Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Company issued 250,000 ordinary shares, each share R.O 1.500 the term of the issue are:0,400 applications and 0,500 allotments and 0,300 in the first

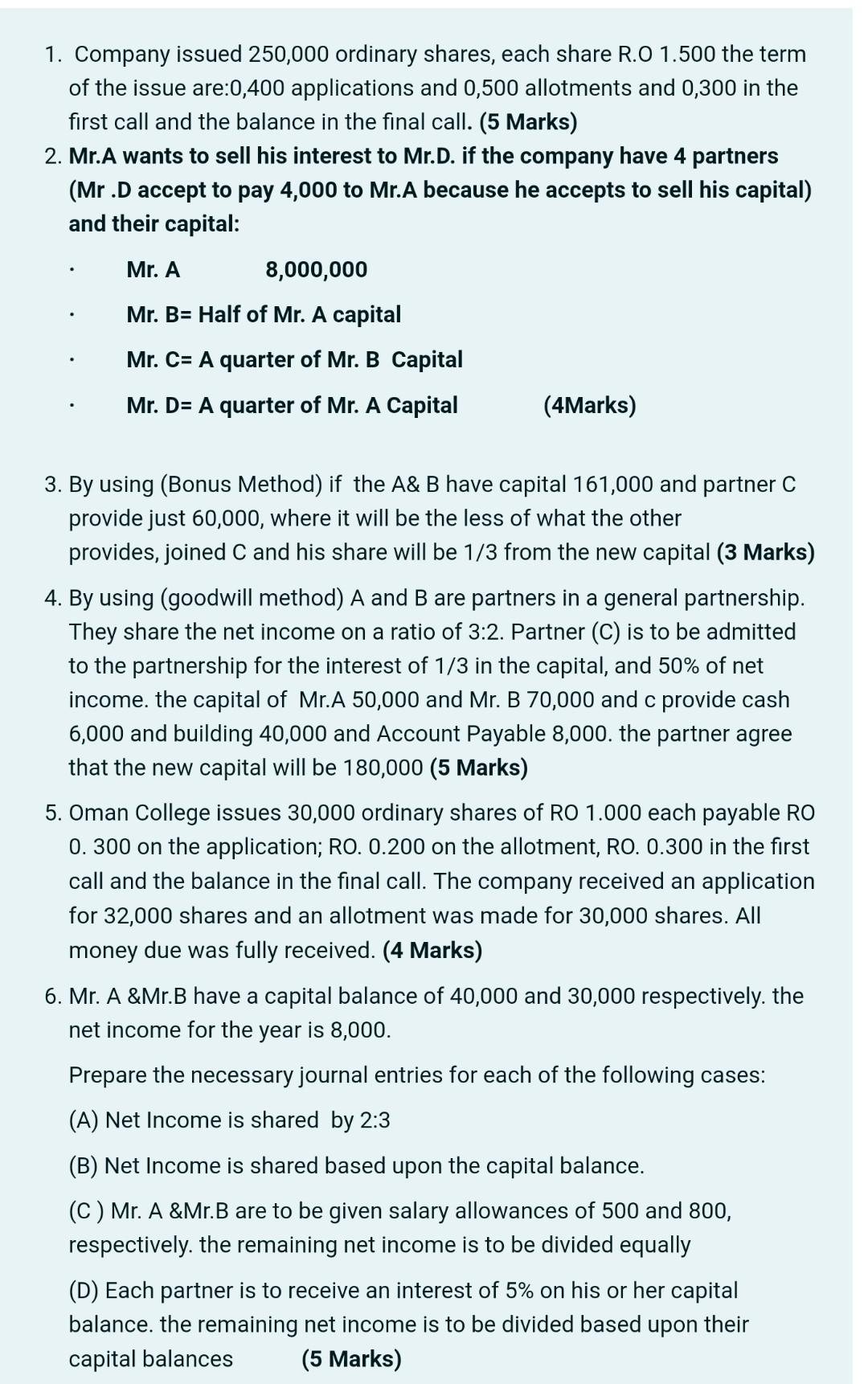

1. Company issued 250,000 ordinary shares, each share R.O 1.500 the term of the issue are:0,400 applications and 0,500 allotments and 0,300 in the first call and the balance in the final call. (5 Marks) 2. Mr.A wants to sell his interest to Mr.D. if the company have 4 partners (Mr.D accept to pay 4,000 to Mr.A because he accepts to sell his capital) and their capital: Mr. A 8,000,000 Mr. B= Half of Mr. A capital Mr. C= A quarter of Mr. B Capital Mr. D= A quarter of Mr. A Capital (4Marks) 3. By using (Bonus Method) if the A& B have capital 161,000 and partner C provide just 60,000, where it will be the less of what the other provides, joined C and his share will be 1/3 from the new capital (3 Marks) 4. By using (goodwill method) A and B are partners in a general partnership. They share the net income on a ratio of 3:2. Partner (C) is to be admitted to the partnership for the interest of 1/3 in the capital, and 50% of net income. the capital of Mr.A 50,000 and Mr. B 70,000 and c provide cash 6,000 and building 40,000 and Account Payable 8,000. the partner agree that the new capital will be 180,000 (5 Marks) 5. Oman College issues 30,000 ordinary shares of RO 1.000 each payable RO 0.300 on the application; RO. 0.200 on the allotment, RO. 0.300 in the first call and the balance in the final call. The company received an application for 32,000 shares and an allotment was made for 30,000 shares. All money due was fully received. (4 Marks) 6. Mr. A&Mr.B have a capital balance of 40,000 and 30,000 respectively. the net income for the year is 8,000. Prepare the necessary journal entries for each of the following cases: (A) Net Income is shared by 2:3 (B) Net Income is shared based upon the capital balance. (C) Mr. A &Mr.B are to be given salary allowances of 500 and 800, respectively. the remaining net income is to be divided equally (D) Each partner is to receive an interest of 5% on his or her capital balance. the remaining net income is to be divided based upon their capital balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started