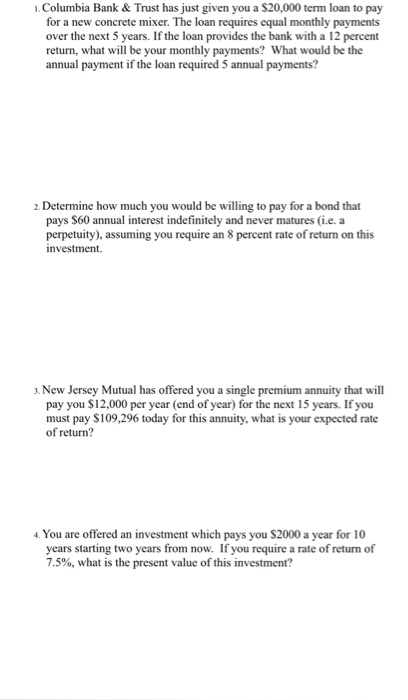

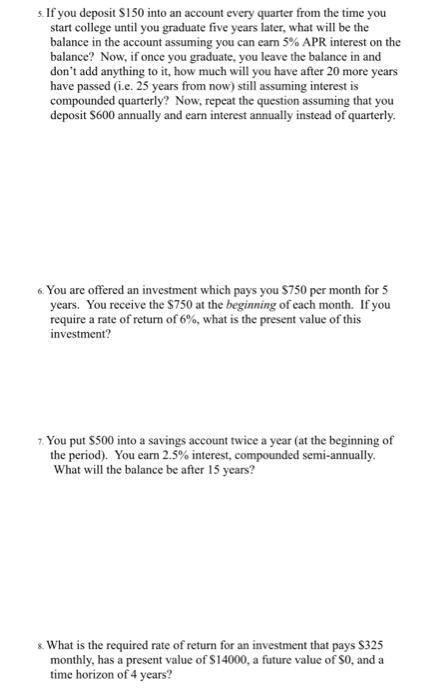

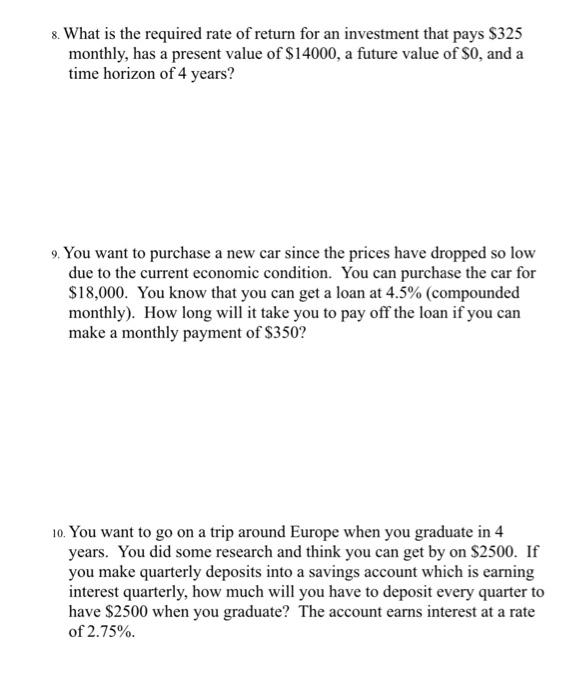

1. Columbia Bank & Trust has just given you a $20,000 term loan to pay for a new concrete mixer. The loan requires equal monthly payments over the next 5 years. If the loan provides the bank with a 12 percent return, what will be your monthly payments? What would be the annual payment if the loan required 5 annual payments? 2. Determine how much you would be willing to pay for a bond that pays $60 annual interest indefinitely and never matures (i.e. a perpetuity), assuming you require an 8 percent rate of return on this investment. 3. New Jersey Mutual has offered you a single premium annuity that will pay you $12,000 per year (end of year) for the next 15 years. If you must pay S109,296 today for this annuity, what is your expected rate of return? 4. You are offered an investment which pays you $2000 a year for 10 years starting two years from now. If you require a rate of return of 7.5%, what is the present value of this investment? s. If you deposit S150 into an account every quarter from the time you start college until you graduate five years later, what will be the balance in the account assuming you can earn 5% APR interest on the balance? Now, if once you graduate, you leave the balance in and don't add anything to it, how much will you have after 20 more yeans have passed (i.e. 25 years from now) still assuming interest is compounded quarterly? Now, repeat the question assuming that you deposit S600 annually and earn interest annually instead of quarterly 6 You are offered an investment which pays you $750 per month for 5 years. You receive the $750 at the beginning of each month. If you require a rate of return of 6%, what is the present value of this investment? 7. You put S500 into a savings account twice a year (at the beginning of the period). You earn 2.5% interest, compounded semi-annually What will the balance be after 15 years? What is the required rate of return for an investment that pays $325 monthly, has a present value of S14000, a future value of S0, anda time horizon of 4 years? s. What is the required rate of return for an investment that pays $325 monthly, has a present value of $14000, a future value of SO, and a time horizon of 4 years? 9. You want to purchase a new car since the prices have dropped so low due to the current economic condition. You can purchase the car for $18,000. You know that you can get a loan at 4.5% (compounded monthly). How long will it take you to pay off the loan if you can make a monthly payment of S350? 10. You want to go on a trip around Europe when you graduate in 4 years. You did some research and think you can get by on $2500. If you make quarterly deposits into a savings account which is earning interest quarterly, how much will you have to deposit every quarter to have $2500 when you graduate? The account earns interest at a rate of 2.75%