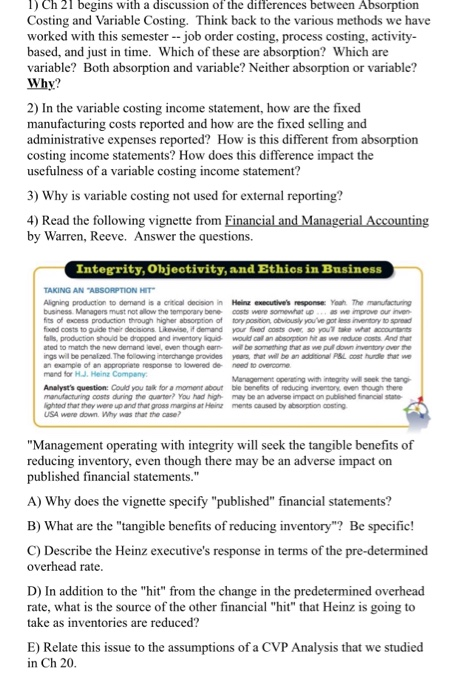

1) Ch 21 begins with a discussion of the differences between Absorption Costing and Variable Costing. Think back to the various methods we have worked with this semester -- job order costing, process costing, activity- based, and just in time. Which of these are absorption? Which are variable? Both absorption and variable? Neither absorption or variable? Why? 2) In the variable costing income statement, how are the fixed manufacturing costs reported and how are the fixed selling and administrative expenses reported? How is this different from absorption costing income statements? How does this difference impact the usefulness of a variable costing income statement? 3) Why is variable costing not used for external reporting? 4) Read the following vignette from Financial and Managerial Accounting by Warren, Reeve. Answer the questions. Integrity, Objectivity, and Ethics in Business TAKING AN ABSORPTION HIT Aligning production to demand is a critical decision in Her c utive's response You The manufacturing business Managers must not allow the comporary bene costs were somewhat we m ove our inven fios of GCSS production through higher absorption of fory position vously youve por inventory to read food costs to guide their decisions. Likewise, if demand your feed costs over you what counts folls, production should be dropped and inventory loud would calan option as we reduce costs. And that ated to match the new demand level, even though or will be something that as we put down inventory over the ings will be penalized. The following interchange provides you that will be an actional PSL cost hurdle that we an example of an appropriate response to lowered de mand for HJ. Hein Company Management operating with integrity will seek tetang Analyst's question: Could you tak for a moment about ble benefits of reducing inventory even though there manufacturing costs during the quarter? You had high may be an adverse impact on published financial state lighted that they were up and that gross margins at Hintments caused by absorption costing USA were down. Why was that the case? "Management operating with integrity will seek the tangible benefits of reducing inventory, even though there may be an adverse impact on published financial statements." A) Why does the vignette specify "published" financial statements? B) What are the "tangible benefits of reducing inventory"? Be specific! C) Describe the Heinz executive's response in terms of the pre-determined overhead rate. D) In addition to the "hit" from the change in the predetermined overhead rate, what is the source of the other financial "hit" that Heinz is going to take as inventories are reduced? E) Relate this issue to the assumptions of a CVP Analysis that we studied in Ch 20