Answered step by step

Verified Expert Solution

Question

1 Approved Answer

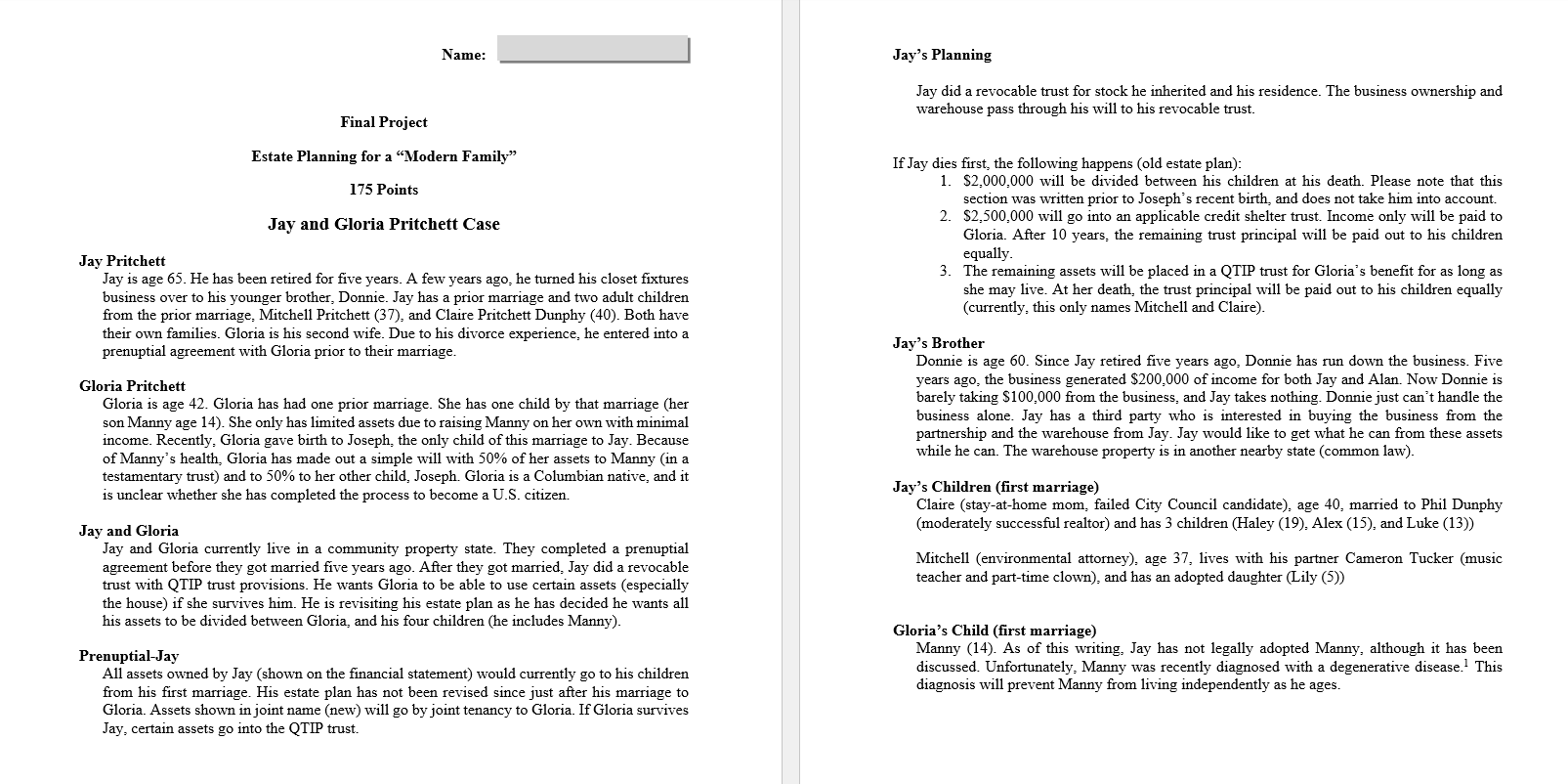

1 . CJay Pritchett Jay is age 6 5 . He has been retired for five years. A few years ago, he turned his closet

CJay Pritchett

Jay is age He has been retired for five years. A few years ago, he turned his closet fixtures

business over to his younger brother, Donnie. Jay has a prior marriage and two adult children

from the prior marriage, Mitchell Pritchett and Claire Pritchett Dunphy Both have

their own families. Gloria is his second wife. Due to his divorce experience, he entered into a

prenuptial agreement with Gloria prior to their marriage.

