Question

1) Closing inventories was £200,000 on the 31st of December 2022. 2) Corporation tax is 35% for the year, half due now and should be

1) Closing inventories was £200,000 on the 31st of December 2022.

2) Corporation tax is 35% for the year, half due now and should be paid in cash and half due in April 2023.

3) Property was revalued from £3,900,000 to £4,500,000.

4) £1,200,000 of new land was purchased using a bank loan.

5) Depreciation (all based on reducing balance): a) Coffee Machines – 25% b) Fixtures and Fittings – 20%

6) A provision for bad debts needs to be added, with 10% of the trade receivables figure considered unlikely to pay.

7) £300,000 of administrative expenses shown as a prepayment is an error on the trial balance, which instead should be an accrual, with the amount relating to this financial year ending 31st of December 2022.

8) £80,000 of the heating and lighting expense shown on the trial balance should be a prepayment and relates to the next financial year.

9) Dividends were distributed to shareholders during the financial year to a value of £1,000,000 in cash.

10) A court case is currently going through the courts in which King’s Coffee Company Ltd is being sued by a customer who was injured on the premises, in which the solicitors estimate they will have to pay out £200,000 and that it is possible (less than 50% possibility) it will lose the court case.

11) A rights issue of 1 for 4 basis, at £15 per share, with 90% of shares bought by shareholders, conducted before the bonus issue.

12) A 5 for 1 bonus issue was given to shareholders. The bonus issue was conducted after the rights issue. The bonus issue should be made using a revenue reserve.

REQUIRED

Please prepare a balance sheet and income statement for 31st December 2022 using the trial balance presented on the previous page, ensuring that you make all the requested adjustments. Please also ensure to add notes of any contingent assets .

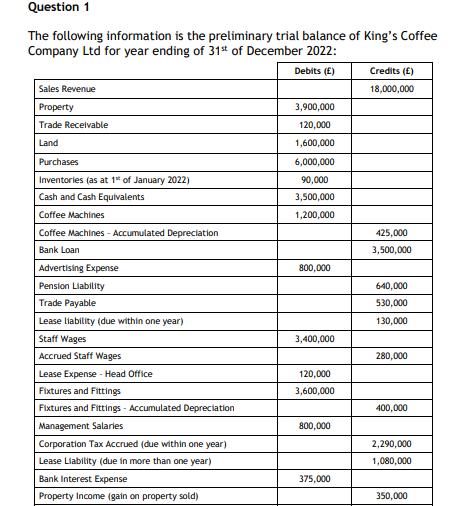

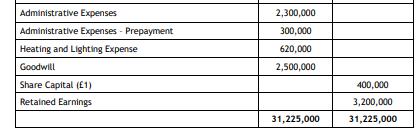

Question 1 The following information is the preliminary trial balance of King's Coffee Company Ltd for year ending of 31st of December 2022: Debits () Sales Revenue Property Trade Receivable Land Purchases Inventories (as at 1" of January 2022) Cash and Cash Equivalents Coffee Machines Coffee Machines - Accumulated Depreciation Bank Loan Advertising Expense Pension Liability Trade Payable Lease liability (due within one year) Staff Wages Accrued Staff Wages Lease Expense Head Office Fixtures and Fittings Fixtures and Fittings - Accumulated Depreciation Management Salaries Corporation Tax Accrued (due within one year) Lease Liability (due in more than one year) Bank Interest Expense Property Income (gain on property sold) 3,900,000 120,000 1,600,000 6,000,000 90,000 3,500,000 1,200,000 800,000 3,400,000 120,000 3,600,000 800,000 375,000 Credits () 18,000,000 425,000 3,500,000 640,000 530,000 130,000 280,000 400,000 2,290,000 1,080,000 350,000

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer Balance Sheet of Kings Coffee Company Ltd as of December 31 2022 Assets Longterm assets Buildings machinery and tools Coffeemakers Net book val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started