Answered step by step

Verified Expert Solution

Question

1 Approved Answer

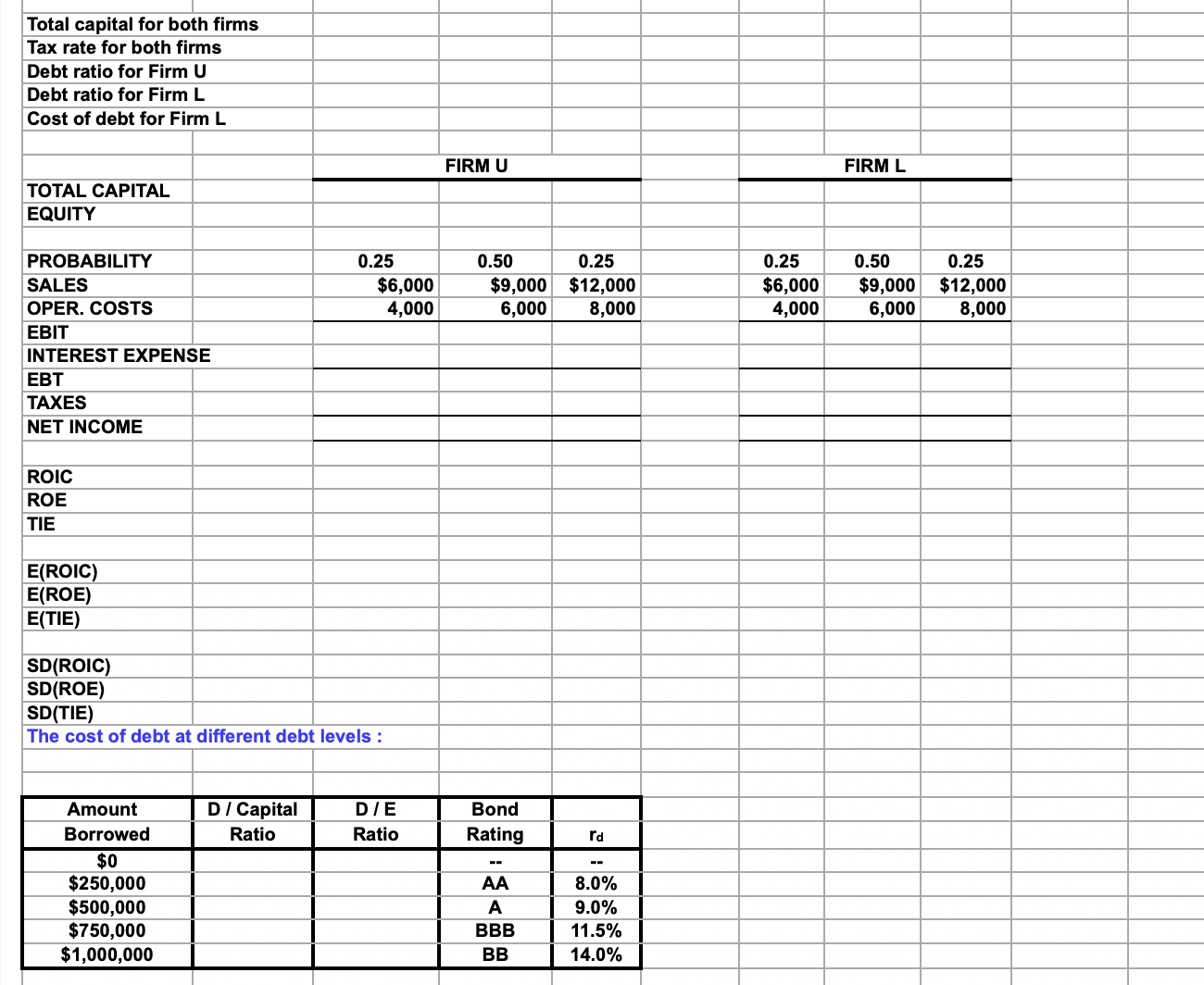

1. Complete the partial income statements and the firms' ratios. 2.what is the value of the SD(ROE) for firms U and L respectively? a.2.65%, 2.65%

1.Complete the partial income statements and the firms' ratios.

