Question

1. Chipotle restaurants are divided into nine (9) regions and regional managers earn year-end bonuses based on the profitability of their regions. Included in General

1. Chipotle restaurants are divided into nine (9) regions and regional managers earn year-end bonuses based on the profitability of their regions. Included in General and Administrative expenses are $50 million of marketing expenses. Currently, the CFO allocates these marketing expenses to each region based on sales dollars generated. Thus, regions with higher sales are allocated more marketing costs. Assume you are a manager of a region that has an above average number of customers (when compared to other locations), and thus, sales for your location are above average. Also, assume that regional managers prefer more money to less.

a. Use the concepts of cost allocation and product cost subsidization to convince the CFO why you think marketing costs allocated to your region are too high. Do not merely provide a definition of cost allocation or product cost subsidization

b. Use the concept of relevant costs to convince the CFO that marketing expenses should not be allocated to any region to determine regional profitability, and therefore, bonuses. Do not merely provide a definition of relevant costs

2. Currently most Chipotle employees are paid a variable wage. More specifically, the number of hours restaurant staff work is related to the number of customers expected on a given day. There has been a recent push to have restaurants guarantee their workers a certain number of hours per week regardless of expected demand. Chipotle is considering doing this in an effort to reduce employee turnover and keep quality employees. The Company has determined that if they pay their workers a fixed wage then their labor costs would equal approximately $1.5 billion.

a. At what sales dollar level would Chipotle have preferred to pay its employees a fixed wage instead of a variable wage? Use 2017 data to determine your answer. Assume Chipotle wants to maximize profits.

3. In the upcoming year, Chipotle is considering replacing an old marketing campaign, which has had modest results in the past with a marketing campaign that costs the same but with a more robust impact on expected sales. Sales volume is projected to increase 3% as a result of the new marketing campaign. Use the operating leverage factor (OLF, your textbook calls this the degree of operating leverage) to forecast how much the dollar value of income from operations is projected to change if sales volume increases 3%. Assume no other changes to operations and that the 3% increase will not take the Company out of its relevant range.

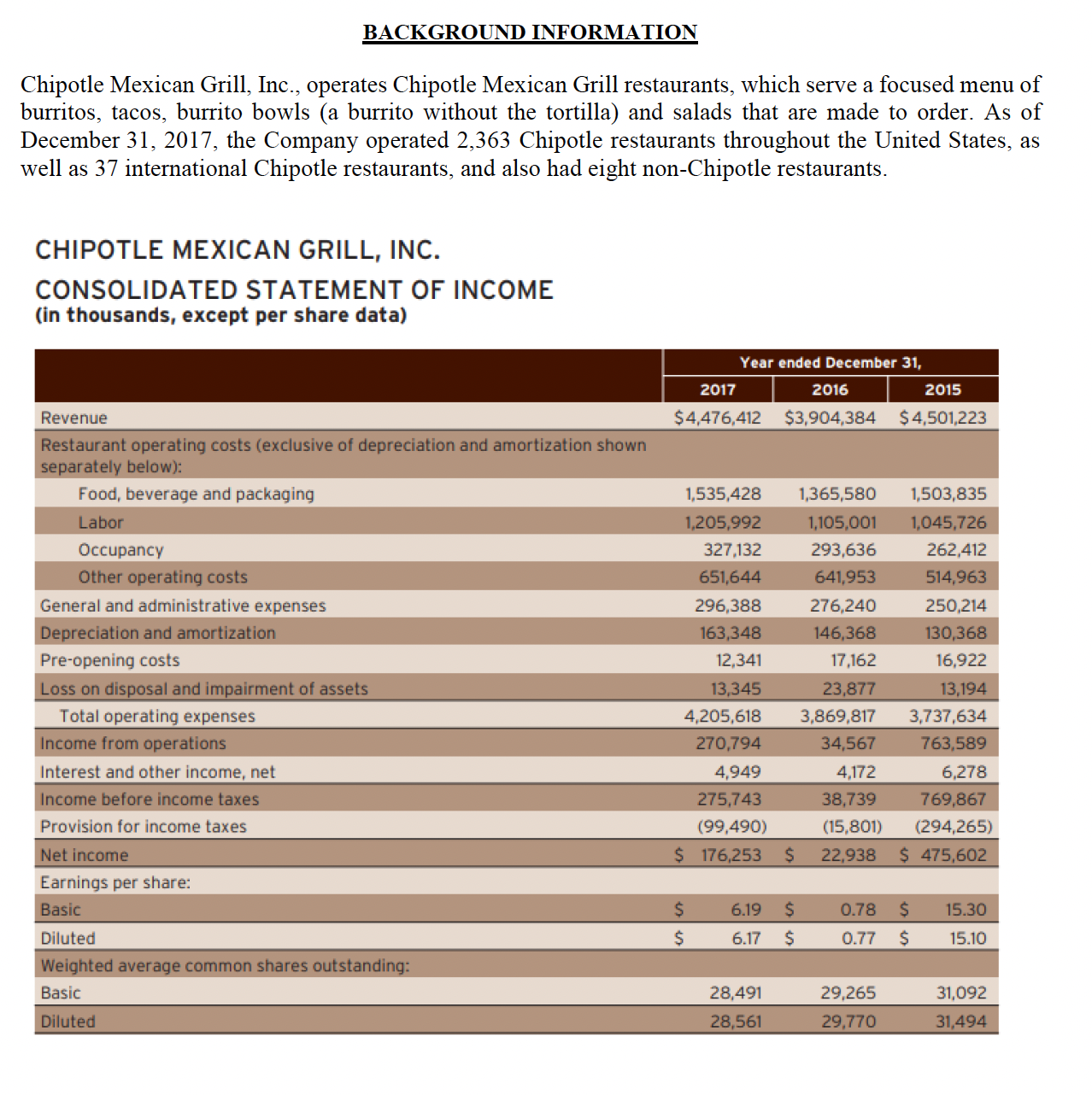

BACKGROUND INFORMATION Chipotle Mexican Grill, Inc., operates Chipotle Mexican Grill restaurants, which serve a focused menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads that are made to order. As of December 31, 2017, the Company operated 2,363 Chipotle restaurants throughout the United States, as well as 37 international Chipotle restaurants, and also had eight non-Chipotle restaurants. CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENT OF INCOME (in thousands, except per share data) Year ended December 31, 2017 2016 2015 Revenue $4,476,412 $3,904,384 $ 4,501,223 Restaurant operating costs (exclusive of depreciation and amortization shown separately below): Food, beverage and packaging 1,535,428 1,365,580 1,503,835 Labor Occupancy Other operating costs General and administrative expenses Depreciation and amortization 1,205,992 1,105,001 1,045,726 327,132 293,636 262,412 651,644 641,953 514,963 296,388 276,240 250,214 163,348 146,368 130,368 Pre-opening costs 12,341 17,162 16,922 Loss on disposal and impairment of assets 13,345 23,877 13,194 Total operating expenses 4,205,618 3,869,817 3,737,634 Income from operations 270,794 34,567 763,589 Interest and other income, net Income before income taxes Provision for income taxes 4,949 275,743 (99,490) 4,172 38,739 6,278 769,867 (15,801) (294,265) Net income $ 176,253 $ 22,938 $ 475,602 Earnings per share: Basic $ 6.19 $ 0.78 $ 15.30 Diluted $ 6.17 $ 0.77 $ 15.10 Weighted average common shares outstanding: Basic Diluted 28,491 29,265 31,092 28,561 29,770 31,494

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started