1. Complete the table by writing the coverage needed (definitions provided in worksheet) in different types of accident given in page 21 of above work sheet.

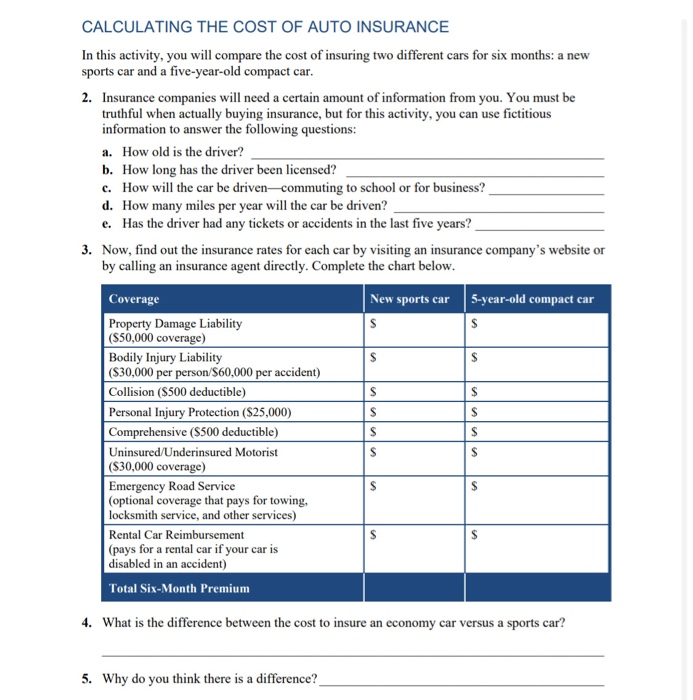

2. You will compare the cost of insuring two different cars for six month: a new sports car and a 5 year old compact Car.

You can find insurance rates of each car by visiting a insurance company website or by calling the insurance agent directly

(please answer all questions, thank you for everything you're doing)

