Answered step by step

Verified Expert Solution

Question

1 Approved Answer

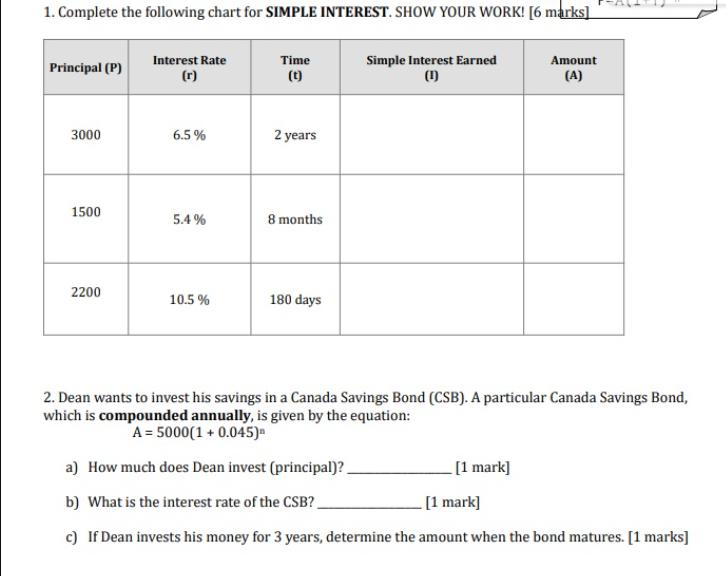

1. Complete the following chart for SIMPLE INTEREST. SHOW YOUR WORK! [6 marks] Principal (P) Interest Rate (r) Time (t) Simple Interest Earned (1)

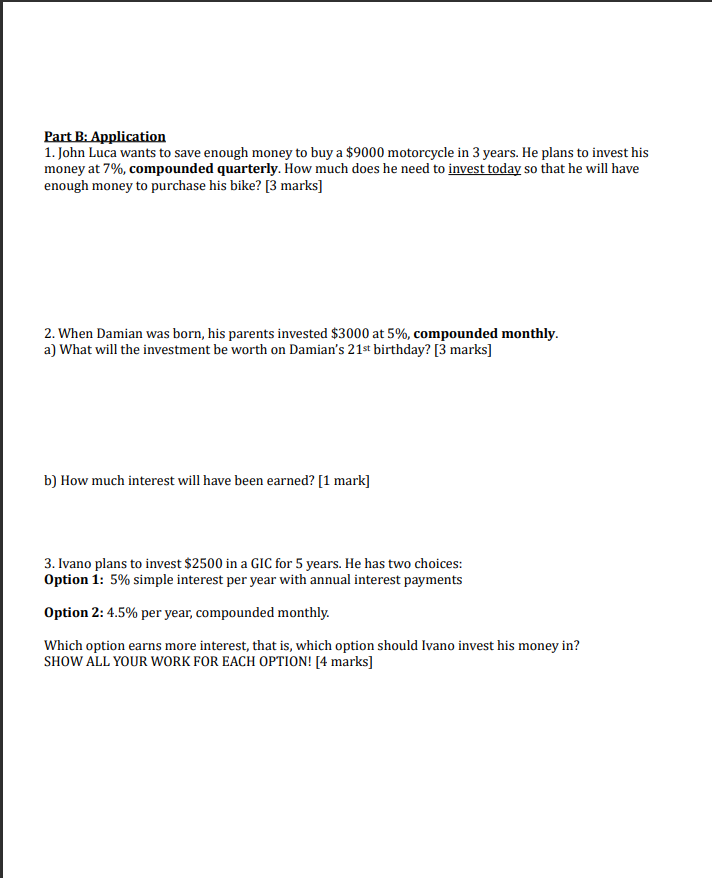

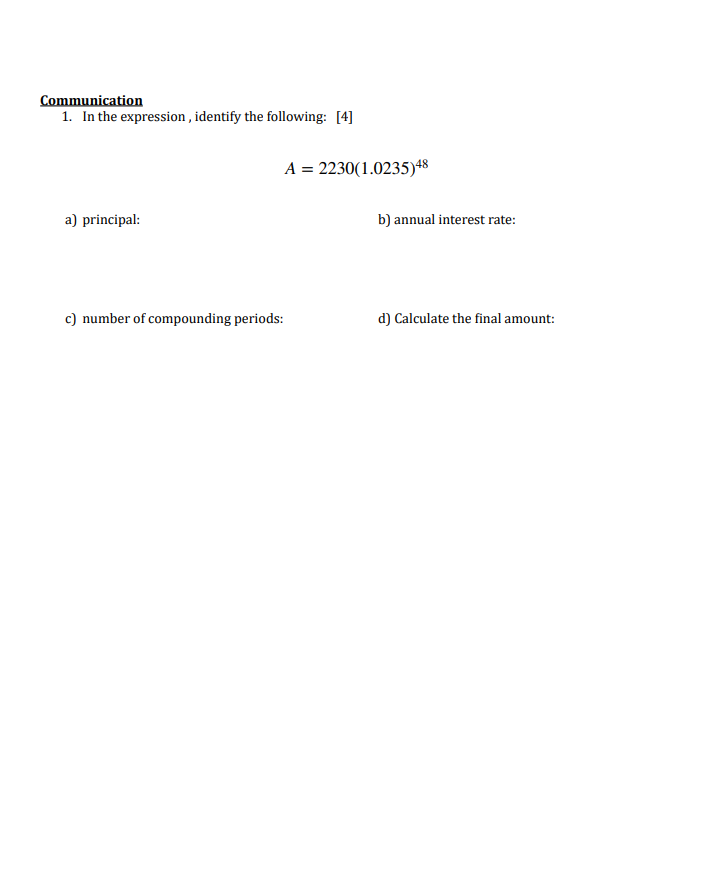

1. Complete the following chart for SIMPLE INTEREST. SHOW YOUR WORK! [6 marks] Principal (P) Interest Rate (r) Time (t) Simple Interest Earned (1) Amount (A) 3000 6.5% 2 years 1500 5.4% 8 months 2200 10.5 % 180 days 2. Dean wants to invest his savings in a Canada Savings Bond (CSB). A particular Canada Savings Bond, which is compounded annually, is given by the equation: A = 5000(1+0.045) a) How much does Dean invest (principal)? b) What is the interest rate of the CSB? [1 mark] [1 mark] c) If Dean invests his money for 3 years, determine the amount when the bond matures. [1 marks] d) How much interest did Dean earn? [1 mark] Part B: Application 1. John Luca wants to save enough money to buy a $9000 motorcycle in 3 years. He plans to invest his money at 7%, compounded quarterly. How much does he need to invest today so that he will have enough money to purchase his bike? [3 marks] 2. When Damian was born, his parents invested $3000 at 5%, compounded monthly. a) What will the investment be worth on Damian's 21st birthday? [3 marks] b) How much interest will have been earned? [1 mark] 3. Ivano plans to invest $2500 in a GIC for 5 years. He has two choices: Option 1: 5% simple interest per year with annual interest payments Option 2: 4.5% per year, compounded monthly. Which option earns more interest, that is, which option should Ivano invest his money in? SHOW ALL YOUR WORK FOR EACH OPTION! [4 marks] Communication 1. In the expression, identify the following: [4] a) principal: A = 2230(1.0235)48 b) annual interest rate: c) number of compounding periods: d) Calculate the final amount:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started