Question

1. Compare the estimated costs you calculate using an activity-based cost system to the estimated costs using the current system of allocating customer service costs.

1. Compare the estimated costs you calculate using an activity-based cost system to the estimated costs using the current system of allocating customer service costs. What causes the different costing methods to produce different results? Which costing system provides management of JBI with better information? Why?

2. What are the strategic implications of your analysis? What recommendations do you have for the management of JBI?

3. What if you were the management at Johnson Beverage, Inc., and you were presented with the possibility of having to negotiate a lower price with this customer?

4. What are all the possible reasons you can think of that your competitor can approach this account with a lower price, but you are unable to?

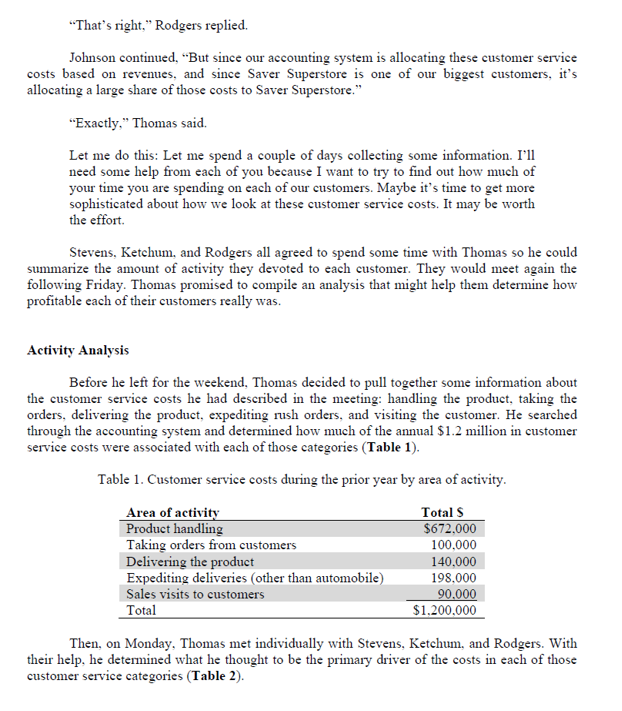

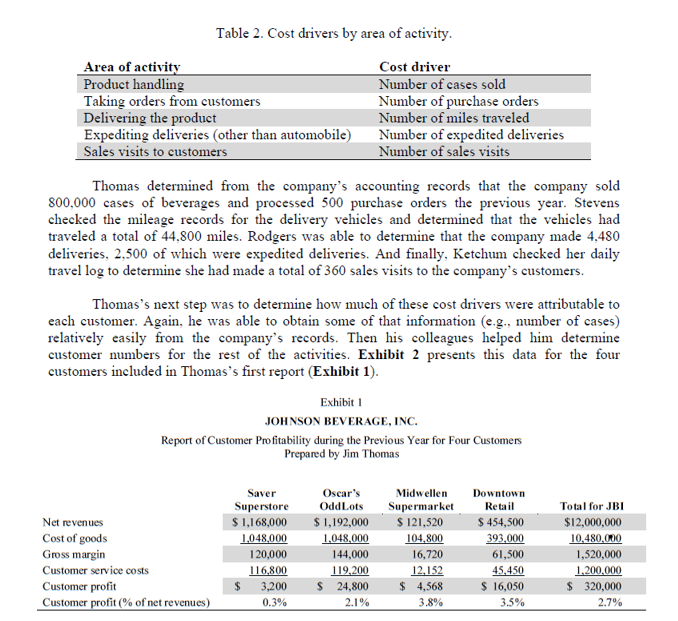

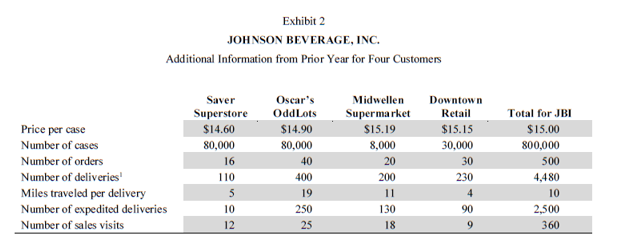

JOHNSON BEVERAGE, INC. As president and primary owner of Johnson Beverage, Inc. (JBI), Jack Johnson was beginning to realize that retaining long-term customers was becoming a challenge. During a delivery run yesterday, driver Joe Stevens had noticed a competitor's sales manager talking with the general manager of Saver Superstore, one of JBI's largest customers. Then, that morning, Johnson's sales manager, Marsha Ketchum, had mentioned that, during her visit with the same general manager on Wednesday, he was starting to make some noises about wanting to negotiate a lower price. This could cause a dilemma because this customer had been one of the company's largest and most loyal customers for years. Johnson leaned back in his chair. These things always seemed to come up on Fridayjust in time to monopolize his thoughts over what otherwise would have been a restful weekend. Deciding to address the situation head-on, he scheduled a meeting with Stevens, Ketchum, and several others for later that afternoon. Company Background JBI distributed beverages to retail customers. The company had been in business for two decades and had become a preferred distributor among several retail outlets in the local area. JBI primarily distributed bottled sports drinks made by small specialty beverage companies, and its business had grown steadily with the popularity of sports drinks over the past 10 to 20 years. Last year, JBI's revenues totaled $12 million. The company serviced about 20 customers whose beverage purchases totaled anywhere from about $100,000 to over $1 million annually. The undiscounted list price on the sports drinks that JBI distributed was $15.20 per case of 24 bottles. The full cost (excluding customer service costs) of the bottled drinks was $13.10 per case. The company offered discounts to some of its customers, which varied by customer based on a number of factors, including the volume of drinks the customer purchased, the future potential of the customer, and the negotiating success of the company's sales representative, among others. I don't think we can lower our price to Saver Superstore much more and make any money on this one. And just think, if we offer a larger discount to them, then we'll have our other customers wanting the same thing-especially the other big ones. I can see it now: Marsha is going to walk in here next month and tell us that Oscar's OddLots has heard about the deal we struck with Saver Superstore, has been talking with that competitor, and they want the same thing. Oscar's OddLots, a large local retailer on the edge of town, was another of JBI's large customers. he Meeting Johnson opened the meeting by summarizing what he had heard from Stevens a etchum over the past couple of days. "It looks like we've got some competition for one of est customers: Saver Superstore. I guess I'm not too surprised. They're a big customer." "This isn't the first time this has happened," added Ketchum. "You might remember t. is same competitor has approached Saver Superstore before. But that time, we were able eep the business by offering a bit more of a discount. I think we'll have to do more of that t me, or I'm afraid we'll lose the customer." Johnson responded quickly. "We can't get into a price war on this. I know this is a istomer, and a loyal one too, but it's certainly not one of our most profitable. I had Jim p me numbers together on several of our accounts. Saver Superstore is one of our lowest-marg 1stomers. Take a look." Jim Thomas in accounting, who was also in the meeting, had prepar report (Exhibit 1), which Johnson laid on the table for the others to look at. Thomas explained how the accounting group compiled the numbers: For each customer, we just pull the revenues right out of the accounting system. We know what they ordered and what we shipped, and we know what price we charge each customer, so that part is pretty easy. And we know that the cost per case, excluding our customer service costs, is $13.10. So we can multiply $13.10 per case by the number of cases we shipped to get our cost of goods. Then, we subtract our cost of goods from revenues for each customer and get a gross margin. Now, you may remember that we've talked about how hard it is to trace our customer service costs to any particular customer. Our customer service costs run about $1.2 million a year, roughly 10% of revenues. To make things easy, we allocate those to each customer based on its share of the company's total revenues. So if a customer accounts for 5% of our revenues, we allocate it 5% of our customer service costs. Then, we calculate a customer margin for each customer. Johnson looked at the numbers and said: I don't think we can lower our price to Saver Superstore much more and make any money on this one. And just think, if we offer a larger discount to them, then we'll have our other customers wanting the same thing-especially the other big ones. I can see it now: Marsha is going to walk in here next month and tell us that Oscar's OddLots has heard about the deal we struck with Saver Superstore, has been talking with that competitor, and they want the same thing. Oscar's OddLots, a large local retailer on the edge of town, was another of JBI's la tomers. Jason Rodgers, the operations manager for JBI, was listening carefully. This was the first he had heard of the situation, but to a careful observer, his nod would have revealed what he was thinking. He said: You know, I'm not a bit surprised to hear all this. Saver Superstore is a great customer. They buy lots of beverages, and they're easy to deal with. They place their orders on a regular basis and almost never ask for anything special. I don't remember the last time we had to run around in the warehouse pulling together a rush order from them. Who wouldn't want that business? Stevens agreed, "You're right. I almost never have to change my delivery schedule because they've asked for quick delivery. And they're right around the corner, so they're easy for us to get to." Rodgers continued: I think about some of our other customers. They seem to never be able to anticipate that they'll be out of stock. Then they call us and make it our problem to deal with. It seems like we have some customers that we work on all day every day. Why can't that competitor go after those customers? It's hard for me to believe that some of those customers are more profitable than Saver Superstore. Maybe we ought to add what we guys in the warehouse call a "pain factor" onto those other customers and then see who is most profitable for us. As Johnson listened, he realized Rodgers might be onto something. "Jim, what types of costs are included in those customer service costs?" Thomas replied, "Well, that number includes several things." He continued: It includes anything related to handling the beverages, like picking the beverages from the warehouse shelves according to the order instructions, moving the beverages over to the dock, and loading them on the delivery truck. It includes any costs related to taking, coordinating, and administering the orders, like what we pay the people in the sales office who take phone orders from customers, the supervisory costs to administer the order, and similar things. It includes anything related to delivering the beverages to the customer's location, like the cost of the delivery trucks, truck maintenance, and what we pay Joe and people like him to drive the trucks. It includes anything related to all those rush orders you're talking about, like overtime, extra scheduling, and stuff like that. And it includes what we pay Marsha for what she does, like visiting the customers to check in on them. So there's quite a bit of stuff in there. Johnson thought about this. "So you're telling me that there are some customers that you are spending a lot more time on than others? And it's not Saver Superstore?" Activity Analysis Before he left for the weekend, Thomas decided to pull together some information about the customer service costs he had described in the meeting: handling the product, taking the orders, delivering the product, expediting rush orders, and visiting the customer. He searched through the accounting system and determined how much of the annual $1.2 million in customer service costs were associated with each of those categories (Table 1). Table 1 . Customer service costs during the prior year by area of activity. Then, on Monday, Thomas met individually with Stevens, Ketchum, and Rodgers. With their help, he determined what he thought to be the primary driver of the costs in each of those customer service categories (Table 2). Table 2. Cost drivers by area of activity. Thomas determined from the company's accounting records that the company sold 800,000 cases of beverages and processed 500 purchase orders the previous year. Stevens checked the mileage records for the delivery vehicles and determined that the vehicles had traveled a total of 44,800 miles. Rodgers was able to determine that the company made 4,480 deliveries, 2,500 of which were expedited deliveries. And finally, Ketchum checked her daily travel log to determine she had made a total of 360 sales visits to the company's customers. Thomas's next step was to determine how much of these cost drivers were attributable to each customer. Again, he was able to obtain some of that information (e.g., number of cases) relatively easily from the company's records. Then his colleagues helped him determine customer numbers for the rest of the activities. Exhibit 2 presents this data for the four customers included in Thomas's first report (Exhibit 1). Exhibit 2 JOHNSON BEVERAGE, INC. Additional Information from Prior Year for Four Customers

