Answered step by step

Verified Expert Solution

Question

1 Approved Answer

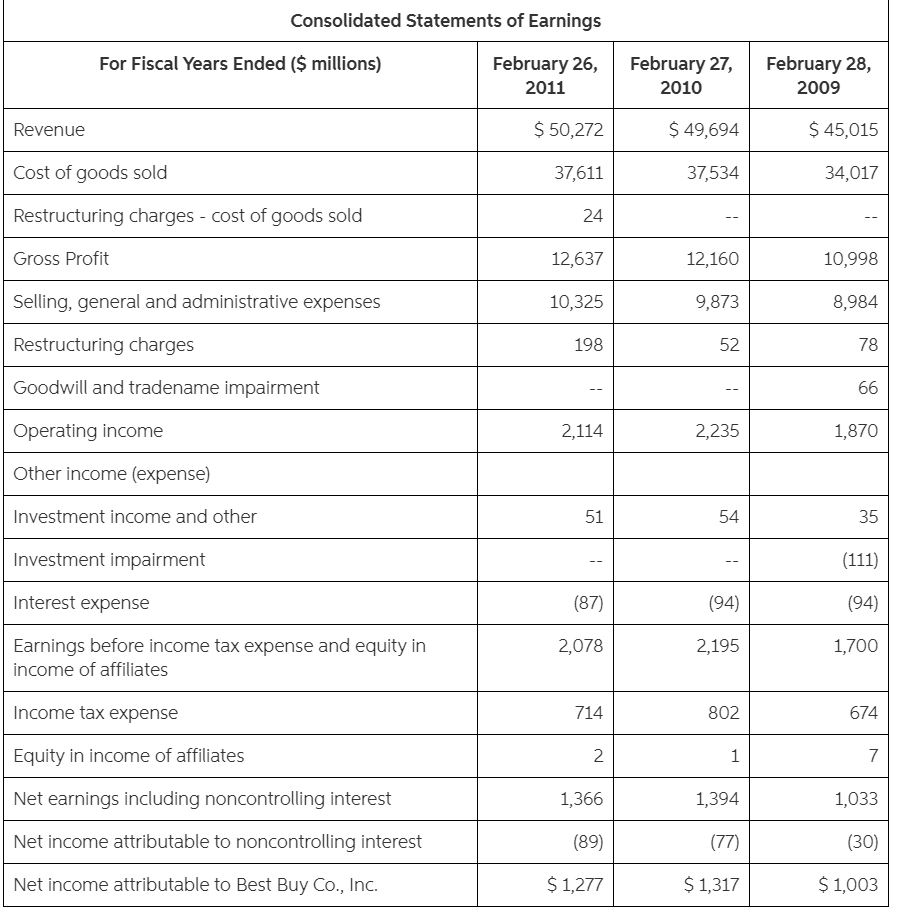

1. Compute Best Buy's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2011. (Do not round until final answer. Round

1. Compute Best Buy's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2011. (Do not round until final answer. Round two decimal places. Do not use NOPM x NOAT to calculate RNOA.)

2011 RNOA = Answer%

2011 NOPM = Answer%

2011 NOAT = Answer

2. Compute return on equity (ROE) for 2011. (Round your answers to two decimal places. Do not round until your final answer.)

