Question

1. Colt Manufacturing has two? divisions: 1)? pistols; and? 2) rifles. Betas for the two divisions have been determined to be beta ?(pistol)=0.8 and beta

1. Colt Manufacturing has two? divisions: 1)? pistols; and? 2) rifles. Betas for the two divisions have been determined to be beta ?(pistol)=0.8 and beta ?(rifle)=1.0. The current? risk-free rate of return is 4.5?%, and the expected market rate of return is 11.5%. The? after-tax cost of debt for Colt is 6.5?%. The pistol? division's financial proportions are 42.5?% debt and 57.5?% ?equity, and the rifle? division's are 52.5?% debt and 47.5?% equity.

a. What is the pistol? division's WACC?

b. What is the rifle? division's WACC?

2. What is the after-tax cost of the following preferred equity? The par value of the preferred share is $100 and the annual dividend is 8%. The preferred shares have no stated maturity. The current market price of the share is $55. Assume that the corporate tax rate is 39?%.

3. Rover's Dog Care has outstanding debt currently selling for $870 per bond. It matures in 8 years, pays interest? semiannually, and has a coupon rate of 15%. If par is $1,000 and the tax rate is 38%, what is the? after-tax cost of debt?

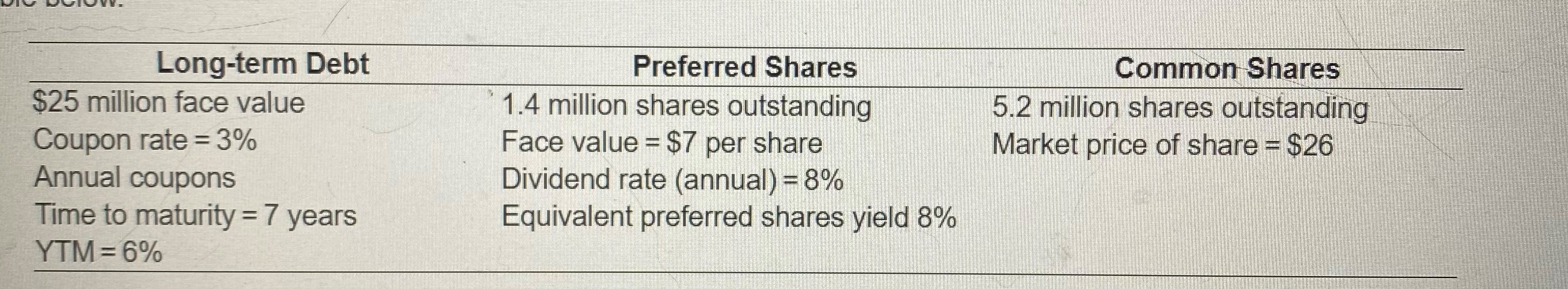

4.Bea Kerr is an analyst in the? treasurer's office at MupetLabs Inc. Mr. Kerr needs your help to estimate the market value weights for? MupetLabs' cost of capital. MupetLabs has? long-term bonds? outstanding, preferred shares outstanding and common shares. Selected information for each of the securities is provided in the table below.

Please view attached photo

a. What is the market value of?long-term debt? (Round to two decimal?places.)

b. What is the market value of preferred?shares? (Round to two decimal?places.)

c. What is the weight of debt in?MupetLabs' capital?structure? ?(Round to two decimal places.)

d. What is the weight of preferred stock in?MupetLabs' capital?structure? (Round to two decimal?places.)

e. What is the weight of common equity in?MupetLabs' capital?structure? (Round to two decimal?places.)

Long-term Debt $25 million face value Coupon rate = 3% Annual coupons Time to maturity = 7 years YTM=6% Preferred Shares 1.4 million shares outstanding Face value = $7 per share Dividend rate (annual) = 8% Equivalent preferred shares yield 8% Common Shares 5.2 million shares outstanding Market price of share = $26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1a Pistol division WACC Cost of debt after tax 65 Cost of equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started