Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.1 Complete the Charles Schwab Risk Profile questionnaire below and determine your risk [4] profile. TIME HORISON Select the number of points for each of

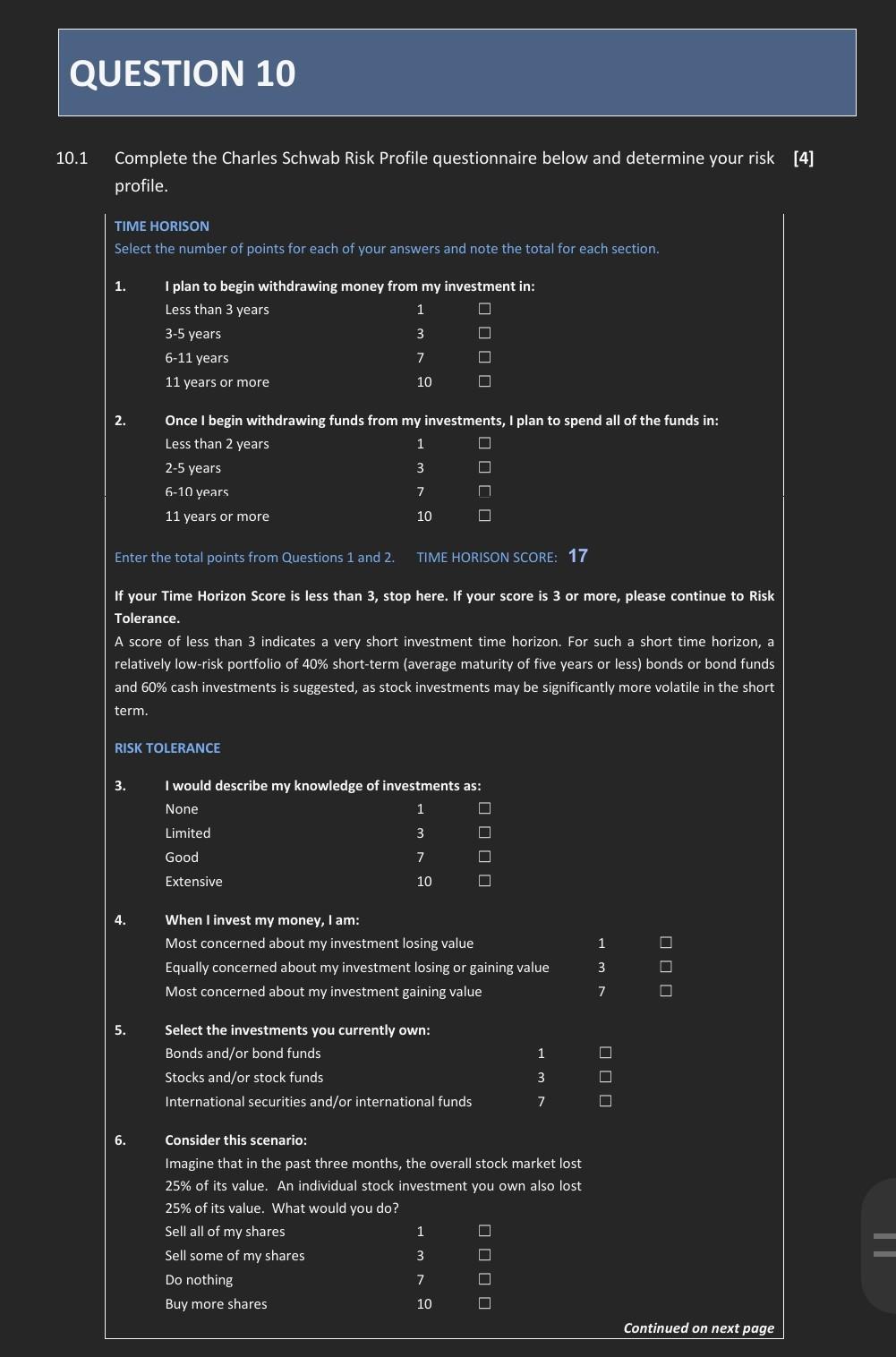

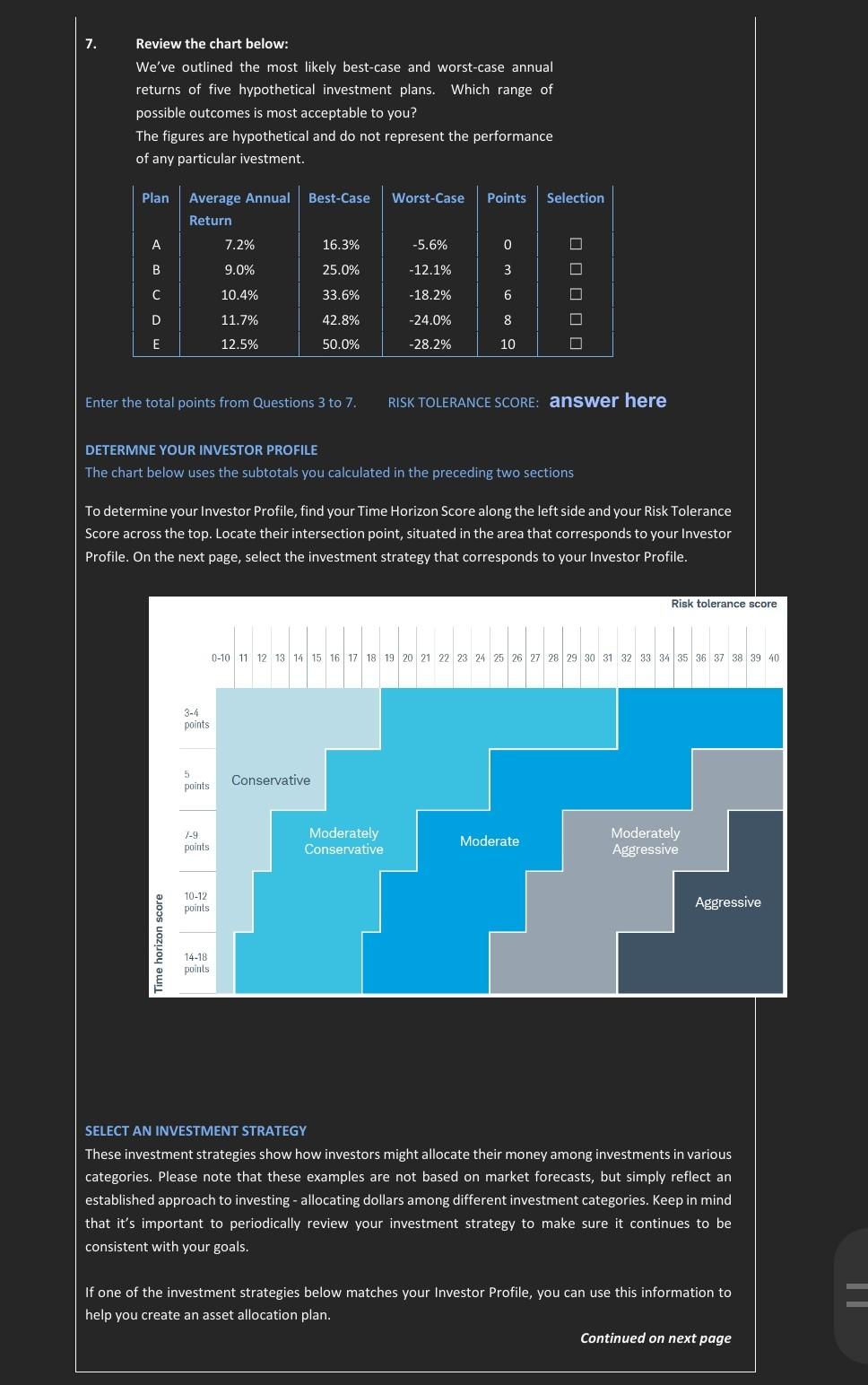

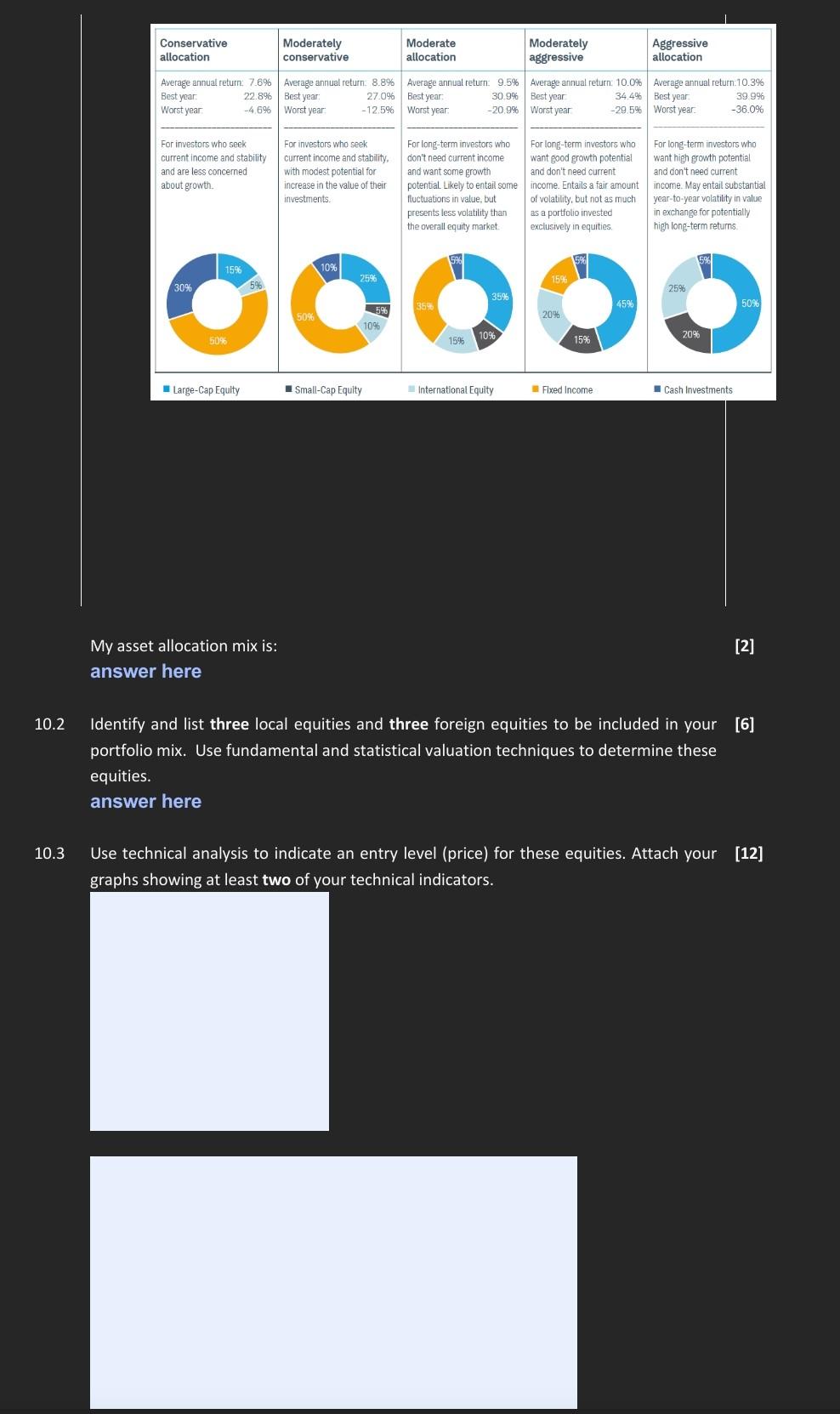

.1 Complete the Charles Schwab Risk Profile questionnaire below and determine your risk [4] profile. TIME HORISON Select the number of points for each of your answers and note the total for each section. 1. 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Enter the total points from Questions 1 and 2. TIME HORISON SCORE: 17 If your Time Horizon Score is less than 3, stop here. If your score is 3 or more, please continue to Risk Tolerance. A score of less than 3 indicates a very short investment time horizon. For such a short time horizon, a relatively low-risk portfolio of 40% short-term (average maturity of five years or less) bonds or bond funds and 60% cash investments is suggested, as stock investments may be significantly more volatile in the short term. RISK TOLERANCE 3. I would describe my knowledge of investments as: None Limited Good Extensive 1 3 7 10 4. When I invest my money, I am: Most concerned about my investment losing value Equally concerned about my investment losing or gaining value Most concerned about my investment gaining value 1 3 7 5. Select the investments you currently own: Bonds and/or bond funds Stocks and/or stock funds International securities and/or international funds 1 3 7 6. Consider this scenario: Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would you do? Sell all of my shares Sell some of my shares 1 Do nothing 3 Buy more shares 7 10 7. Review the chart below: We've outlined the most likely best-case and worst-case annual returns of five hypothetical investment plans. Which range of possible outcomes is most acceptable to you? The figures are hypothetical