2011 ROE = Answer%

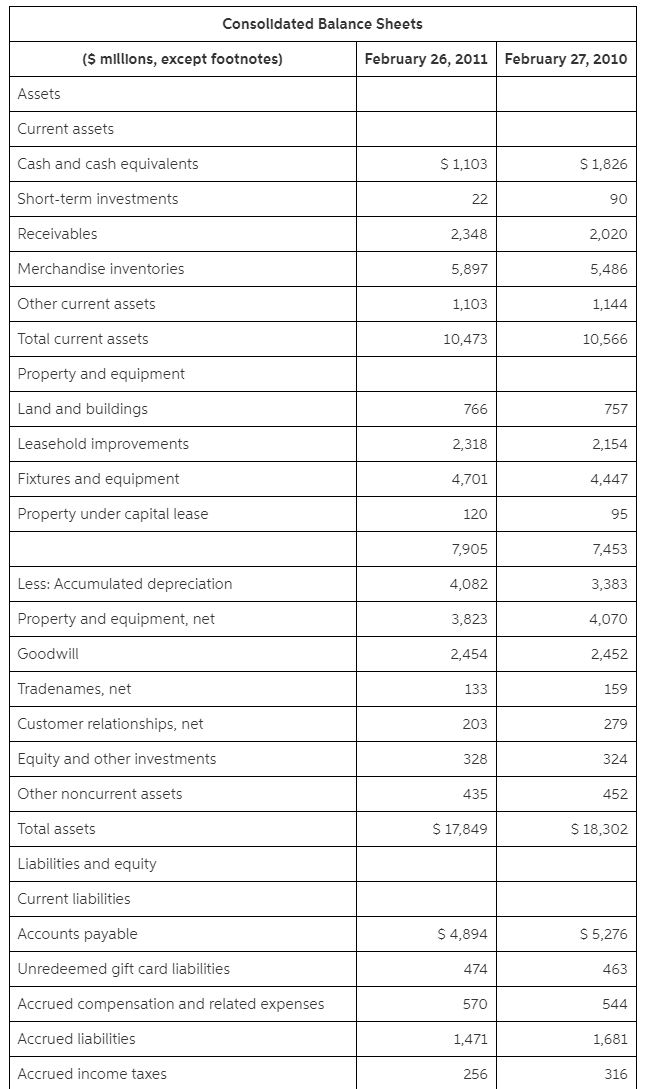

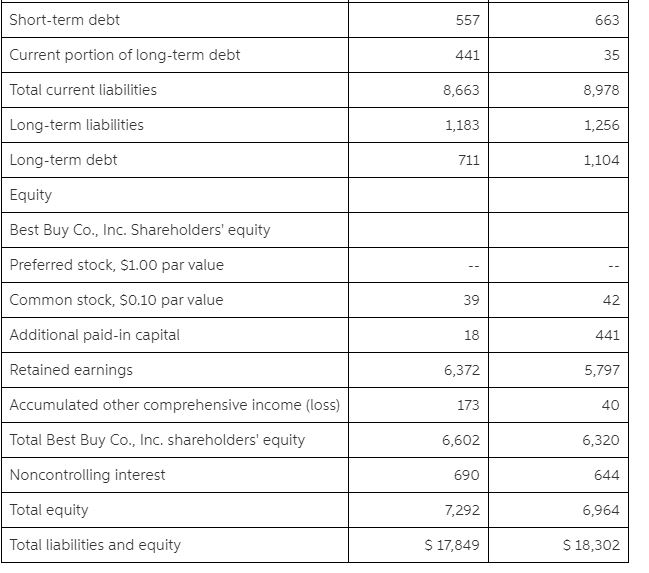

Consolidated Balance Sheets ($ millions, except footnotes) February 26, 2011 February 27, 2010 Assets Current assets Cash and cash equivalents $ 1,103 $ 1,826 Short-term investments 22 90 Receivables 2,348 2,020 Merchandise inventories 5,897 5,486 Other current assets 1,103 1,144 Total current assets 10,473 10,566 Property and equipment Land and buildings 766 757 Leasehold improvements 2,318 2,154 Fixtures and equipment 4,701 4,447 Property under capital lease 120 95 7,905 7,453 Less: Accumulated depreciation 4,082 3,383 Property and equipment, net 3,823 4,070 Goodwill 2,454 2,452 Tradenames, net 133 159 Customer relationships, net 203 279 Equity and other investments 328 324 Other noncurrent assets 435 452 Total assets Liabilities and equity $ 17,849 $ 18,302 Current liabilities Accounts payable Unredeemed gift card liabilities Accrued compensation and related expenses Accrued liabilities Accrued income taxes $ 4,894 $ 5,276 474 463 570 544 1,471 1,681 256 316

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Best Buy Co a Return on Equity Net income Average sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started