JOHNSON BEVERAGE, INC. As president and primary owner of Johnson Beverage, Inc. (JBI), Jack Johnson was beginning to realize that retaining long-term customers was becoming a challenge. During a delivery run yesterday, driver Joe Stevens had noticed a competitor's sales manager talking with the general manager of Saver Superstore, one of JBI's largest customers. Then, that morning, Johnson's sales manager, Marsha Ketchum, had mentioned that, during her visit with the same general manager on Wednesday, he was starting to make some noises about wanting to negotiate a lower price. This could cause a dilemma because this customer had been one of the company's largest and most loyal customers for years. Johnson leaned back in his chair. These things always seemed to come up on Fridayjust in time to monopolize his thoughts over what otherwise would have been a restful weekend. Deciding to address the situation head-on, he scheduled a meeting with Stevens, Ketchum, and several others for later that afternoon. Company Background JBI distributed beverages to retail customers. The company had been in business for two decades and had become a preferred distributor among several retail outlets in the local area. JBI primarily distributed bottled sports drinks made by small specialty beverage companies, and its business had grown steadily with the popularity of sports drinks over the past 10 to 20 years. Last year, JBI's revenues totaled $12 million. The company serviced about 20 customers whose beverage purchases totaled anywhere from about $100,000 to over $1 million annually. The undiscounted list price on the sports drinks that JBI distributed was $15.20 per case of 24 bottles. The full cost (excluding customer service costs) of the bottled drinks was $13.10 per case. The company offered discounts to some of its customers, which varied by customer based on a number of factors, including the volume of drinks the customer purchased, the future potential of the customer, and the negotiating success of the company's sales representative, among others. I don't think we can lower our price to Saver Superstore much more and make any money on this one. And just think, if we offer a larger discount to them, then we'll have our other customers wanting the same thing-especially the other big ones. I can see it now: Marsha is going to walk in here next month and tell us that Oscar's OddLots has heard about the deal we struck with Saver Superstore, has been talking with that competitor, and they want the same thing. Oscar's OddLots, a large local retailer on the edge of town, was another of JBI's large customers. he Meeting Johnson opened the meeting by summarizing what he had heard from Stevens a etchum over the past couple of days. "It looks like we've got some competition for one of est customers: Saver Superstore. I guess I'm not too surprised. They're a big customer." "This isn't the first time this has happened," added Ketchum. "You might remember t. is same competitor has approached Saver Superstore before. But that time, we were able eep the business by offering a bit more of a discount. I think we'll have to do more of that t me, or I'm afraid we'll lose the customer." Johnson responded quickly. "We can't get into a price war on this. I know this is a istomer, and a loyal one too, but it's certainly not one of our most profitable. I had Jim p me numbers together on several of our accounts. Saver Superstore is one of our lowest-marg 1stomers. Take a look." Jim Thomas in accounting, who was also in the meeting, had prepar report (Exhibit 1), which Johnson laid on the table for the others to look at. Thomas explained how the accounting group compiled the numbers: For each customer, we just pull the revenues right out of the accounting system. We know what they ordered and what we shipped, and we know what price we charge each customer, so that part is pretty easy. And we know that the cost per case, excluding our customer service costs, is $13.10. So we can multiply $13.10 per case by the number of cases we shipped to get our cost of goods. Then, we subtract our cost of goods from revenues for each customer and get a gross margin. Now, you may remember that we've talked about how hard it is to trace our customer service costs to any particular customer. Our customer service costs run about $1.2 million a year, roughly 10% of revenues. To make things easy, we allocate those to each customer based on its share of the company's total revenues. So if a customer accounts for 5% of our revenues, we allocate it 5% of our customer service costs. Then, we calculate a customer margin for each customer. Johnson looked at the numbers and said: I don't think we can lower our price to Saver Superstore much more and make any money on this one. And just think, if we offer a larger discount to them, then we'll have our other customers wanting the same