and do not represent the performance of any particular ivestment. Enter the total points from Questions 3 to 7. RISK TOLERANCE SCORE: anSWer here DETERMNE YOUR INVESTOR PROFILE The chart below uses the subtotals you calculated in the preceding two sections To determine your Investor Profile, find your Time Horizon Score along the left side and your Risk Tolerance Score across the top. Locate their intersection point, situated in the area that corresponds to your Investor Profile. On the next page, select the investment strategy that corresponds to your Investor Profile. Risk tolerance sc SELECT AN INVESTMENT STRATEGY These investment strategies show how investors might allocate their money among investments in various categories. Please note that these examples are not based on market forecasts, but simply reflect an established approach to investing - allocating dollars among different investment categories. Keep in mind that it's important to periodically review your investment strategy to make sure it continues to be consistent with your goals. If one of the investment strategies below matches your Investor Profile, you can use this information to help you create an asset allocation plan. Continued on next page - Large-Cap Equity - Small-Cap Equity international Equity Flied Income Cash investments My asset allocation mix is: [2] answer here 0.2 Identify and list three local equities and three foreign equities to be included in your [6] portfolio mix. Use fundamental and statistical valuation techniques to determine these equities. answer here 0.3 Use technical analysis to indicate an entry level (price) for these equities. Attach your [12] graphs showing at least two of your technical indicators. .2 Identify and list three local equities and three foreign equities to be included in your [6] portfolio mix. Use fundamental and statistical valuation techniques to determine these equities. answer here .3 Use technical