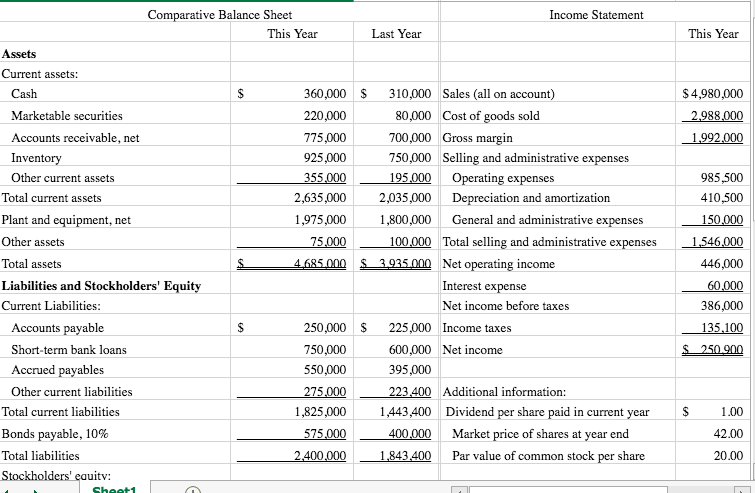

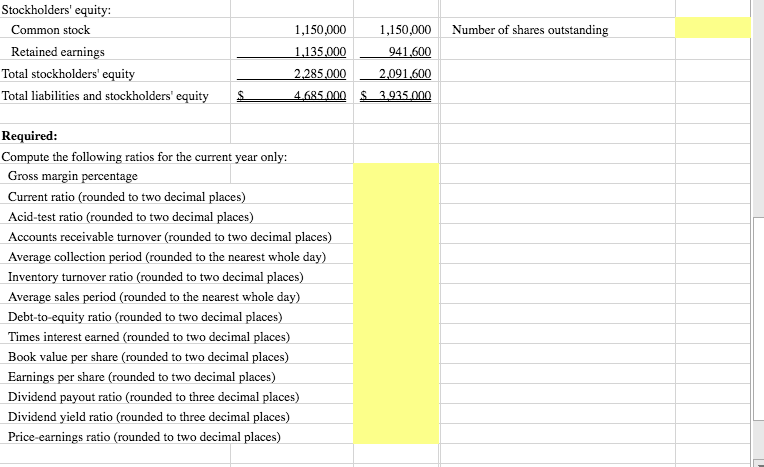

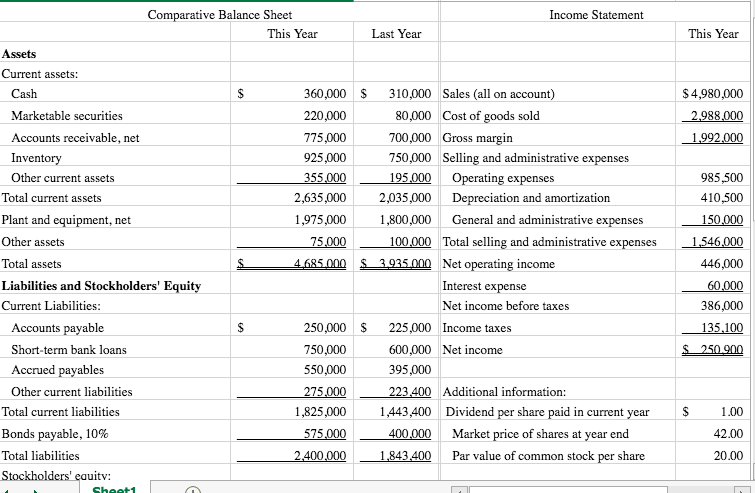

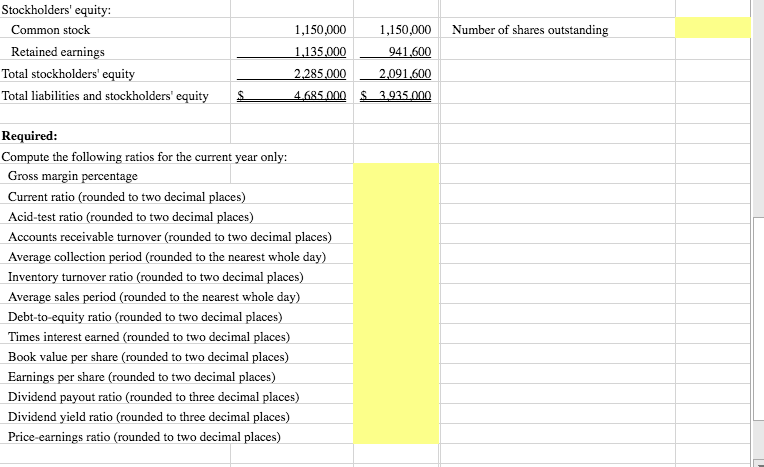

1. Compute and interpret financial ratios that managers use to assess liquidity. 2. Compute and interpret financial ratios that managers use for asset management purposes. 3. Compute and interpret financial ratios that managers use for debt management purposes. All answers must be entered as a formula. Click OK to begin. This Year $4,980,000 2.988.000 1,992.000 Comparative Balance Sheet Income Statement This Year Last Year Assets Current assets: Cash S 360,000 $ 310,000 Sales (all on account) Marketable securities 220,000 80,000 Cost of goods sold Accounts receivable, net 775,000 700,000 Gross margin Inventory 925,000 750,000 Selling and administrative expenses Other current assets 355.000 195,000 Operating expenses Total current assets 2,635,000 2,035,000 Depreciation and amortization Plant and equipment, net 1,975,000 1,800,000 General and administrative expenses Other assets 75,000 100.000 Total selling and administrative expenses Total assets S 4,685,000 $3,935.000 Net operating income Liabilities and Stockholders' Equity Interest expense Current Liabilities: Net income before taxes Accounts payable S 250,000 $225,000 Income taxes Short-term bank loans 750,000 600,000 Net income Accrued payables 550,000 395,000 Other current liabilities 275,000 223.400 Additional information: Total current liabilities 1,825,000 1,443,400 Dividend per share paid in current year Bonds payable, 10% 575,000 400,000 Market price of shares at year end Total liabilities 2,400.000 1,843.400 Par value of common stock per share Stockholders' equitv: 985,500 410,500 150.000 1,546,000 446,000 60,000 386,000 135,100 S 250.900 S 1.00 42.00 20.00 Sheet1 Number of shares outstanding Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 1,150,000 1,150,000 1,135.000 941,600 2.285.000 2,091,600 4.685.000 $ 3.935.000 Required: Compute the following ratios for the current year only: Gross margin percentage Current ratio (rounded to two decimal places) Acid-test ratio (rounded to two decimal places) Accounts receivable turnover (rounded to two decimal places) Average collection period (rounded to the nearest whole day) Inventory turnover ratio (rounded to two decimal places) Average sales period (rounded to the nearest whole day) Debt-to-equity ratio (rounded to two decimal places) Times interest earned (rounded to two decimal places) Book value per share (rounded to two decimal places) Earnings per share (rounded to two decimal places) Dividend payout ratio (rounded to three decimal places) Dividend yield ratio (rounded to three decimal places) Price-earnings ratio (rounded to two decimal places)