Question

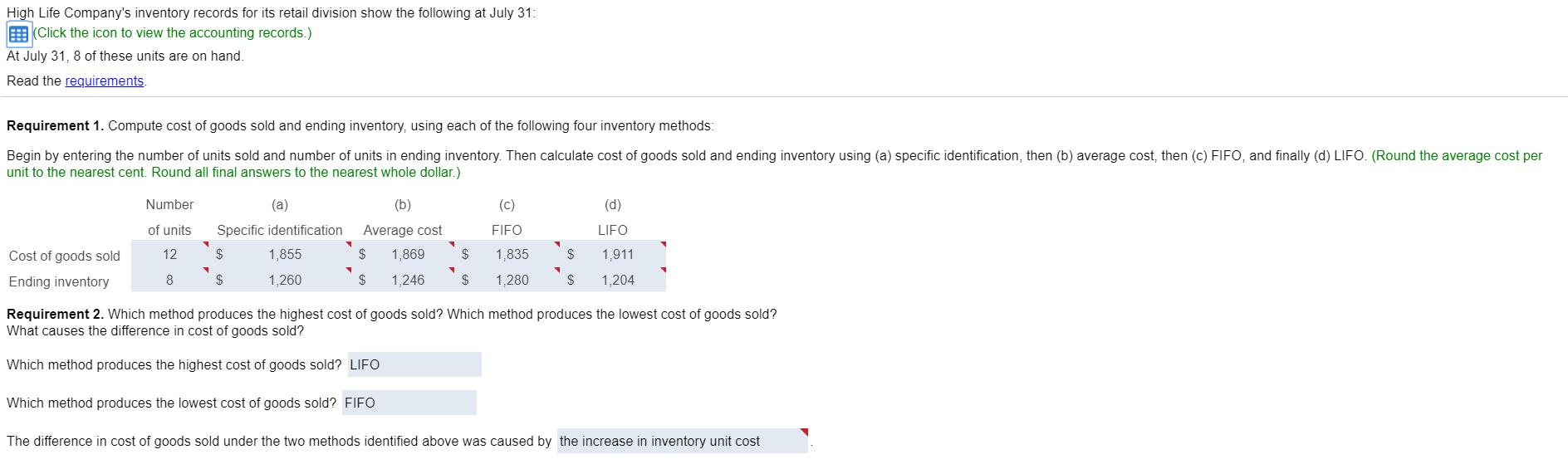

1. Compute cost of goods sold and ending inventory, using each of the following methods: a. Specific identification, with seven $165 units and four $175

1. | Compute cost of goods sold and ending inventory, using each of the following methods: | ||||||||

| |||||||||

2. | Which method produces the highest cost of goods sold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? |

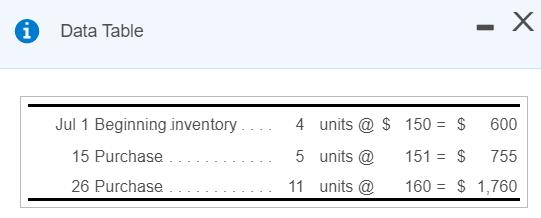

Data Table Jul 1 Beginning inventory. 4 units @ $ 150 = $ 600 %3D 15 Purchase 5 units @ 151 = $ 755 26 Purchase 11 units @ 160 = $ 1,760

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Specific identification FIFO LIFO Weighted Average Cost of Goods Sold 1355 1675 1911 1869 Ending Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial And Managerial Accounting The Financial Chapters

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

6th Edition

978-0134486840, 134486838, 134486854, 134486846, 9780134486833, 978-0134486857

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App