Question

1. Check ALL of the following that are true statements regarding how liquid an asset is. A. The MORE homogeneous the asset the MORE liquid

1. Check ALL of the following that are true statements regarding how liquid an asset is.

A. The MORE homogeneous the asset the MORE liquid the asset.

B. The LOWER the transactions costs to trade an asset the MORE liquid the asset is.

C. The HIGER the transactions costs to trade an asset the MORE liquid the asset is.

D. The HIGHER the information costs the LESS liquid the asset is.

E. The HIGHER the information costs the MORE liquid the asset is.

F. The MORE homogeneous the asset the LESS liquid the asset.

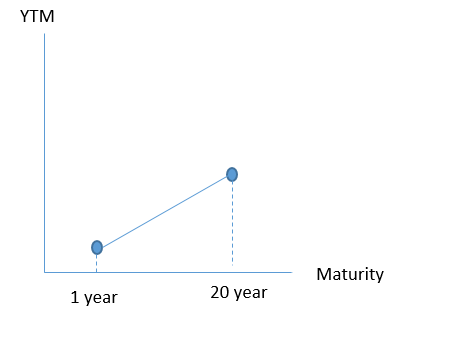

2.

Use the figure to help you answer the question.

Assume congress passes a law that makes interest on 20 year bonds tax free (no taxes on 20 year bond interest), but interest on 1 year bonds is still taxed.

Given this information you would expect the term structure to move to a ....

A. steeper slope because demand for 20 year bonds would increase.

B. flatter slope because demand for 20 year bonds would decrease.

C. steeper slope because demand for 20 year bonds would decrease.

D. flatter slope because demand for 20 year bonds would increase.

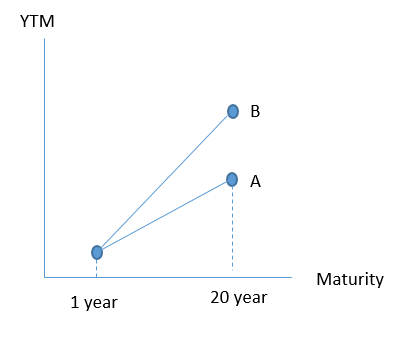

3.

Use the figure to answer the question

You are a financial analyst for the Federal Reserve Bank. One of your duties is to forecast future inflation. If you see the 20 year bond move from A to B on the graph, base on the expectations hypothesis, you would expect

A. future inflation to be lower, because bond prices are rising.

B. future inflation to be lower, because bond prices are falling.

C. future inflation to be higher, because bond prices are falling.

D. future inflation to be higher, because bond prices are rising.

YTM Maturity 1 year 20 year YTM o B Maturity 1 year 20 year YTM Maturity 1 year 20 year YTM o B Maturity 1 year 20 year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started