analysis to indicate an entry level (price) for these equities. Attach your [12] graphs showing at least two of your technical indicators. .1 Complete the Charles Schwab Risk Profile questionnaire below and determine your risk [4] profile. TIME HORISON Select the number of points for each of your answers and note the total for each section. 1. 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Enter the total points from Questions 1 and 2. TIME HORISON SCORE: 17 If your Time Horizon Score is less than 3, stop here. If your score is 3 or more, please continue to Risk Tolerance. A score of less than 3 indicates a very short investment time horizon. For such a short time horizon, a relatively low-risk portfolio of 40% short-term (average maturity of five years or less) bonds or bond funds and 60% cash investments is suggested, as stock investments may be significantly more volatile in the short term. RISK TOLERANCE 3. I would describe my knowledge of investments as: None Limited Good Extensive 1 3 7 10 4. When I invest my money, I am: Most concerned about my investment losing value Equally concerned about my investment losing or gaining value Most concerned about my investment gaining value 1 3 7 5. Select the investments you currently own: Bonds and/or bond funds Stocks and/or stock funds International securities and/or international funds 1 3 7 6. Consider this scenario: Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would you do? Sell all of my shares Sell some of my shares 1 Do nothing 3 Buy more shares 7 10 7. Review the chart below: We've outlined the most likely best-case and worst-case annual returns of five hypothetical investment plans. Which range of possible outcomes is most acceptable to you? The figures are hypothetical and do not represent the performance of any particular ivestment. Enter the total points from Questions 3 to 7. RISK TOLERANCE SCORE: anSWer here DETERMNE YOUR INVESTOR PROFILE The chart below