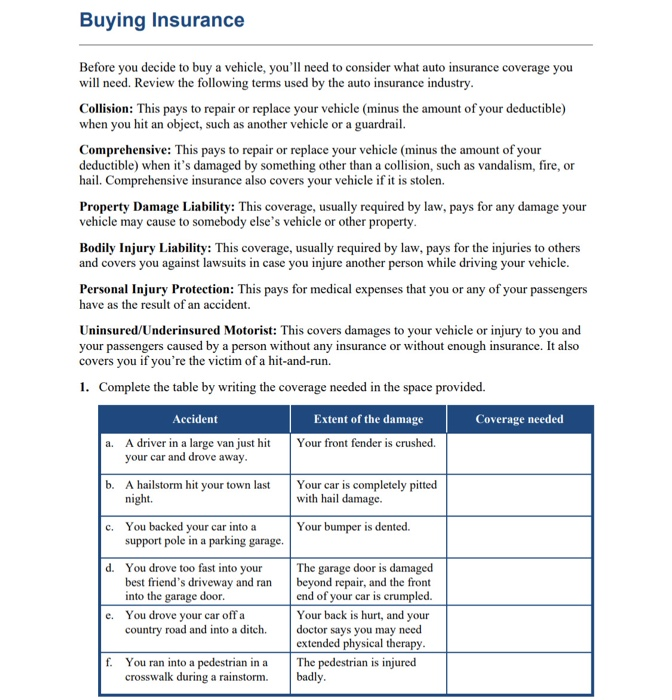

Buying Insurance Before you decide to buy a vehicle, you'll need to consider what auto insurance coverage you will need. Review the following terms used by the auto insurance industry. Collision: This pays to repair or replace your vehicle (minus the amount of your deductible) when you hit an object, such as another vehicle or a guardrail. Comprehensive: This pays to repair or replace your vehicle (minus the amount of your deductible) when it's damaged by something other than a collision, such as vandalism, fire, or hail. Comprehensive insurance also covers your vehicle if it is stolen. Property Damage Liability: This coverage, usually required by law, pays for any damage your vehicle may cause to somebody else's vehicle or other property. Bodily Injury Liability: This coverage, usually required by law, pays for the injuries to others and covers you against lawsuits in case you injure another person while driving your vehicle. Personal Injury Protection: This pays for medical expenses that you or any of your passengers have as the result of an accident. Uninsured/Underinsured Motorist: This covers damages to your vehicle or injury to you and your passengers caused by a person without any insurance or without enough insurance. It also covers you if you're the victim of a hit-and-run. 1. Complete the table by writing the coverage needed in the space provided. Accident Extent of the damage Coverage needed a. A driver in a large van just hit Your front fender is crushed. your car and drove away. b. A hailstorm hit your town last Your car is completely pitted night. with hail damage. c. You backed your car into a Your bumper is dented. support pole in a parking garage. d. You drove too fast into your The garage door is damaged best friend's driveway and ran beyond repair, and the front into the garage door. end of your car is crumpled. e. You drove your car off a Your back is hurt, and your country road and into a ditch. doctor says you may need extended physical therapy. f. You ran into a pedestrian in a The pedestrian is injured crosswalk during a rainstorm. badly. CALCULATING THE COST OF AUTO INSURANCE In this activity, you will compare the cost of insuring two different cars for six months: a new sports car and a five-year-old compact car. 2. Insurance companies will need a certain amount of information from you. You must be truthful when actually buying insurance, but for this activity, you can use fictitious information to answer the following questions: a. How old is the driver? b. How long has the driver been licensed? c. How will the car be driven-commuting to school or for business? d. How many miles per year will the car be driven? e. Has the driver had any tickets or accidents in the last five years? 3. Now, find out the insurance rates for each car by visiting an insurance company's website or by calling an insurance agent directly. Complete the chart below. Coverage New sports car 5-year-old compact car Property Damage Liability s $ ($50,000 coverage) Bodily Injury Liability ($30,000 per person/S60,000 per accident) Collision ($500 deductible) Personal Injury Protection ($25,000) Comprehensive (S500 deductible) Uninsured/Underinsured Motorist ($30,000 coverage) Emergency Road Service (optional coverage that pays for towing, locksmith service, and other services) Rental Car Reimbursement (pays for a rental car if your car is disabled in an accident) Total Six-Month Premium S S S $ S S S $ S $ S A $ 4. What is the difference between the cost to insure an economy car versus a sports car? 5. Why do you think there is a difference? Buying Insurance Before you decide to buy a vehicle, you'll need to consider what auto insurance coverage you will need. Review the following terms used by the auto insurance industry. Collision: This pays to repair or replace your vehicle (minus the amount of your deductible) when you hit an object, such as another vehicle or a guardrail. Comprehensive: This pays to repair or replace your vehicle (minus the amount of your deductible) when it's damaged by something other than a collision, such as vandalism, fire, or hail. Comprehensive insurance also covers your vehicle if it is stolen. Property Damage Liability: This coverage, usually required by law, pays for any damage your vehicle may cause to somebody else's vehicle or other property. Bodily Injury Liability: This coverage, usually required by law, pays for the injuries to others and covers you against lawsuits in case you injure another person while driving your vehicle. Personal Injury Protection: This pays for medical expenses that you or any of your passengers have as the result of an accident. Uninsured/Underinsured Motorist: This covers damages to your vehicle or injury to you and your passengers caused by a person without any insurance or without enough insurance. It also covers you if you're the victim of a hit-and-run. 1. Complete the table by writing the coverage needed in the space provided. Accident Extent of the damage Coverage needed a. A driver in a large van just hit Your front fender is crushed. your car and drove away. b. A hailstorm hit your town last Your car is completely pitted night. with hail damage. c. You backed your car into a Your bumper is dented. support pole in a parking garage. d. You drove too fast into your The garage door is damaged best friend's driveway and ran beyond repair, and the front into the garage door. end of your car is crumpled. e. You drove your car off a Your back is hurt, and your country road and into a ditch. doctor says you may need extended physical therapy. f. You ran into a pedestrian in a The pedestrian is injured crosswalk during a rainstorm. badly. CALCULATING THE COST OF AUTO INSURANCE In this activity, you will compare the cost of insuring two different cars for six months: a new sports car and a five-year-old compact car. 2. Insurance companies will need a certain amount of information from you. You must be truthful when actually buying insurance, but for this activity, you can use fictitious information to answer the following questions: a. How old is the driver? b. How long has the driver been licensed? c. How will the car be driven-commuting to school or for business? d. How many miles per year will the car be driven? e. Has the driver had any tickets or accidents in the last five years? 3. Now, find out the insurance rates for each car by visiting an insurance company's website or by calling an insurance agent directly. Complete the chart below. Coverage New sports car 5-year-old compact car Property Damage Liability s $ ($50,000 coverage) Bodily Injury Liability ($30,000 per person/S60,000 per accident) Collision ($500 deductible) Personal Injury Protection ($25,000) Comprehensive (S500 deductible) Uninsured/Underinsured Motorist ($30,000 coverage) Emergency Road Service (optional coverage that pays for towing, locksmith service, and other services) Rental Car Reimbursement (pays for a rental car if your car is disabled in an accident) Total Six-Month Premium S S S $ S S S $ S $ S A $ 4. What is the difference between the cost to insure an economy car versus a sports car? 5. Why do you think there is a difference