thing-especially the other big ones. I can see it now: Marsha is going to walk in here next month and tell us that Oscar's OddLots has heard about the deal we struck with Saver Superstore, has been talking with that competitor, and they want the same thing. Oscar's OddLots, a large local retailer on the edge of town, was another of JBI's la tomers. Jason Rodgers, the operations manager for JBI, was listening carefully. This was the first he had heard of the situation, but to a careful observer, his nod would have revealed what he was thinking. He said: You know, I'm not a bit surprised to hear all this. Saver Superstore is a great customer. They buy lots of beverages, and they're easy to deal with. They place their orders on a regular basis and almost never ask for anything special. I don't remember the last time we had to run around in the warehouse pulling together a rush order from them. Who wouldn't want that business? Stevens agreed, "You're right. I almost never have to change my delivery schedule because they've asked for quick delivery. And they're right around the corner, so they're easy for us to get to." Rodgers continued: I think about some of our other customers. They seem to never be able to anticipate that they'll be out of stock. Then they call us and make it our problem to deal with. It seems like we have some customers that we work on all day every day. Why can't that competitor go after those customers? It's hard for me to believe that some of those customers are more profitable than Saver Superstore. Maybe we ought to add what we guys in the warehouse call a "pain factor" onto those other customers and then see who is most profitable for us. As Johnson listened, he realized Rodgers might be onto something. "Jim, what types of costs are included in those customer service costs?" Thomas replied, "Well, that number includes several things." He continued: It includes anything related to handling the beverages, like picking the beverages from the warehouse shelves according to the order instructions, moving the beverages over to the dock, and loading them on the delivery truck. It includes any costs related to taking, coordinating, and administering the orders, like what we pay the people in the sales office who take phone orders from customers, the supervisory costs to administer the order, and similar things. It includes anything related to delivering the beverages to the customer's location, like the cost of the delivery trucks, truck maintenance, and what we pay Joe and people like him to drive the trucks. It includes anything related to all those rush orders you're talking about, like overtime, extra scheduling, and stuff like that. And it includes what we pay Marsha for what she does, like visiting the customers to check in on them. So there's quite a bit of stuff in there. Johnson thought about this. "So you're telling me that there are some customers that you are spending a lot more time on than others? And it's not Saver Superstore?" Activity Analysis Before he left for the weekend, Thomas decided to pull together some information about the customer service costs he had described in the meeting: handling the product, taking the orders, delivering the product, expediting rush orders, and visiting the customer. He searched through the accounting system and determined how much of the annual $1.2 million in customer service costs were associated with each of those categories (Table 1). Table 1 . Customer service costs during the prior year by area of activity. Then, on Monday, Thomas met individually with Stevens, Ketchum, and Rodgers. With their help, he determined what he thought to be the primary driver of the costs in each of those customer service categories (Table 2). Table 2. Cost drivers by area of activity. Thomas determined from the company's accounting records that the company sold 800,000 cases of beverages and processed 500 purchase orders the previous year. Stevens checked the mileage records for the delivery vehicles and determined that the vehicles had traveled a total of 44,800 miles. Rodgers was able to determine that the company made 4,480 deliveries, 2,500 of which were expedited deliveries. And finally, Ketchum checked her daily travel log to determine she had made a total of 360 sales visits to the company's customers. Thomas's next step was to determine how much of these cost drivers were attributable to each customer. Again, he was able to obtain some of that information (e.g., number of cases) relatively easily from the company's records. Then his colleagues helped him determine customer numbers for the rest of the activities. Exhibit 2 presents this data for the four customers included in Thomas's first report (Exhibit 1). Exhibit 2 JOHNSON BEVERAGE, INC. Additional Information from Prior Year for Four Customers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started