Question: 1. Citing relevant legislation and case law to support your answer, calculate Bill Ong's ordinary income.2. Citing relevant legislation, identify each type of CGT asset

1. Citing relevant legislation and case law to support your answer, calculate Bill Ong's ordinary income.2. Citing relevant legislation, identify each type of CGT asset and calculate Bill Ong's net capital gain.3. Calculate Bill Ong's general deductions (i.e. the total amount that he can deduct under section 8-1 of the Income Tax Assessment Act 1997).4. Calculate Bill Ong's decline in value for those assets that are not allocated to the low value pool.5. Calculate the decline in value for the low value pool and calculate the closing balance for the pool.6. Calculate Bill Ong's taxable income.7. Calculate Bill Ong's Basic Income Tax Liability.

8. Calculate Bill Ong's tax payable or tax refund (as the case may be).

Bill Ong is a builder employed by A1 Homes Pty Ltd. As an employee, he is neither registered nor required to be registered for GST. Bill is married with one child and does not have any private health insurance. During the year ending 30 June 2020, he received wages of $80,000 from which PAYG withholding of $25,000 was deducted by his employer.

Bill is a keen fisherman and spends most weekends fishing with his son, Kevin. During the year, he entered the annual fishing competition held by the Huon Valley Fishing Association, and won first prize, which was a cash amount of $500.

In January 2020, his friend Peter decided to completely replace the kitchen in his house, and asked Bill to help him install the new kitchen. Bill was happy to help and provided the assistance for free. However, in recognition of Bill's help, his friend gave him a Fishing Australia gift voucher for $300. Bill used this voucher to purchase a new fishing rod and reel.

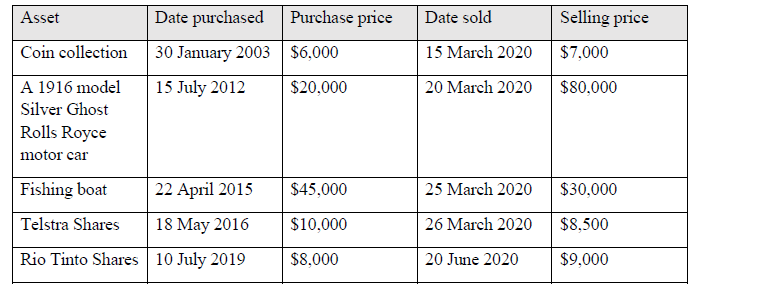

During the year ending 30 June 2020, Bill sold the following assets:

Bill incurred the following expenditure during the year ending 30 June 2020: A pair of Ray-Ban sunglasses which cost $400 on 8December 2019. He tells you that he needs these because his job requires him to be outdoors all day. Bill attended a welding course costing $3,000, which he completed at the local TAFE College. A new set of chisels costing $80 on 4 June 2020, which he uses exclusively for work purposes. A new drill unit costing $350 on 2 May 2020, which he uses exclusively for work purposes. A new tool carrier costing $1,500 on 1 July 2019, which he uses exclusively for work purposes. A new Toyota Hi-Lux motor vehicle costing $62,000 on 1 July 2019, which he uses 80% for work purposes. He kept a log-book.

Vehicle running costs of $12,000 for the year, which excludes depreciation.

On the advice of his previous accountant, Bill established a Low Value Pool, since most of his tools and equipment cost less than $1,000. As at 1 July 2019 the opening balance of the pool was $2,500.

Asset Coin collection A 1916 model Silver Ghost Rolls Royce motor car Fishing boat Telstra Shares Rio Tinto Shares Date purchased 30 January 2003 15 July 2012 22 April 2015 18 May 2016 10 July 2019 Purchase price $6,000 $20,000 $45,000 $10,000 $8,000 Date sold 15 March 2020 20 March 2020 25 March 2020 26 March 2020 20 June 2020 Selling price $7,000 $80,000 $30,000 $8,500 $9,000

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

1 Citing relevant legislation and case law to support your answer calculate Bill Ongs ordinary income Bill Ongs ordinary income is calculated by adding all of his assessable income together then deduc... View full answer

Get step-by-step solutions from verified subject matter experts