uses the subtotals you calculated in the preceding two sections To determine your Investor Profile, find your Time Horizon Score along the left side and your Risk Tolerance Score across the top. Locate their intersection point, situated in the area that corresponds to your Investor Profile. On the next page, select the investment strategy that corresponds to your Investor Profile. Risk tolerance sc SELECT AN INVESTMENT STRATEGY These investment strategies show how investors might allocate their money among investments in various categories. Please note that these examples are not based on market forecasts, but simply reflect an established approach to investing - allocating dollars among different investment categories. Keep in mind that it's important to periodically review your investment strategy to make sure it continues to be consistent with your goals. If one of the investment strategies below matches your Investor Profile, you can use this information to help you create an asset allocation plan. Continued on next page - Large-Cap Equity - Small-Cap Equity international Equity Flied Income Cash investments My asset allocation mix is: [2] answer here 0.2 Identify and list three local equities and three foreign equities to be included in your [6] portfolio mix. Use fundamental and statistical valuation techniques to determine these equities. answer here 0.3 Use technical analysis to indicate an entry level (price) for these equities. Attach your [12] graphs showing at least two of your technical indicators. .2 Identify and list three local equities and three foreign equities to be included in your [6] portfolio mix. Use fundamental and statistical valuation techniques to determine these equities. answer here .3 Use technical analysis to indicate an entry level (price) for these equities. Attach your [12] graphs showing at least two of your technical indicators

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started