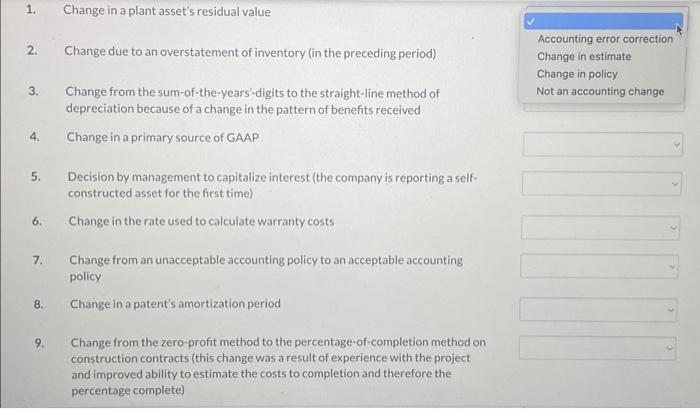

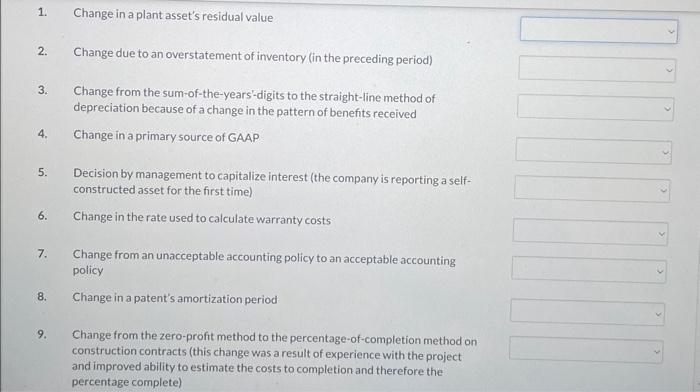

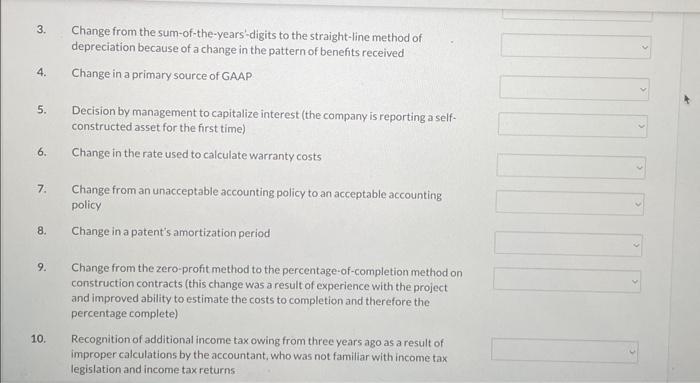

1. Change in a plant asset's residual value Accounting error correction 2. Change due to an overstatement of inventory (in the preceding period) Change in estimate Change in policy 3. Change from the sum-of-the-years-digits to the straight-line method of Not an accounting change depreciation because of a change in the pattern of benefits received 4. Change in a primary source of GAAP 5. Decision by management to capitalize interest (the company is reporting a selfconstructed asset for the first time) 6. Change in the rate used to calculate warranty costs 7. Change.from an unacceptable accounting policy to an acceptable accounting policy 8. Change in a patent's amortization period 9. Change from the zero-profit method to the percentage-of-completion method on construction contracts (this change was a result of experience with the project and improved ability to estimate the costs to completion and therefore the percentage complete) 1. Change in a plant asset's residual value 2. Change due to an overstatement of inventory (in the preceding period) 3. Change from the sum-of-the-years-digits to the straight-line method of depreciation because of a change in the pattern of benefits received 4. Change in a primary source of GAAP 5. Decision by management to capitalize interest (the company is reporting a selfconstructed asset for the first time) 6. Change in the rate used to calculate warranty costs 7. Change from an unacceptable accounting policy to an acceptable accounting policy 8. Change in a patent's amortization period 9. Change from the zero-profit method to the percentage-of-completion method on construction contracts (this change was a result of experience with the project and improved ability to estimate the costs to completion and therefore the percentage complete) 3. Change from the sum-of-the-years-digits to the straight-line method of depreciation because of a change in the pattern of benefits received 4. Change in a primary source of GAAP 5. Decision by management to capitalize interest (the company is reporting a selfconstructed asset for the first time) 6. Change in the rate used to calculate warranty costs 7. Change from an unacceptable accounting policy to an acceptable accounting policy 8. Change in a patent's amortization period 9. Change from the zero-profit method to the percentage-of-completion method on construction contracts (this change was a result of experience with the project and improved ability to estimate the costs to completion and therefore the percentage complete) 10. Recognition of additional income tax owing from three years ago as a result of improper calculations by the accountant, who was not familiar with income tax legislation and income tax returns