5 ? Selling price per Kg is GH36. Administrative overheads are GH150,000 per quarter; of which one-third is variable, whilst half of production overheads are fixed. Required: Prepare income statements for the four quarters using a. Marginal Costing Technique b. Absorption Costing Technique c. Reconcile the profits 2. Kingmaker Concretes and Engineering Ltd is considering launch four cement block products. The products are 5- inches Sandcem (FiveSand), 6-inches Sandcem (SixSand), 5-inches Quarrycem (FiveQuarry) and 6- inches Quarycem (SixQuarry) The variable costs associated with these products are shown below: Product FiveSand SixSand FiveQuarry SixQuarry GH GH GH Variable cost 40000 60000 90000 GH 140000 There are fixed costs GH54,000 for each product line and the C/S ratio is estimated to be 60%. You are required to calculate: i. The profit/loss at each of the four cement blocks (present in the form of an income statement using marginal costing principles) ii. The break-even point in sales in value iii. What level of sales should be achieved to earn an after-tax profit of GH 14,400: assuming a tax rate of 20%, on FiveSand cement block.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CEAVAG Limited Income Statements Part 1 Marginal Costing Technique Note Under marginal costing only variable costs direct labor variable production overheads and variable administrative overheads are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started