Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Combining two negatively correlated assets to reduce risk is known as A) diversification B) valuation C) securitization D) risk aversion 2) Risk that affects

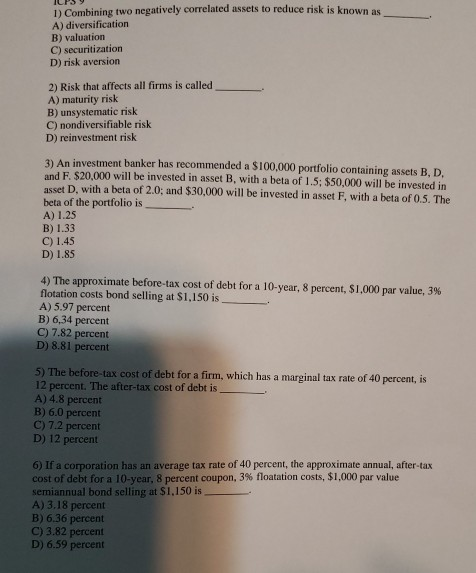

1) Combining two negatively correlated assets to reduce risk is known as A) diversification B) valuation C) securitization D) risk aversion 2) Risk that affects all firms is called A) maturity risk B) unsystematic risk C) nondiversifiable risk D) reinvestment risk 3) An investment banker has recommended a $100,000 portfolio containing assets B, D, and F. $20,000 will be invested in asset B, with a beta of 1.5; $50,000 will be invested in asset D, with a beta of 2.0; and $30,000 will be invested in asset F, with a beta of 0.5. The beta of the portfolio is A) 1.25 B) 1.33 C) 1.45 D) 1.85 4) The approximate before-tax cost of debt for a 10-year, 8 percent, $1,000 par value, 3% flotation costs bond selling at $1,150 is A) 5.97 percent B) 6,34 percent C) 7.82 percent D) 8.81 percent 5) The before-tax cost of debt for a firm, which has a marginal tax rate of 40 percent, is 12 percent. The after-tax cost of debt is A) 4.8 percent B) 6.0 percent C) 7.2 percent D) 12 percent 6) If a corporation has an average tax rate of 40 percent, the approximate annual, after-tax cost of debt for a 10-year, 8 percent coupon, 3% floatation costs, $1,000 par value semiannual bond selling at $1,150 is A) 3.18 percent B) 6.36 percent C) 3.82 percent D) 6.59 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started