Gloria Pritchett

Gloria is age Gloria has had one prior marriage. She has one child by that marriage her

son Manny age She only has limited assets due to raising Manny on her own with minimal

income. Recently, Gloria gave birth to Joseph, the only child of this marriage to Jay. Because

of Manny's health, Gloria has made out a simple will with of her assets to Manny in a

testamentary trust and to to her other child, Joseph. Gloria is a Columbian native, and it

is unclear whether she has completed the process to become a US citizen.

Jay and Gloria

Jay and Gloria currently live in a community property state. They completed a prenuptial

agreement before they got married five years ago. After they got married, Jay did a revocable

trust with QTIP trust provisions. He wants Gloria to be able to use certain assets especially

the house if she survives him. He is revisiting his estate plan as he has decided he wants all

his assets to be divided between Gloria, and his four children he includes Manny

PrenuptialJay

All assets owned by Jay shown on the financial statement would currently go to his children

from his first marriage. His estate plan has not been revised since just after his marriage to

Gloria. Assets shown in joint name new will go by joint tenancy to Gloria. If Gloria survives

Jay, certain assets go into the QTIP trust.

Gloria. After years, the remaining trust principal will be paid out to his children

equally.

The remaining assets will be placed in a QTIP trust for Gloria's benefit for as long as

she may live. At her death, the trust principal will be paid out to his children equally

currently this only names Mitchell and Claire

Jay's Brother

Donnie is age Since Jay retired five years ago, Donnie has run down the business. Five

years ago, the business generated $ of income for both Jay and Alan. Now Donnie is

barely taking $ from the business, and Jay takes nothing. Donnie just can't handle the

business alone. Jay has a third party who is interested in buying the business from the

partnership and the warehouse from Jay. Jay would like to get what he can from these assets

while he can. The warehouse property is in another nearby state common law

Jay's Children first marriage

Claire stayathome mom, failed City Council candidate age married to Phil Dunphy

moderately successful realtor and has children Haley Alex and Luke

Mitchell environmental attorney age lives with his partner Cameron Tucker music

teacher and parttime clown and has an adopted daughter Lily

Gloria's Child first marriage

Manny As of this writing, Jay has not legally adopted Manny, although it has been

discussed. Unfortunately, Manny was recently diagnosed with a degenerative disease. This

diagnosis will prevent Manny from living independently as he ages.alculate the total of the assets that will pass through Jays Probate Estate if he dies first.Jay Pritchett

Jay is age He has been retired for five years. A few years ago, he turned his closet fixtures

business over to his younger brother, Donnie. Jay has a prior marriage and two adult children

from the prior marriage, Mitchell Pritchett and Claire Pritchett Dunphy Both have

their own families. Gloria is his second wife. Due to his divorce experience, he entered into a

prenuptial agreement with Gloria prior to their marriage.

Gloria Pritchett

Gloria is age Gloria has had one prior marriage. She has one child by that marriage her

son Manny age She only has limited assets due to raising Manny on her own with minimal

income. Recently, Gloria gave birth to Joseph, the only child of this marriage

Calculate the total of the assets that will be included in Jays Gross Estate if he dies first.

Based on Jay and Glorias financial information and family status, provide your recommendations that will accommodate their specific estate plan goals. Provide your rationale and the economic benefits of your recommended estate planning vehicles.

Take into consideration the cost of implementing the estate planning vehicles. Your analysis should also include a review of the familys assets and expenses, and how your estate planning recommendations will impact their current budget and expenses. Do not forget that either spouse may predecease the other.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started