Question

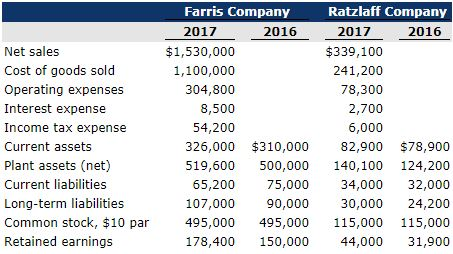

1. Comparative statement data for Farris Company and Ratzlaff Company, two competitors, appear below. All balance sheet data are as of December 31, 2017, and

1. Comparative statement data for Farris Company and Ratzlaff Company, two competitors, appear below. All balance sheet data are as of December 31, 2017, and December 31, 2016.

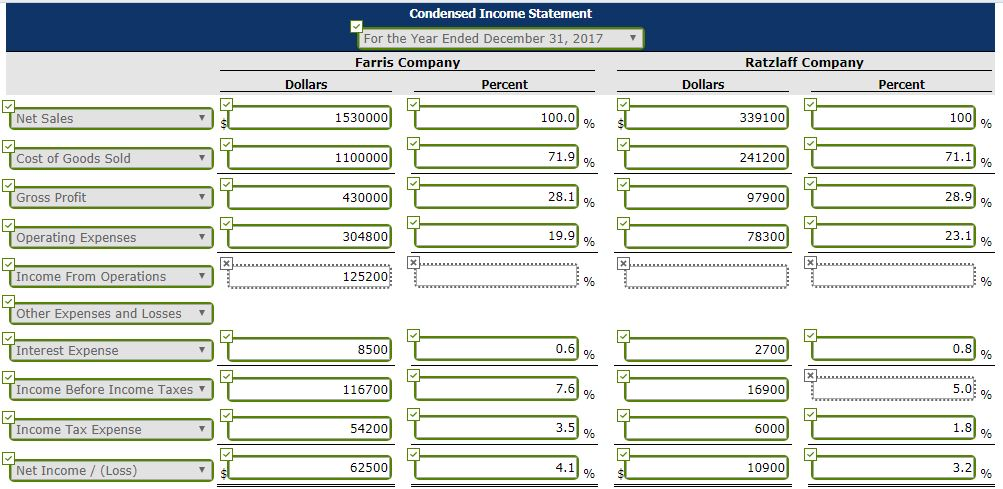

2. Prepare a vertical analysis of the 2017 income statement data for Farris Company and Ratzlaff Company in columnar form. (Round percentages to 1 decimal place, e.g. 12.1%.)

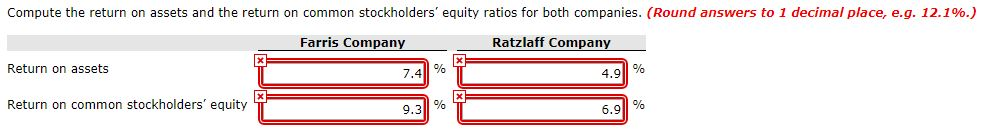

3. Compute the return on assets and the return on common stockholders equity ratios for both companies. (Round answers to 1 decimal place, e.g. 12.1%.) Please give explanation so I understand. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started