Answered step by step

Verified Expert Solution

Question

1 Approved Answer

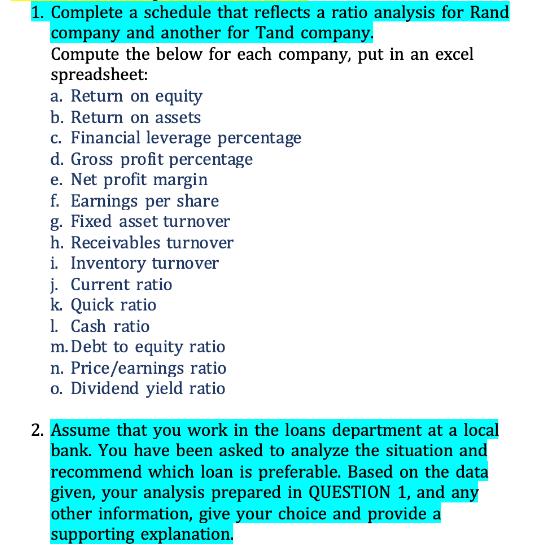

1. Complete a schedule that reflects a ratio analysis for Rand company and another for Tand company. Compute the below for each company, put

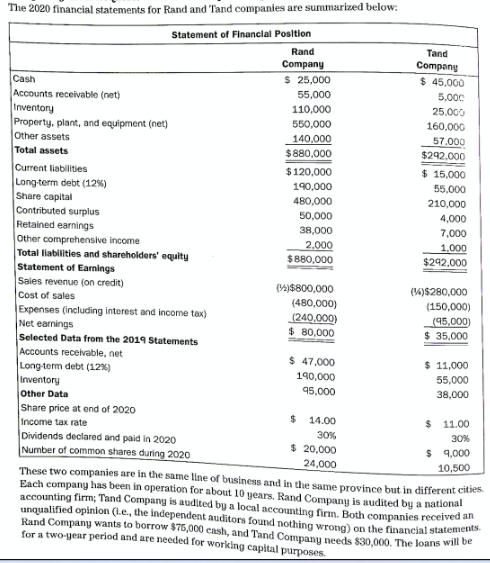

1. Complete a schedule that reflects a ratio analysis for Rand company and another for Tand company. Compute the below for each company, put in an excel spreadsheet: a. Return on equity b. Return on assets c. Financial leverage percentage d. Gross profit percentage e. Net profit margin f. Earnings per share g. Fixed asset turnover h. Receivables turnover i. Inventory turnover j. Current ratio k. Quick ratio 1. Cash ratio m.Debt to equity ratio n. Price/earnings ratio o. Dividend yield ratio 2. Assume that you work in the loans department at a local bank. You have been asked to analyze the situation and recommend which loan is preferable. Based on the data given, your analysis prepared in QUESTION 1, and any other information, give your choice and provide a supporting explanation. The 2020 financial statements for Rand and Tand companies are summarized below: Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Other assets Total assets Current liabilities Long-term debt (12%) Share capital Contributed surplus Retained earnings Other comprehensive income Total liabilities and shareholders' equity Statement of Earnings Sales revenue (on credit) Cost of sales Expenses (including interest and income tax) Net earnings Selected Data from the 2019 Statements Accounts receivable, net Long-term debt (12%) Inventory Other Data Share price at end of 2020 Income tax rate Dividends declared and paid in 2020 Number of common shares during 2020 Rand Company $ 25,000 55,000 110,000 550,000 140,000 $880,000 $120,000 190,000 480,000 50,000 38,000 2,000 $880,000 (4)$800,000 (480,000) (240,000) $ 80,000 $ 47,000 190,000 95,000 $14.00 30% $ 20,000 24,000 Tand Company $ 45,000 5,000 25.000 160,000 57.000 $292,000 $ 15,000 55,000 210,000 4,000 7,000 1,000 $292,000 (14)$280,000 (150,000) (95,000) $ 35,000 $ 11,000 55,000 38,000 $ 11.00 30% $ 9,000 10,500 These two companies are in the same line of business and in the same province but in different cities Each company has been in operation for about 10 years. Rand Company is audited by a national accounting firm; Tand Company is audited by a local accounting firm. Both companies received an unqualified opinion (i.e., the independent auditors found nothing wrong) on the financial statements Rand Company wants to borrow $75,000 cash, and Tand Company needs $30,000. The loans will be for a two-year period and are needed for working capital purposes.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To complete the schedule for the ratio analysis for Rand and Tand companies we first need to calculate each of the listed ratios using the 2020 financial statements provided The ratios are standard fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started