2.what is the value of the SD(ROE) for firms U and L respectively?

a.2.65%, 2.65% b.2.65%, 5.30%

c.5.30%, 5.30% d.5.30%, 2.65%

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Total capital for both firms } \\ \hline \multicolumn{8}{|c|}{ Tax rate for both firms } \\ \hline \multicolumn{8}{|c|}{ Debt ratio for Firm U } \\ \hline \multicolumn{8}{|c|}{ Debt ratio for Firm L } \\ \hline \multicolumn{8}{|c|}{ Cost of debt for Firm L } \\ \hline & & \multirow{2}{*}{\multicolumn{3}{|c|}{ FIRM U }} & \multirow{2}{*}{\multicolumn{3}{|c|}{ FIRM L }} \\ \hline & & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{8}{|c|}{TOTALCAPITALEQUITY}} \\ \hline & & & & & & & \\ \hline PROBABILITY & & 0.25 & 0.50 & 0.25 & 0.25 & 0.50 & 0.25 \\ \hline SALES & & $6,000 & $9,000 & $12,000 & $6,000 & $9,000 & $12,000 \\ \hline OPER. COSTS & & 4,000 & 6,000 & 8,000 & 4,000 & 6,000 & 8,000 \\ \hline \multicolumn{8}{|l|}{ EBIT } \\ \hline \multicolumn{8}{|c|}{ INTEREST EXPENSE } \\ \hline \multicolumn{8}{|l|}{ EBT } \\ \hline TAXES & & & & & & & \\ \hline NET INCOME & & & & & & & \\ \hline & & & & & & & \\ \hline \multicolumn{8}{|l|}{ ROIC } \\ \hline \multicolumn{8}{|l|}{ ROE } \\ \hline \multicolumn{8}{|l|}{ TIE } \\ \hline \multicolumn{7}{|l|}{ E(ROIC) } & \\ \hline \multicolumn{8}{|l|}{E(ROE)} \\ \hline \multicolumn{8}{|l|}{E(TIE)} \\ \hline & & & & & & & \\ \hline \multicolumn{8}{|l|}{ SD(ROIC) } \\ \hline \multicolumn{8}{|l|}{ SD(ROE) } \\ \hline \multicolumn{8}{|l|}{ SD(TIE) } \\ \hline \multicolumn{8}{|c|}{ The cost of debt at different debt levels: } \\ \hline & & & & & & & \\ \hline Amount & D/Capital & D/E & Bond & & & & \\ \hline Borrowed & Ratio & Ratio & Rating & rd & & & \\ \hline$0 & & & - & - & & & \\ \hline$250,000 & & & AA & 8.0% & & & \\ \hline$500,000 & & & A & 9.0% & & & \\ \hline$750,000 & & & BBB & 11.5% & & & \\ \hline$1,000,000 & & & BB & 14.0% & & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Total capital for both firms } \\ \hline \multicolumn{8}{|c|}{ Tax rate for both firms } \\ \hline \multicolumn{8}{|c|}{ Debt ratio for Firm U } \\ \hline \multicolumn{8}{|c|}{ Debt ratio for Firm L } \\ \hline \multicolumn{8}{|c|}{ Cost of debt for Firm L } \\ \hline & & \multirow{2}{*}{\multicolumn{3}{|c|}{ FIRM U }} & \multirow{2}{*}{\multicolumn{3}{|c|}{ FIRM L }} \\ \hline & & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{8}{|c|}{TOTALCAPITALEQUITY}} \\ \hline & & & & & & & \\ \hline PROBABILITY & & 0.25 & 0.50 & 0.25 & 0.25 & 0.50 & 0.25 \\ \hline SALES & & $6,000 & $9,000 & $12,000 & $6,000 & $9,000 & $12,000 \\ \hline OPER. COSTS & & 4,000 & 6,000 & 8,000 & 4,000 & 6,000 & 8,000 \\ \hline \multicolumn{8}{|l|}{ EBIT } \\ \hline \multicolumn{8}{|c|}{ INTEREST EXPENSE } \\ \hline \multicolumn{8}{|l|}{ EBT } \\ \hline TAXES & & & & & & & \\ \hline NET INCOME & & & & & & & \\ \hline & & & & & & & \\ \hline \multicolumn{8}{|l|}{ ROIC } \\ \hline \multicolumn{8}{|l|}{ ROE } \\ \hline \multicolumn{8}{|l|}{ TIE } \\ \hline \multicolumn{7}{|l|}{ E(ROIC) } & \\ \hline \multicolumn{8}{|l|}{E(ROE)} \\ \hline \multicolumn{8}{|l|}{E(TIE)} \\ \hline & & & & & & & \\ \hline \multicolumn{8}{|l|}{ SD(ROIC) } \\ \hline \multicolumn{8}{|l|}{ SD(ROE) } \\ \hline \multicolumn{8}{|l|}{ SD(TIE) } \\ \hline \multicolumn{8}{|c|}{ The cost of debt at different debt levels: } \\ \hline & & & & & & & \\ \hline Amount & D/Capital & D/E & Bond & & & & \\ \hline Borrowed & Ratio & Ratio & Rating & rd & & & \\ \hline$0 & & & - & - & & & \\ \hline$250,000 & & & AA & 8.0% & & & \\ \hline$500,000 & & & A & 9.0% & & & \\ \hline$750,000 & & & BBB & 11.5% & & & \\ \hline$1,000,000 & & & BB & 14.0% & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started