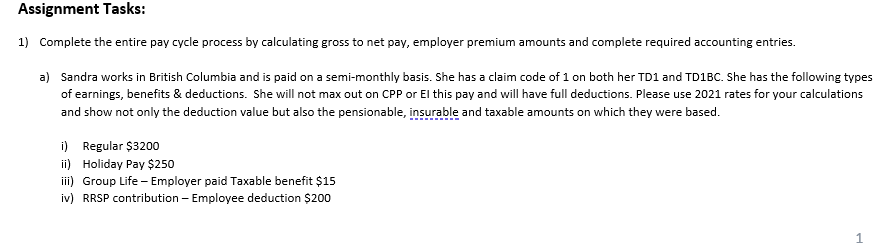

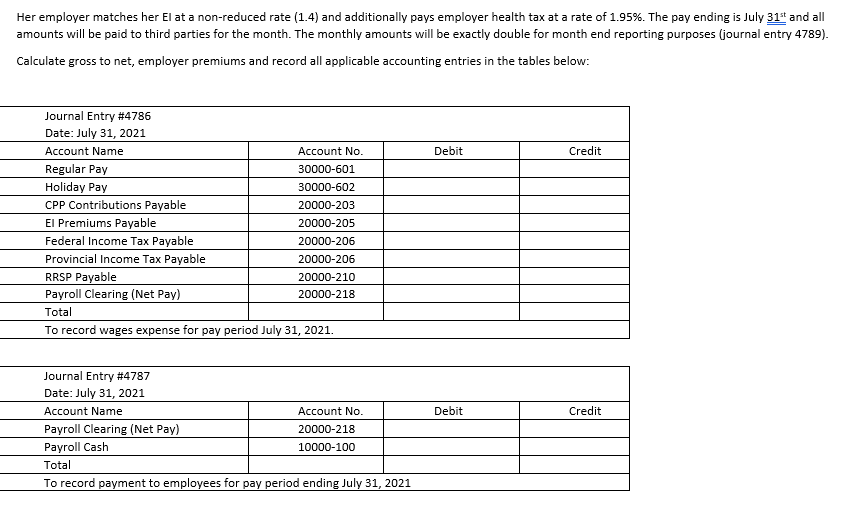

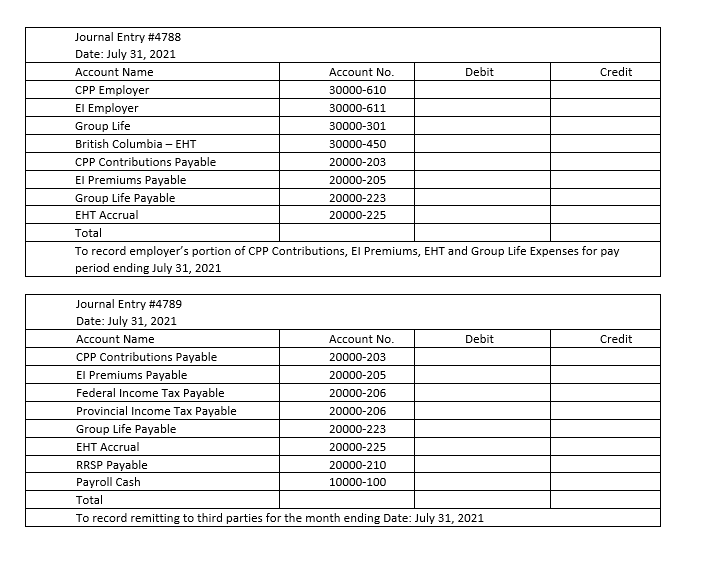

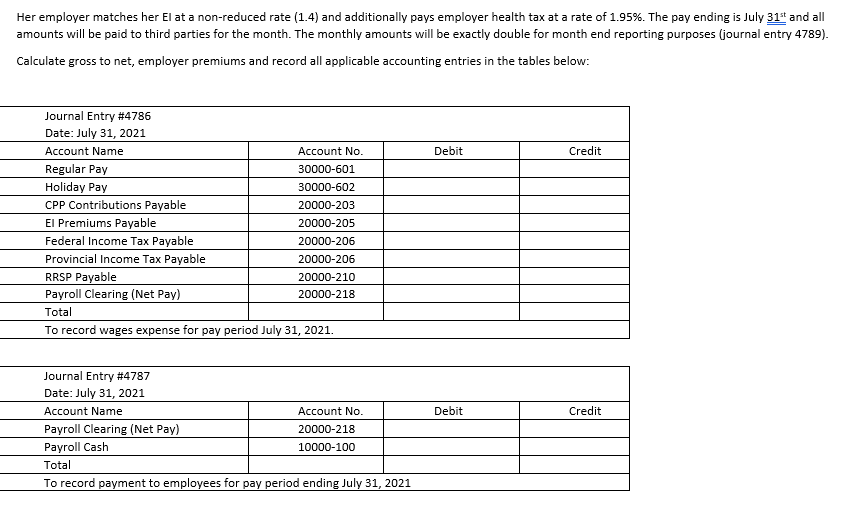

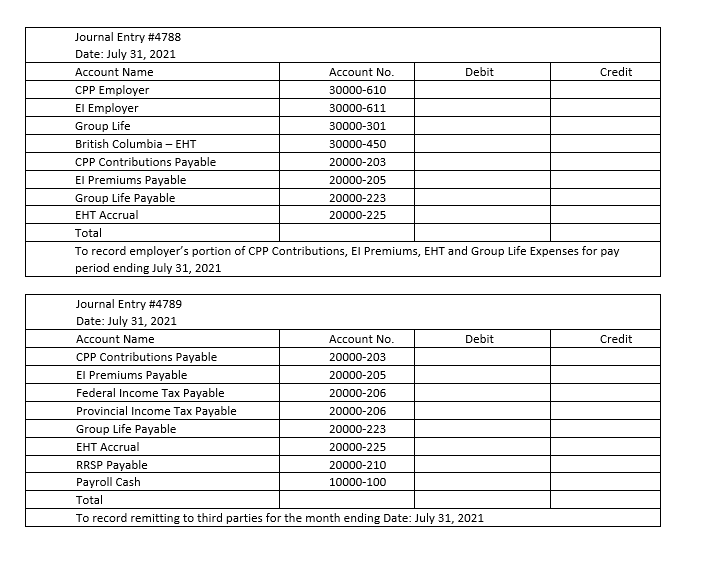

1) Complete the entire pay cycle process by calculating gross to net pay, employer premium amounts and complete required accounting entries. a) Sandra works in British Columbia and is paid on a semi-monthly basis. She has a claim code of 1 on both her TD1 and TD1BC. She has the following types of earnings, benefits \& deductions. She will not max out on CPP or El this pay and will have full deductions. Please use 2021 rates for your calculations and show not only the deduction value but also the pensionable, insurable and taxable amounts on which they were based. i) Regular $3200 ii) Holiday Pay $250 iii) Group Life - Employer paid Taxable benefit $15 iv) RRSP contribution - Employee deduction $200 Her employer matches her El at a non-reduced rate (1.4) and additionally pays employer health tax at a rate of 1.95%. The pay ending is July 31st and all amounts will be paid to third parties for the month. The monthly amounts will be exactly double for month end reporting purposes (journal entry 4789 ). Calculate gross to net, employer premiums and record all applicable accounting entries in the tables below: \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|l|}{ Journal Entry \#4789 } \\ Date: July 31, 2021 & Account No. & Debit & \multicolumn{1}{|l|}{ Credit } \\ \hline Account Name & 20000203 & & \\ \hline CPP Contributions Payable & 20000205 & & \\ \hline El Premiums Payable & 20000206 & & \\ \hline Federal Income Tax Payable & 20000206 & & \\ \hline Provincial Income Tax Payable & 20000223 & & \\ \hline Group Life Payable & 20000225 & & \\ \hline EHT Accrual & 20000210 & & \\ \hline RRSP Payable & 10000100 & & \\ \hline \multicolumn{2}{|l|}{ Payroll Cash } & & \\ \hline \multicolumn{2}{|l|}{ Total } & & \\ \hline \multicolumn{2}{|l|}{ To record remitting to third parties for the month ending Date: July 31, 2021 } \\ \hline \end{tabular} 1) Complete the entire pay cycle process by calculating gross to net pay, employer premium amounts and complete required accounting entries. a) Sandra works in British Columbia and is paid on a semi-monthly basis. She has a claim code of 1 on both her TD1 and TD1BC. She has the following types of earnings, benefits \& deductions. She will not max out on CPP or El this pay and will have full deductions. Please use 2021 rates for your calculations and show not only the deduction value but also the pensionable, insurable and taxable amounts on which they were based. i) Regular $3200 ii) Holiday Pay $250 iii) Group Life - Employer paid Taxable benefit $15 iv) RRSP contribution - Employee deduction $200 Her employer matches her El at a non-reduced rate (1.4) and additionally pays employer health tax at a rate of 1.95%. The pay ending is July 31st and all amounts will be paid to third parties for the month. The monthly amounts will be exactly double for month end reporting purposes (journal entry 4789 ). Calculate gross to net, employer premiums and record all applicable accounting entries in the tables below: \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|l|}{ Journal Entry \#4789 } \\ Date: July 31, 2021 & Account No. & Debit & \multicolumn{1}{|l|}{ Credit } \\ \hline Account Name & 20000203 & & \\ \hline CPP Contributions Payable & 20000205 & & \\ \hline El Premiums Payable & 20000206 & & \\ \hline Federal Income Tax Payable & 20000206 & & \\ \hline Provincial Income Tax Payable & 20000223 & & \\ \hline Group Life Payable & 20000225 & & \\ \hline EHT Accrual & 20000210 & & \\ \hline RRSP Payable & 10000100 & & \\ \hline \multicolumn{2}{|l|}{ Payroll Cash } & & \\ \hline \multicolumn{2}{|l|}{ Total } & & \\ \hline \multicolumn{2}{|l|}{ To record remitting to third parties for the month ending Date: July 31, 2021 } \\ \hline \end{tabular}