Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Cole Products is considering acquiring a manufacturing plant. The purchase price is $1,854,150. The owners believe the plant will generate net cash inflows

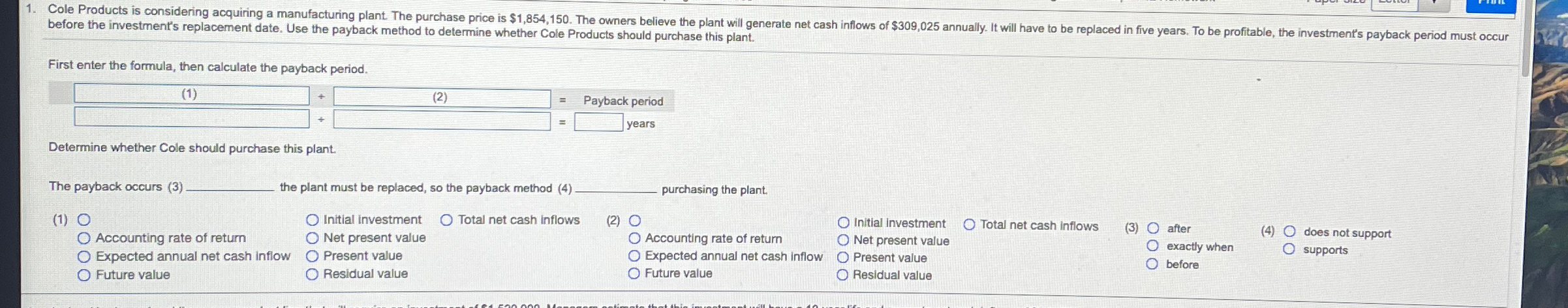

1. Cole Products is considering acquiring a manufacturing plant. The purchase price is $1,854,150. The owners believe the plant will generate net cash inflows of $309,025 annually. It will have to be replaced in five years. To be profitable, the investment's payback period must occur before the investment's replacement date. Use the payback method to determine whether Cole Products should purchase this plant. First enter the formula, then calculate the payback period. (1) + (2) = Payback period years Determine whether Cole should purchase this plant. The payback occurs (3) - (1) O the plant must be replaced, so the payback method (4) purchasing the plant. O Accounting rate of return O Expected annual net cash inflow O Future value Initial investment O Net present value Present value Residual value O Total net cash inflows (2) O O Accounting rate of return Expected annual net cash inflow O Future value O Residual value Initial investment O Net present value O Total net cash inflows (3) O after O Present value O exactly when O before (4) O does not support O supports

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started